Property Valuation Information

- Serial Number : 460210019

- Tax Year : 2024

- Owner Names : ENGEMANN, JENNIFER R & P DANIEL

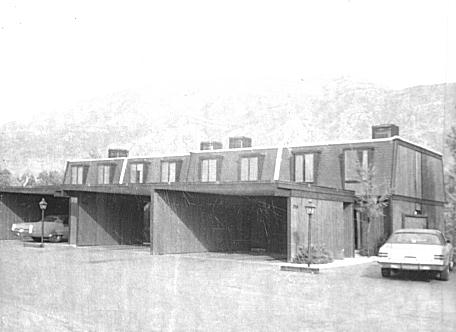

- Property Address : 2960 MARRCREST WEST - PROVO

- Tax District : 110 - PROVO CITY

- Acreage : 0.05

- Property Classification : RP - RES PRIMARY

- Legal Description : COM SW COR LOT 14, SEC E, MARRCREST PUD; 2.97 FT ALONG ARC OF 39 FT RAD CUR TO L (CHD 88 DEG 59'57"W 2.97 FT); N 1 DEG 11'E 36.19 FT; S 80 DEG 17'E 77.10 FT; S 9 DEG 43'W 15.11 FT; N 80 DEG 17'W 2.05 FT; 15.71 ALONG ARC OF 10 FT RAD CUR TO R (CHD S 46 DEG 11'W 14.14 FT); N 49'W 50 FT TO BEG. AREA .05 ACRE

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Primary Residential | $265,800 |

$300,500 |

|||||||

| Total Property Market Value | $265,800 | $300,500 | |||||||