Property Valuation Information

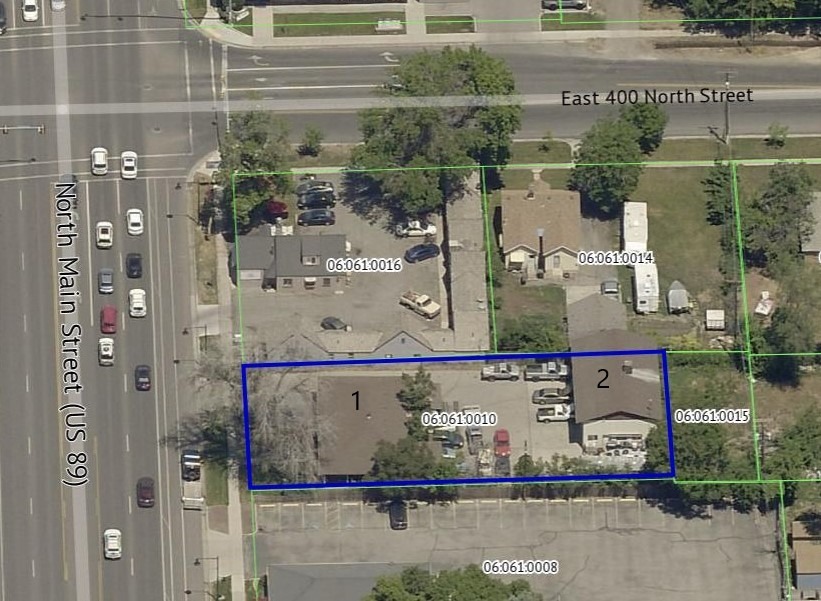

- Serial Number : 060610010

- Tax Year : 2024

- Owner Names : R&M PERRY LLC

- Property Address : 356 N MAIN - SPRINGVILLE

- Tax District : 130 - SPRINGVILLE CITY

- Acreage : 0.3

- Property Classification : C - COMMERCIAL

- Legal Description : COM. 41/2 FT N OF SW COR LOT 3, BLK 61, PLAT A, SPV. CITY SURVEY; N 78 FT; E 10 RDS, S 78 FT; W 10 RDS TO BEG. AREA .30 ACRE.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Non-Primary Residential | $414,200 |

$441,000 |

|||||||

| Total Property Market Value | $414,200 | $441,000 | |||||||