Property Valuation Information

- Serial Number : 466010240

- Tax Year : 2025

- Owner Names : HOOPES, JOHN LAMRO & MYRNA GALE (ET AL)

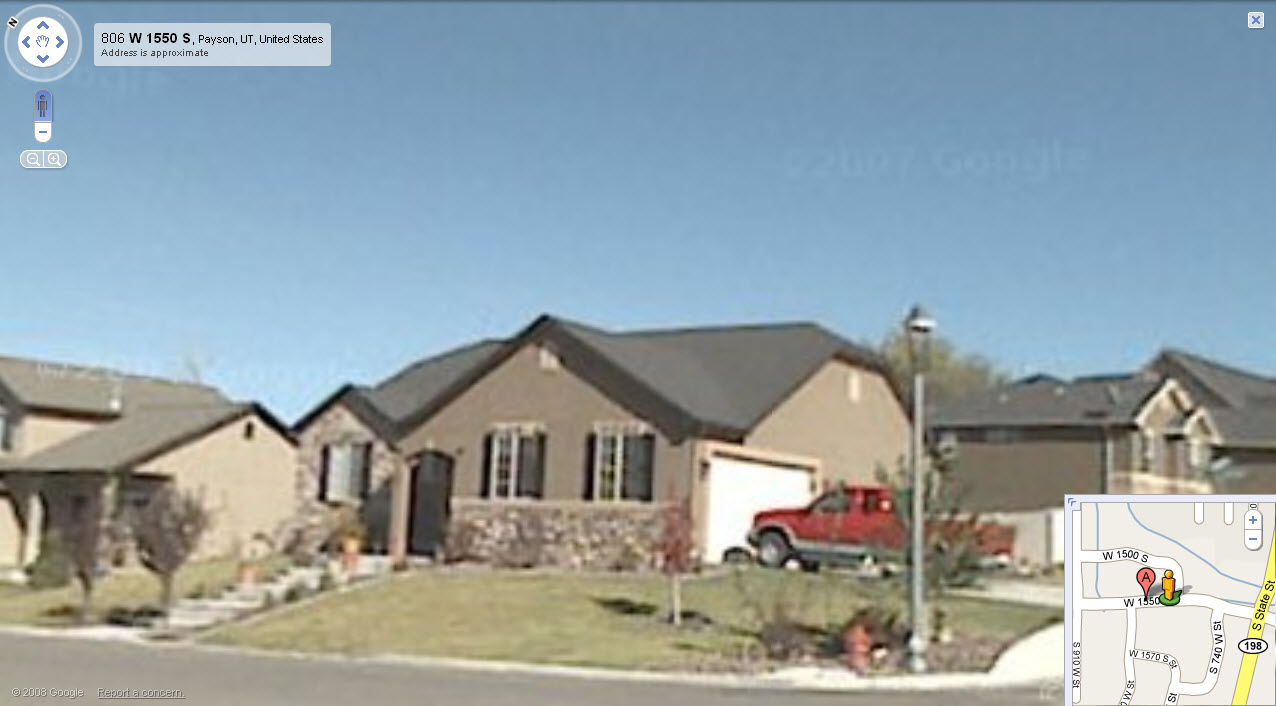

- Property Address : 1541 S 780 WEST - PAYSON

- Tax District : 170 - PAYSON CITY

- Acreage : 0.213

- Property Classification : RP - RES PRIMARY

- Legal Description : LOT 240, PLAT C, MAPLES AT BROOKSIDE PRD AMENDED. AREA 0.213 AC.

| Property Types: | 2024 Market Value |

2025 Market Value |

|||||||

| Primary Residential | $485,600 |

$485,600 |

|||||||

| Total Property Market Value | $485,600 | $485,600 | |||||||