Property Valuation Information

- Serial Number : 081190004

- Tax Year : 2025

- Owner Names : HANSEN, MICHELLE (ET AL)

- Property Address : PAYSON

- Tax District : 170 - PAYSON CITY

- Acreage : 0.1

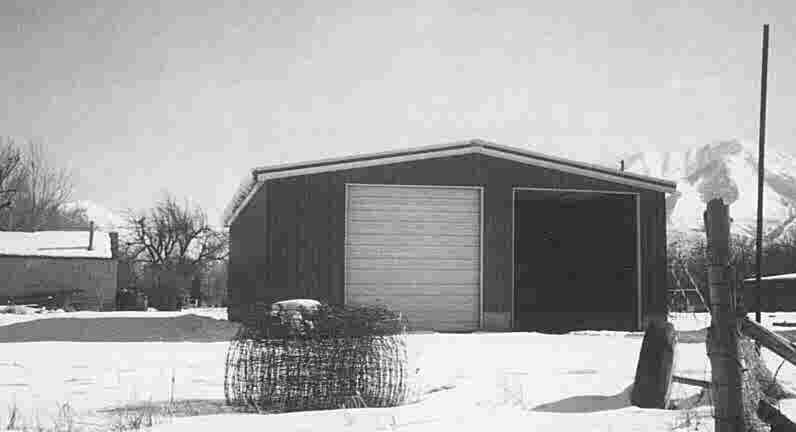

- Property Classification : RA - RESIDENTIAL-ADJOINING

- Legal Description : COM 100 FT S OF NW COR OF BLK 9, PLAT P, PAYSON CITY SUR; E 140 FT; S 32.5 FT; W 140 FT; N 32.5 FT TO BEG.

| Property Types: | 2024 Market Value |

2025 Market Value |

|||||||

| Primary Residential | $32,100 |

$32,100 |

|||||||

| Total Property Market Value | $32,100 | $32,100 | |||||||