Property Valuation Information

- Serial Number : 270260016

- Tax Year : 2024

- Owner Names : ARDELIA PROPERTIES LLC

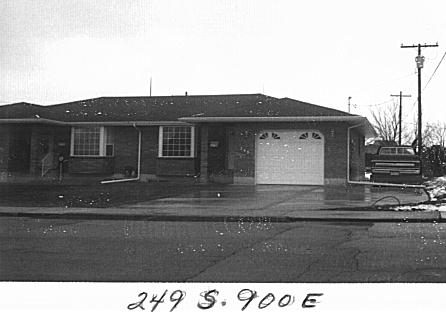

- Property Address : 249 S 900 EAST - SPANISH FORK

- Tax District : 150 - SPANISH FORK CITY

- Acreage : 0.16

- Property Classification : RP - RES PRIMARY

- Legal Description : COM W 769.06 FT & S 277.06 FT & S 29'17"W 83.14 FT & S 11'W 135 FT FR E1/4 COR OF SEC 19, T8S, R3E, SLM; S 11'W 45 FT; S 85 DEG 38'57"W 160.06 FT; N 11'E 45 FT; N 85 DEG 38'57"E 160.06 FT TO BEG. AREA .16 AC

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Primary Residential | $361,700 |

$353,200 |

|||||||

| Total Property Market Value | $361,700 | $353,200 | |||||||