Property Valuation Information

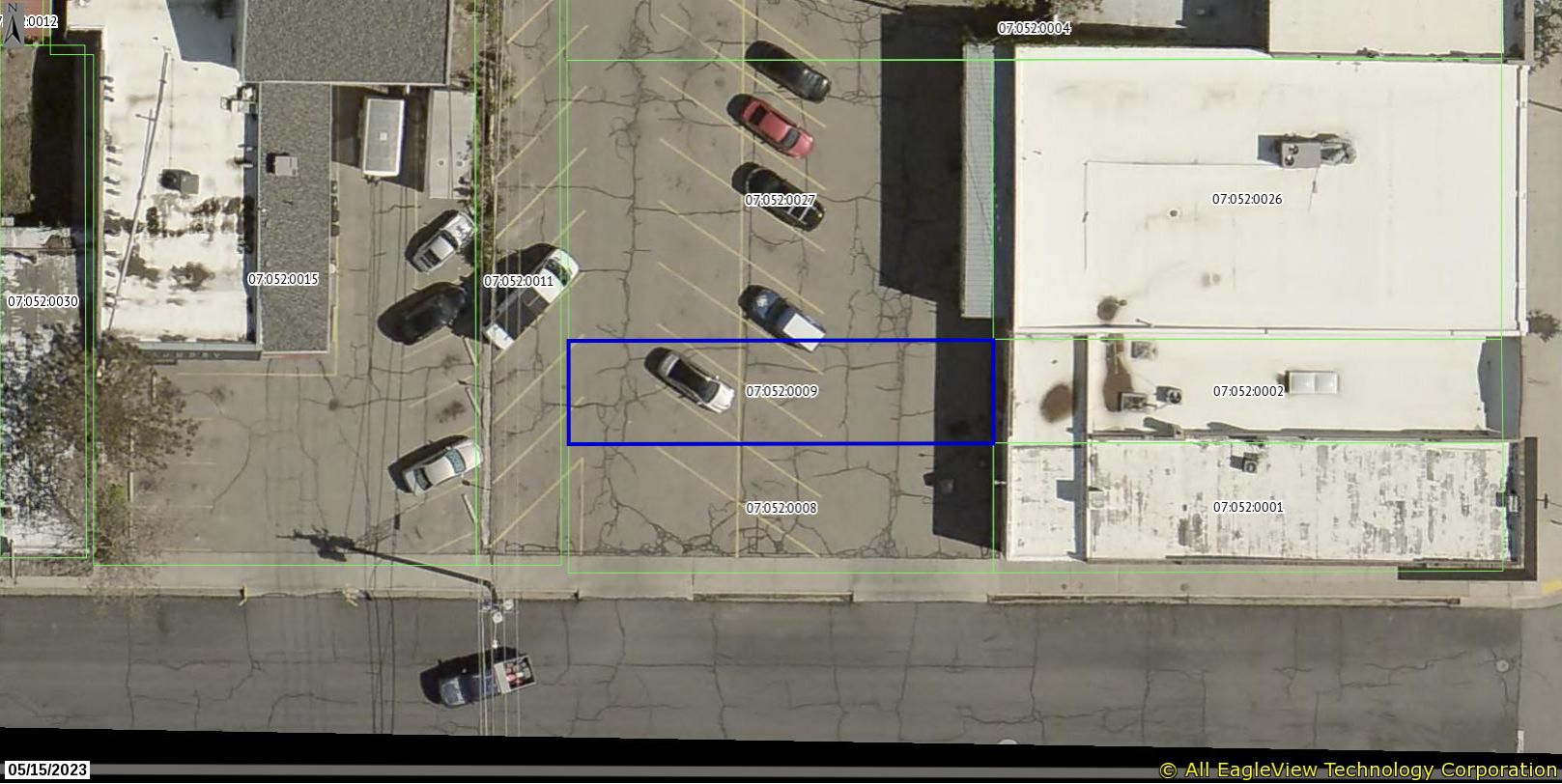

- Serial Number : 070520009

- Tax Year : 2024

- Owner Names : BUSHNELL, MIRIAM

- Property Address : SPANISH FORK

- Tax District : 150 - SPANISH FORK CITY

- Acreage : 0.04

- Property Classification : C - COMMERCIAL

- Legal Description : COM. 99 FT W & 25 FT N OF SE COR BLK 52, PLAT A, SPANISH FORK CIRY SUR; N 20 FT; W 5 RODS; S 20 FT; E 5 RODS TO BEG.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Non-Primary Residential | $57,700 |

$64,900 |

|||||||

| Total Property Market Value | $57,700 | $64,900 | |||||||