Property Valuation Information

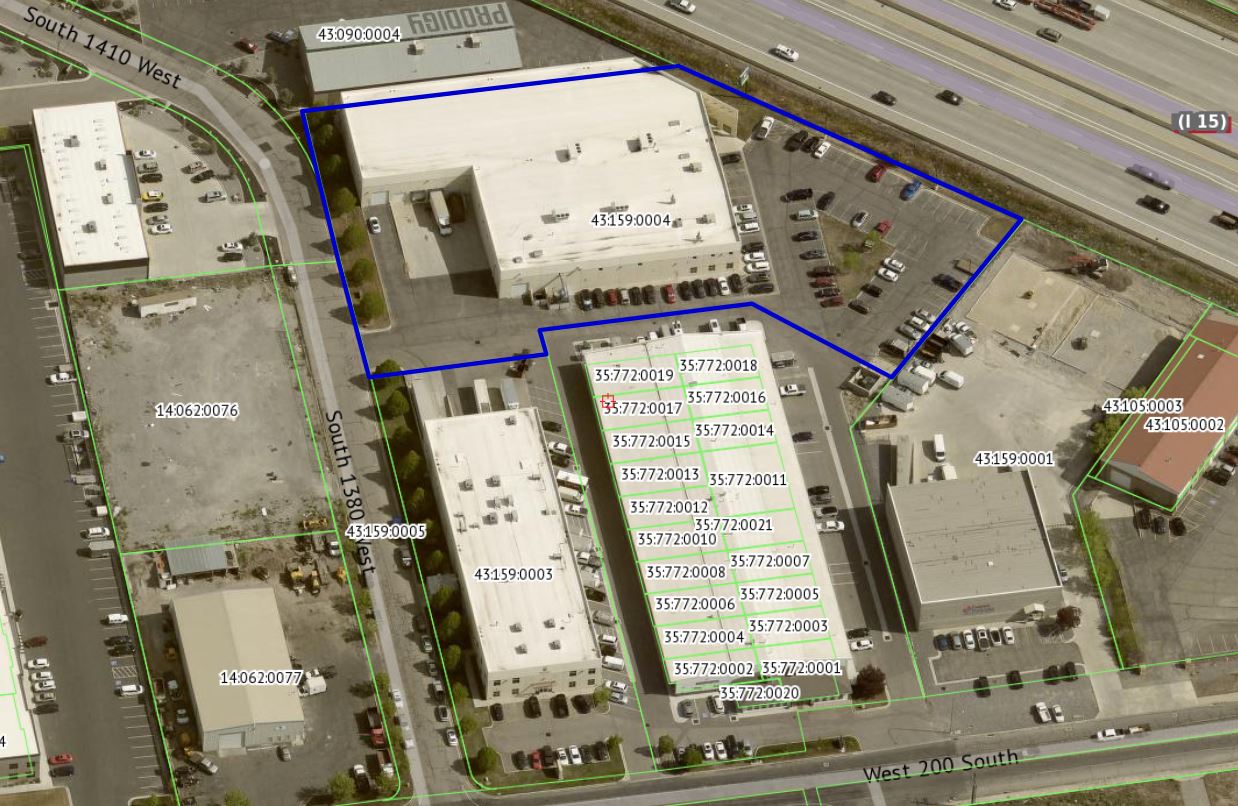

- Serial Number : 431590004

- Tax Year : 2024

- Owner Names : BJS VI LLC

- Property Address : 133 S 1380 WEST - LINDON

- Tax District : 085 - LINDON CITY W/WATER CONS

- Acreage : 2.282

- Property Classification : C - COMMERCIAL

- Legal Description : LOT 4, PLAT D, JACOBSON COMMERCIAL SUBDV. AREA 2.282 AC.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Non-Primary Residential | $6,002,700 |

$6,731,400 |

|||||||

| Total Property Market Value | $6,002,700 | $6,731,400 | |||||||