Property Valuation Information

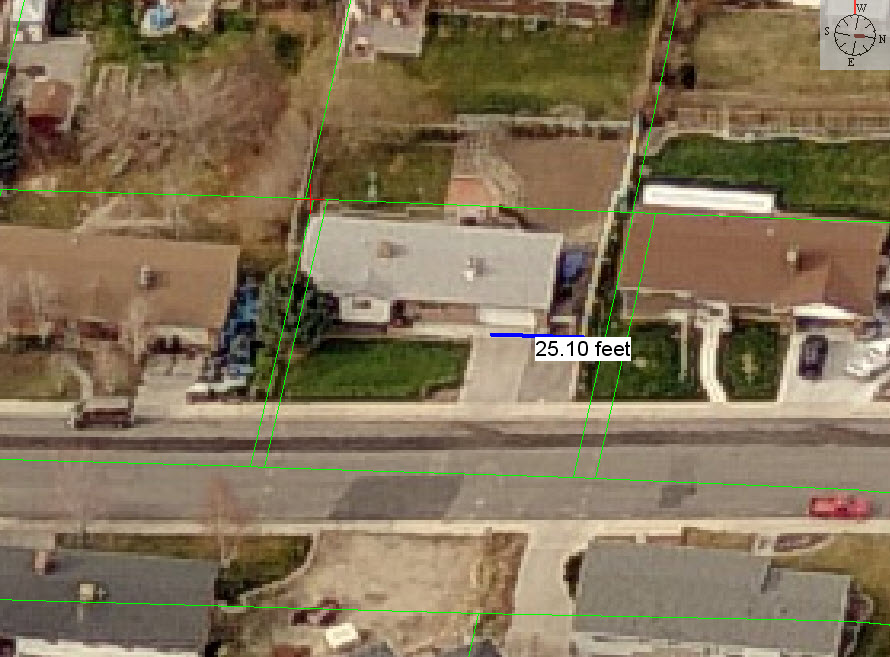

- Serial Number : 350270044

- Tax Year : 2025

- Owner Names : SPENCER, ERIC J & ANNAMARIE M

- Property Address : 740 S 1680 EAST - PLEASANT GROVE

- Tax District : 070 - PLEASANT GROVE CITY

- Acreage : 0.2221

- Property Classification : RP - RES PRIMARY

- Legal Description : THE SOUTH 84 FT OF LOT 44, PLAT C, BLACKHAWK ESTATES SUB AREA 0.212 AC. ALSO THE NORTH 4 FT OF LOT 43, PLAT C, BLACKHAWK ESTATES SUB AREA 0.010 AC. TOTAL AREA .222 AC.

| Property Types: | 2024 Market Value |

2025 Market Value |

|||||||

| Primary Residential | $443,700 |

$443,700 |

|||||||

| Total Property Market Value | $443,700 | $443,700 | |||||||