Property Valuation Information

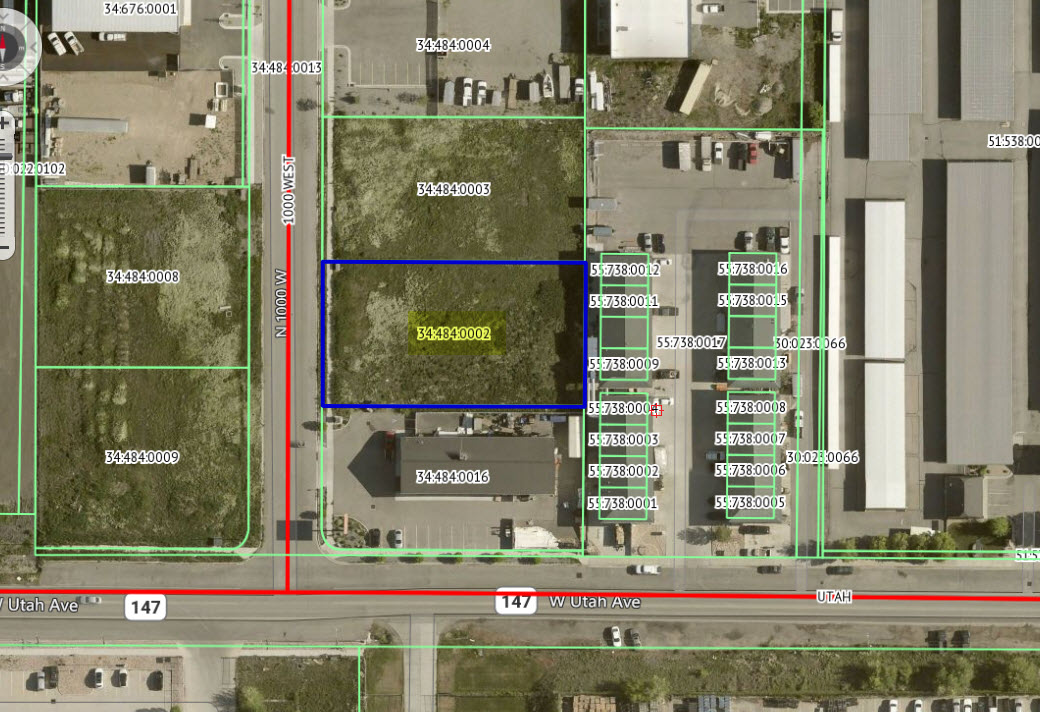

- Serial Number : 344840002

- Tax Year : 2025

- Owner Names : VARGAS, BLANCA E (ET AL)

- Property Address : 54 N 1000 WEST - PAYSON

- Tax District : 170 - PAYSON CITY

- Acreage : 0.50726

- Property Classification : V - VACANT

- Legal Description : LOT 2, PLAT A, APEX STORAGE SUB AREA 0.507 AC.

| Property Types: | 2024 Market Value |

2025 Market Value |

|||||||

| Vacant | $204,400 |

$204,400 |

|||||||

| Total Property Market Value | $204,400 | $204,400 | |||||||