Property Valuation Information

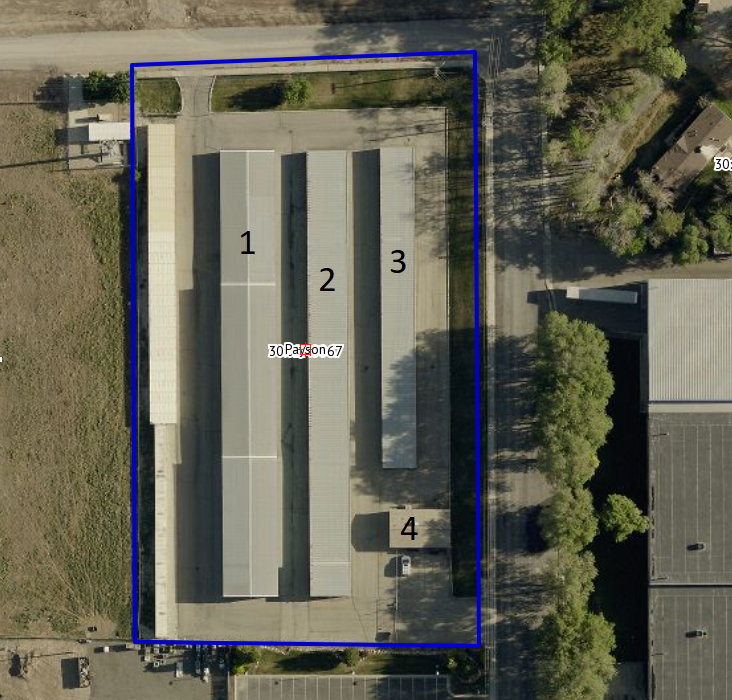

- Serial Number : 300270067

- Tax Year : 2024

- Owner Names : KEEP IT SAFE STORAGE LLC

- Property Address : 857 N 500 EAST - PAYSON

- Tax District : 170 - PAYSON CITY

- Acreage : 2.596563

- Property Classification : MRC - MULTIPLE RES + COMM

- Legal Description : COM E 1363.844 FT & S 441.298 FT FR NW COR. SEC. 9, T9S, R2E, SLB&M.; N 89 DEG 6' 58" W 257.62 FT; N 0 DEG 11' 31" W 432.529 FT; N 87 DEG 56' 56" E 257.706 FT; S 0 DEG 11' 31" E 445.727 FT TO BEG. AREA 2.597 AC.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Primary Residential | $66,500 |

$63,400 |

|||||||

| Non-Primary Residential | $1,515,500 |

$1,607,500 |

|||||||

| Total Property Market Value | $1,582,000 | $1,670,900 | |||||||