Property Valuation Information

- Serial Number : 412280024

- Tax Year : 2024

- Owner Names : BERGLUND, WAYNE

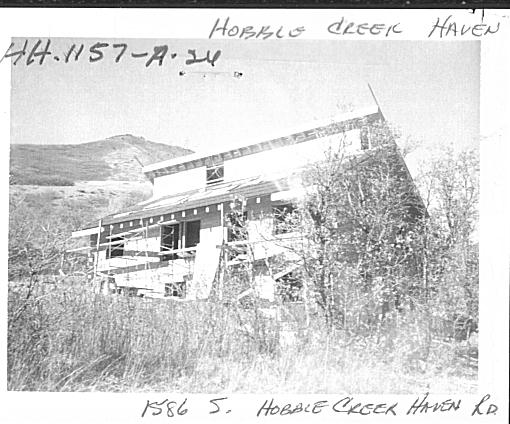

- Property Address : 1586 S HOBBLE CREEK HAVEN RD - SPRINGVILLE DISTRICT

- Tax District : 120 - NEBO SCHOOL DIST S/A 6-7-8

- Acreage : 1.500477

- Property Classification : RPO - RP PLUS ACREAGE

- Legal Description : LOT 24, PLAT A, HOBBLE CREEK HAVEN MHD AMENDED SUB AREA 1.500 AC.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Primary Residential | $609,900 |

$622,100 |

|||||||

| Non-Primary Residential | $8,800 |

$8,800 |

|||||||

| Total Property Market Value | $618,700 | $630,900 | |||||||