Property Valuation Information

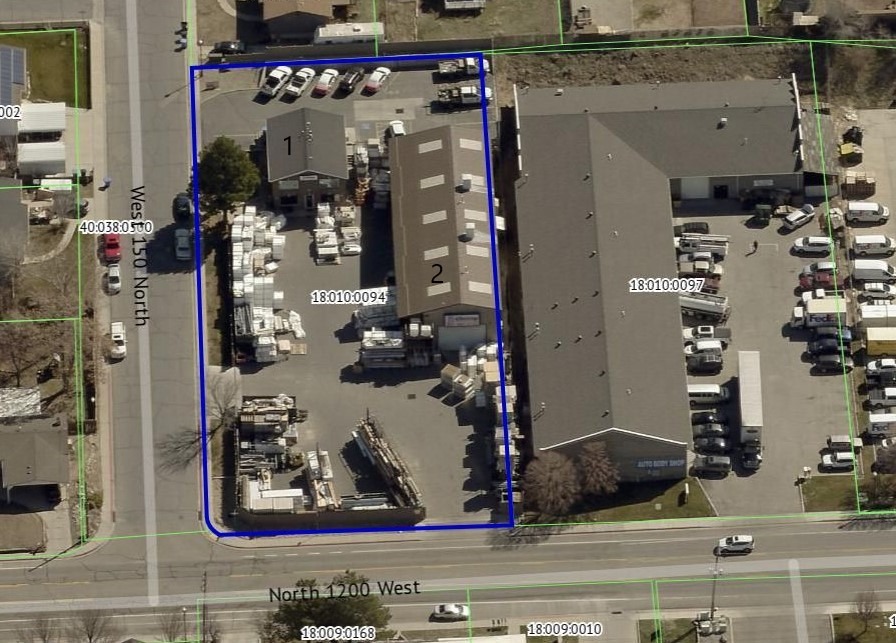

- Serial Number : 180100094

- Tax Year : 2024

- Owner Names : JACOBSON HOLDINGS LLC

- Property Address : 140 N 1200 WEST - OREM

- Tax District : 090 - OREM CITY

- Acreage : 0.83

- Property Classification : C - COMMERCIAL

- Legal Description : COM N 56'48"W 770.27 FT & W 2346.45 FT FR E1/4 COR SEC 16, T6S, R2E, SLM; S 89 DEG 58'31"W 291.35 FT; N 13'21"W 120.03 FT; ALONG ARC OF 15 FT RAD CUR R (CHD N 65 DEG 43'52"E 12.03 FT); N 89 DEG 58'31"E 280.43 FT; S 11'37"E 125 FT TO BEG. AREA .83 ACRE.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Non-Primary Residential | $1,142,100 |

$1,194,000 |

|||||||

| Total Property Market Value | $1,142,100 | $1,194,000 | |||||||