Property Valuation Information

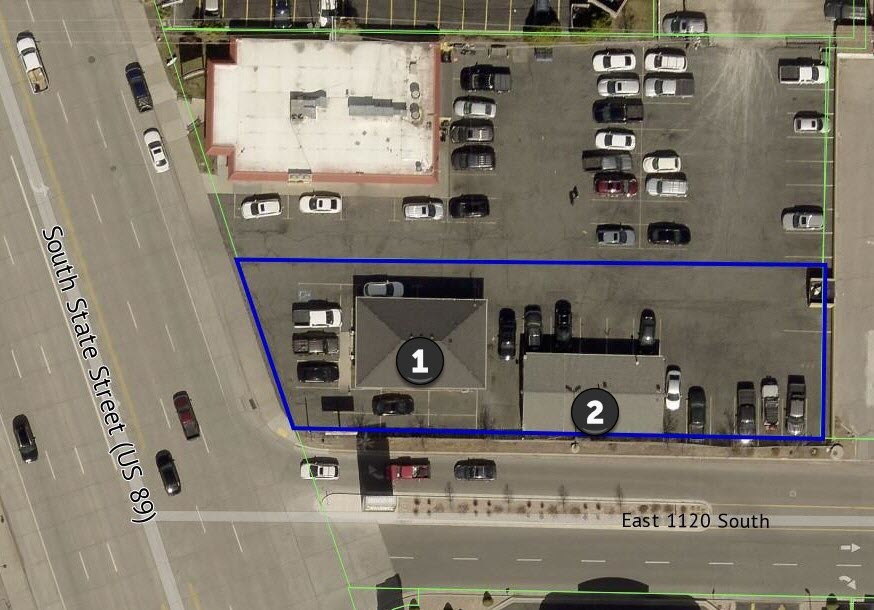

- Serial Number : 180570121

- Tax Year : 2024

- Owner Names : HARO, MATILDE (ET AL)

- Property Address : 1133 S STATE - OREM

- Tax District : 090 - OREM CITY

- Acreage : 0.306289

- Property Classification : MRC - MULTIPLE RES + COMM

- Legal Description : COM N 585.1 FT & W 53 FT FR S 1/4 COR. SEC. 23, T6S, R2E, SLB&M.; S 89 DEG 21' 52" E 220 FT; S 0 DEG 54' 0" W 65 FT; N 88 DEG 44' 0" W 197.9 FT; N 18 DEG 31' 0" W 66.5 FT TO BEG. AREA 0.306 AC.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Primary Residential | $112,100 |

$108,100 |

|||||||

| Non-Primary Residential | $342,000 |

$372,600 |

|||||||

| Total Property Market Value | $454,100 | $480,700 | |||||||