Property Valuation Information

- Serial Number : 210230108

- Tax Year : 2024

- Owner Names : HURST, KENNETH CRAIG (ET AL)

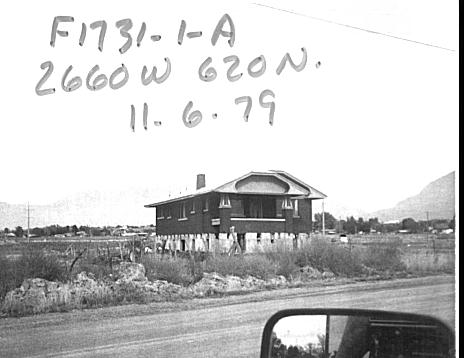

- Property Address : 2660 W 620 NORTH - PROVO

- Tax District : 110 - PROVO CITY

- Acreage : 2.86

- Property Classification : RPO - RP PLUS ACREAGE

- Legal Description : COM S 500.99 FT & W 181.83 FT FR N 1/4 COR. SEC. 3 T7S R2E SLB&M.; S 0 DEG 56' 51" E 686.46 FT; N 89 DEG 12' 1" W 190.54 FT; N 0 DEG 57' 11" W 460.08 FT; N 89 DEG 32' 40" E 15.91 FT; N 0 DEG 55' 21" W 111.12 FT; N 89 DEG 32' 40" E 20 FT; N 0 DEG 55' 21" W 111.16 FT; N 89 DEG 34' 19" E 154.49 FT TO BEG. AREA 2.860 AC.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Primary Residential | $376,800 |

$394,300 |

|||||||

| Non-Primary Residential | $150,600 |

$150,600 |

|||||||

| Total Property Market Value | $527,400 | $544,900 | |||||||