Property Valuation Information

- Serial Number : 210325200

- Tax Year : 2024

- Owner Names : FRONK, JAN P & DAVID G

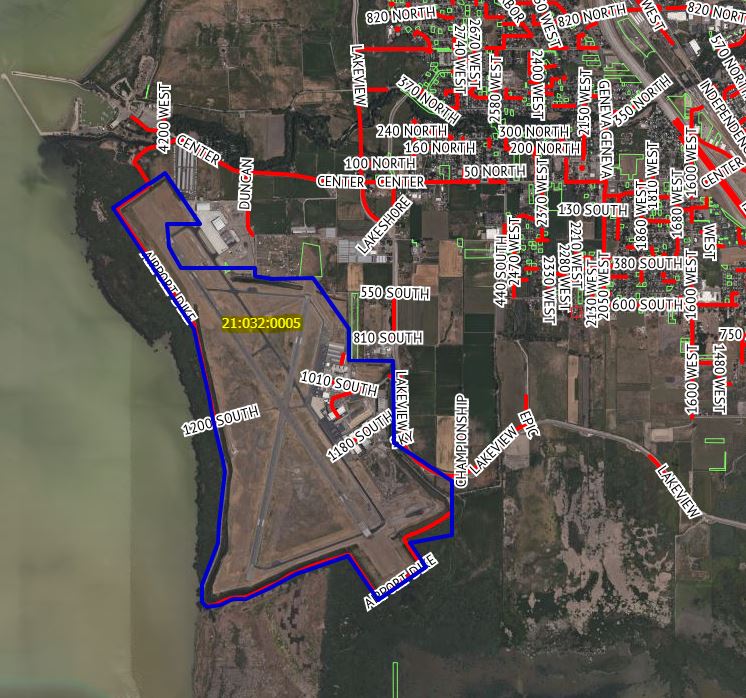

- Property Address : 3410 W 1010 SOUTH - PROVO

- Tax District : 110 - PROVO CITY

- Acreage : 0

- Property Classification : CB - COMM-BLDG ONLY

- Legal Description : BLDG ONLY ON SWNW,NENW,SENW 15 SECTION 9 TOWNSHIP 7 S

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Non-Primary Residential | $302,000 |

$330,500 |

|||||||

| Total Property Market Value | $302,000 | $330,500 | |||||||