Property Valuation Information

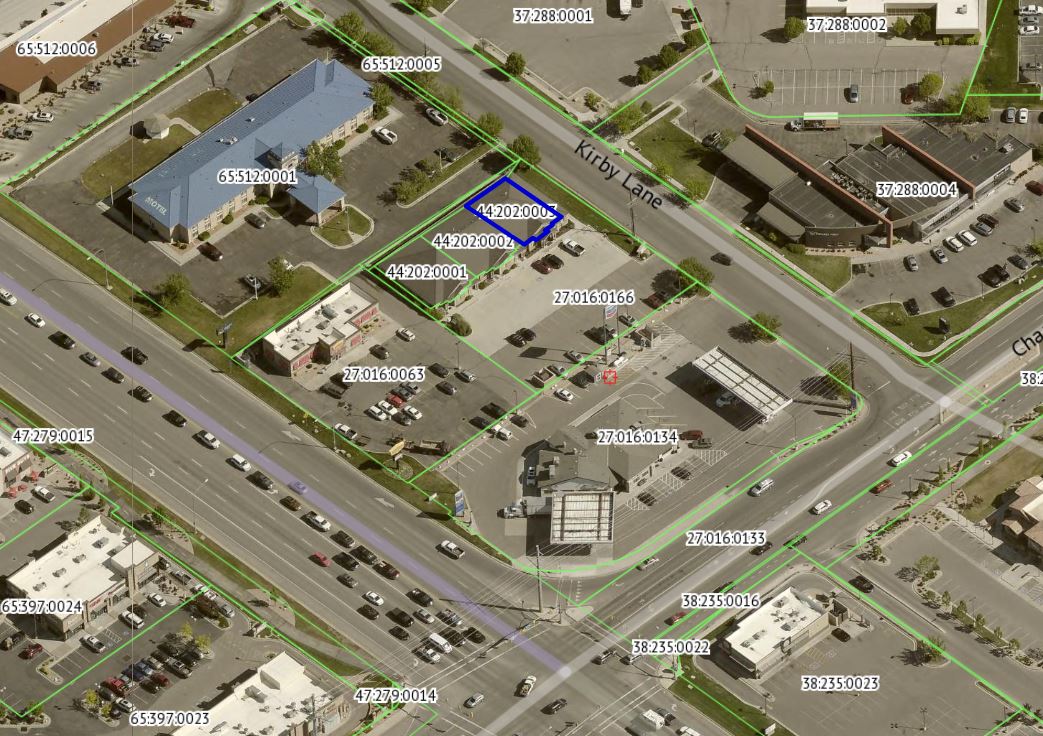

- Serial Number : 442020003

- Tax Year : 2024

- Owner Names : LDHB PROPERTIES LLC

- Property Address : 646 E KIRBY LANE - SPANISH FORK

- Tax District : 150 - SPANISH FORK CITY

- Acreage : 0.060452

- Property Classification : COC - COMM CONDO

- Legal Description : LOT 3, PLAT A, KIRBY LANE BUSINESS COMPLEX SUB AREA 0.060 AC.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Non-Primary Residential | $538,500 |

$549,300 |

|||||||

| Total Property Market Value | $538,500 | $549,300 | |||||||