Property Valuation Information

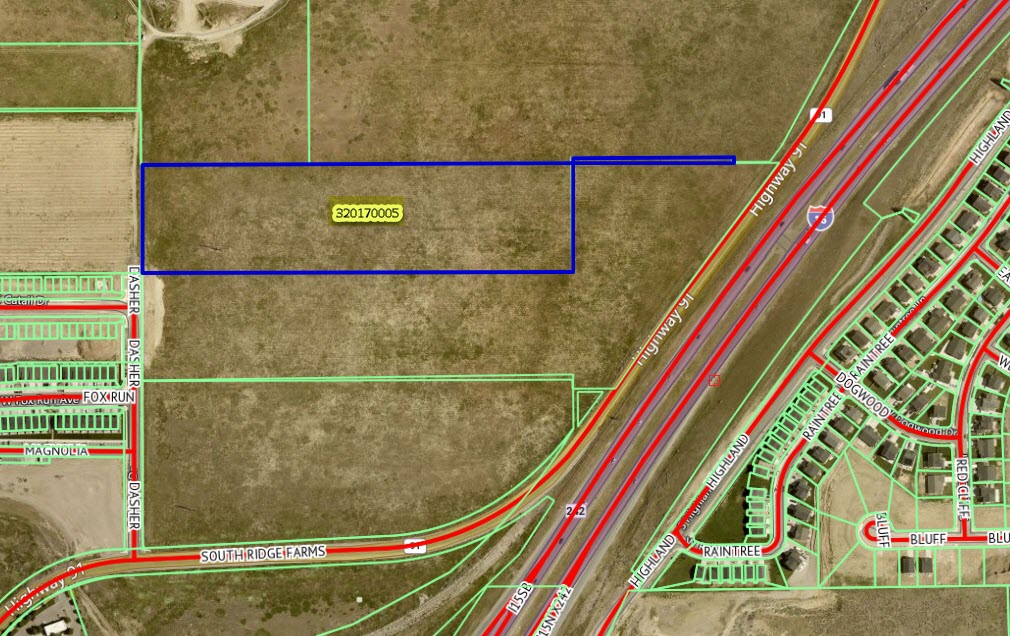

- Serial Number : 320170005

- Tax Year : 2024

- Owner Names : DOUGLAS GREENHALGH FAMILY ENTERPRISES LLC (ET AL)

- Property Address : SANTAQUIN

- Tax District : 190 - SANTAQUIN CITY

- Acreage : 10.1875

- Property Classification : V - VACANT

- Legal Description : COM N 60 RD FR SW COR. SEC. 11, T10S, R1E, SLB&M.; N 20 RD; E 80 RD; N 1 RD; E 30 RD; S 1 RD; W 30 RD; S 20 RD; W 80 RD TO BEG. AREA 10.188 AC.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Vacant | $485,900 |

$601,100 |

|||||||

| Greenbelt Land Value | $448 |

$0 |

|||||||

| Total Property Market Value | $485,900 | $601,100 | |||||||

Note:

Greenbelt values are shown for reference only and are not part of the total property market value, but are utilized as part of the proposed tax calculations