Property Valuation Information

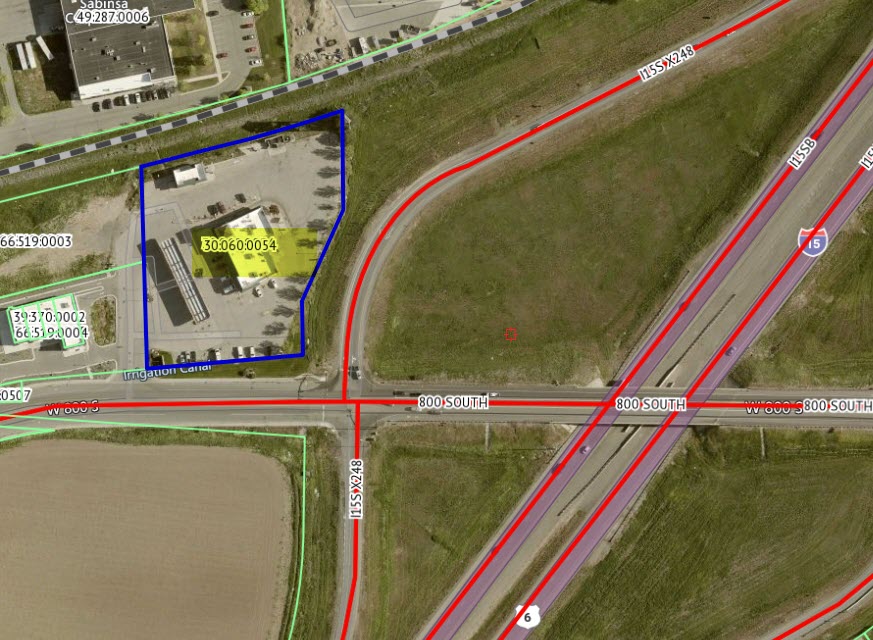

- Serial Number : 300600054

- Tax Year : 2024

- Owner Names : 7-ELEVEN INC

- Property Address : 1522 W 800 SOUTH - PAYSON

- Tax District : 170 - PAYSON CITY

- Acreage : 2.14133

- Property Classification : C - COMMERCIAL

- Legal Description : COM N 89 DEG 42' 17" E 2300.93 FT & N 2118.37 FT FR SW COR. SEC. 18, T9S, R2E, SLB&M.; N 76 DEG 7' 52" E 95.67 FT; ALONG A CURVE TO L (CHORD BEARS: N 73 DEG 54' 47" E 224.27 FT, RADIUS = 2897.54 FT); S 0 DEG 0' 26" W 152.08 FT; S 24 DEG 14' 33" W 152.39 FT; S 0 DEG 17' 48" E 82 FT; S 84 DEG 57' 35" W 240 FT; N 1 DEG 19' 19" W 309.12 FT TO BEG. AREA 2.141 AC.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Non-Primary Residential | $2,528,400 |

$2,593,100 |

|||||||

| Total Property Market Value | $2,528,400 | $2,593,100 | |||||||