Property Valuation Information

- Serial Number : 080850017

- Tax Year : 2024

- Owner Names : POULSON, JACOB & KRISTEN

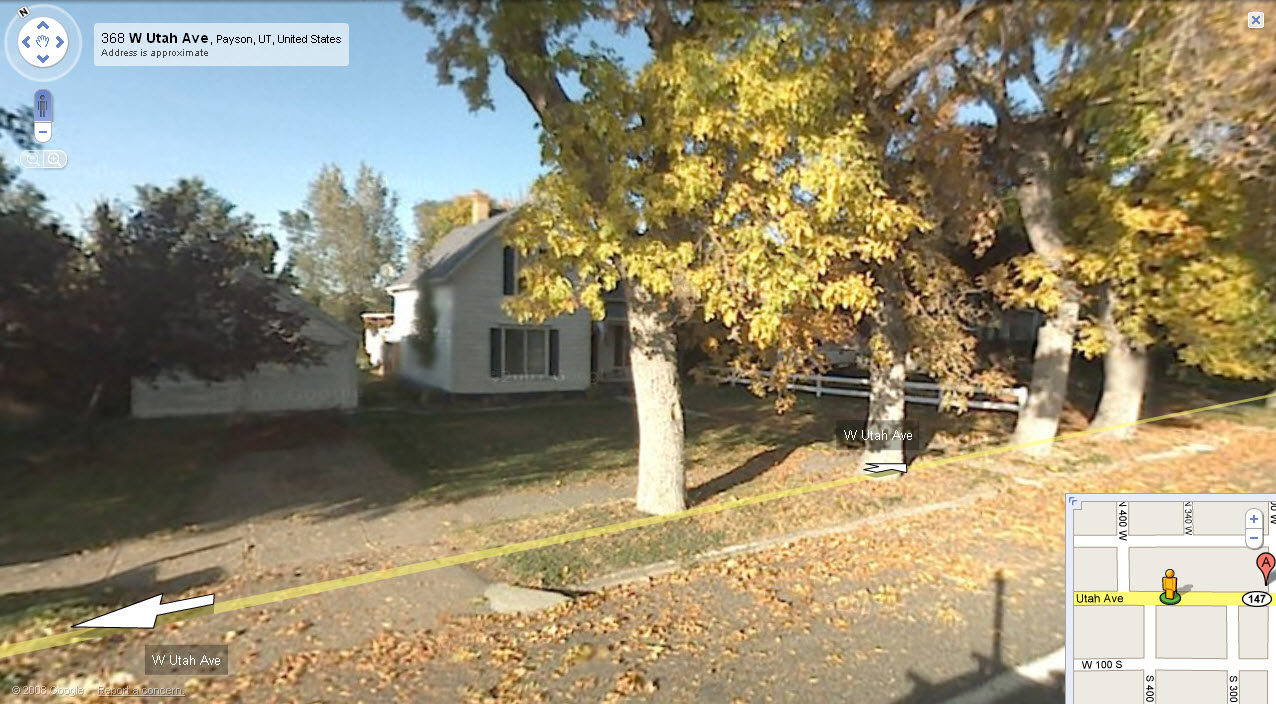

- Property Address : 360 W UTAH AVE - PAYSON

- Tax District : 170 - PAYSON CITY

- Acreage : 0.23

- Property Classification : RP - RES PRIMARY

- Legal Description : COM 226 FT E OF SW COR OF LOT 4, BLK 1, PLAT N, PAYSON CITY SURVEY; E 69.68 FT; N 143 FT; W 69.68 FT; S 143 FT TO BEG.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Primary Residential | $356,800 |

$357,700 |

|||||||

| Total Property Market Value | $356,800 | $357,700 | |||||||