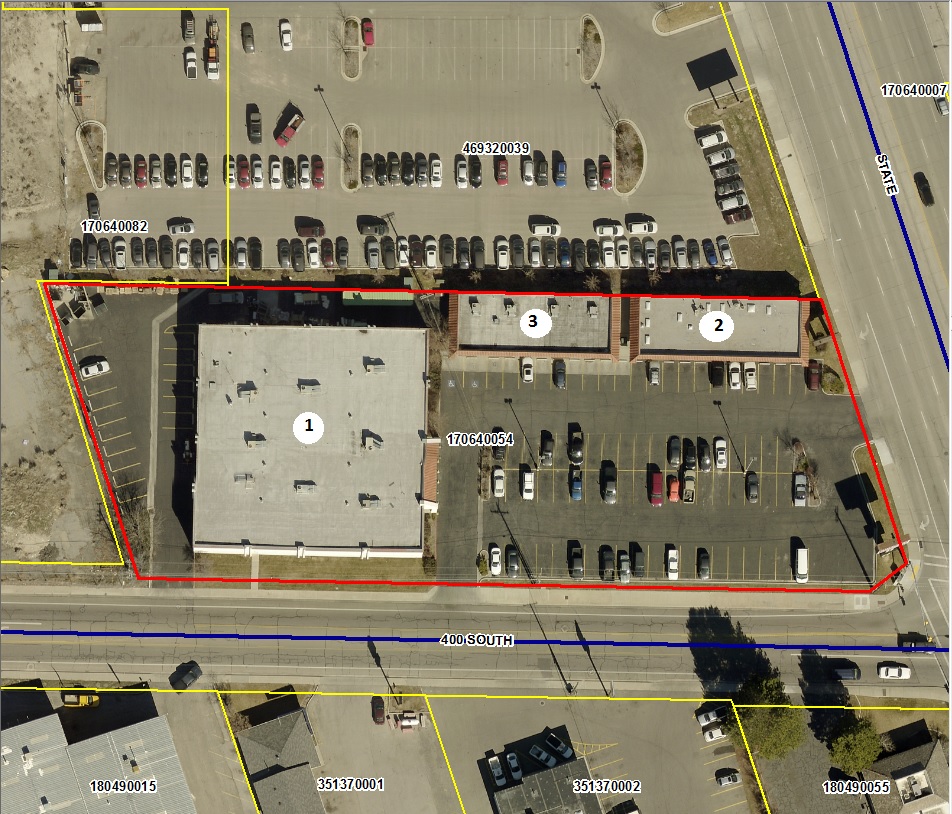

Property Valuation Information

- Serial Number : 170640054

- Tax Year : 2024

- Owner Names : HARRISON INVESTMENTS LC

- Property Address : 384 S STATE ST - OREM

- Tax District : 090 - OREM CITY

- Acreage : 1.65108

- Property Classification : C - COMMERCIAL

- Legal Description : COM N 23.95 FT & E 515.95 FT FR SW COR. SEC. 14, T6S, R2E, SLB&M.; S 88 DEG 59' 11" E 412.36 FT; N 52 DEG 48' 34" E 25.98 FT; N 17 DEG 44' 59" W 156.44 FT; N 88 DEG 53' 1" W 438.51 FT; S 17 DEG 45' 0" E 174.24 FT TO BEG. AREA 1.651 AC.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Non-Primary Residential | $3,177,300 |

$3,402,700 |

|||||||

| Total Property Market Value | $3,177,300 | $3,402,700 | |||||||