Property Valuation Information

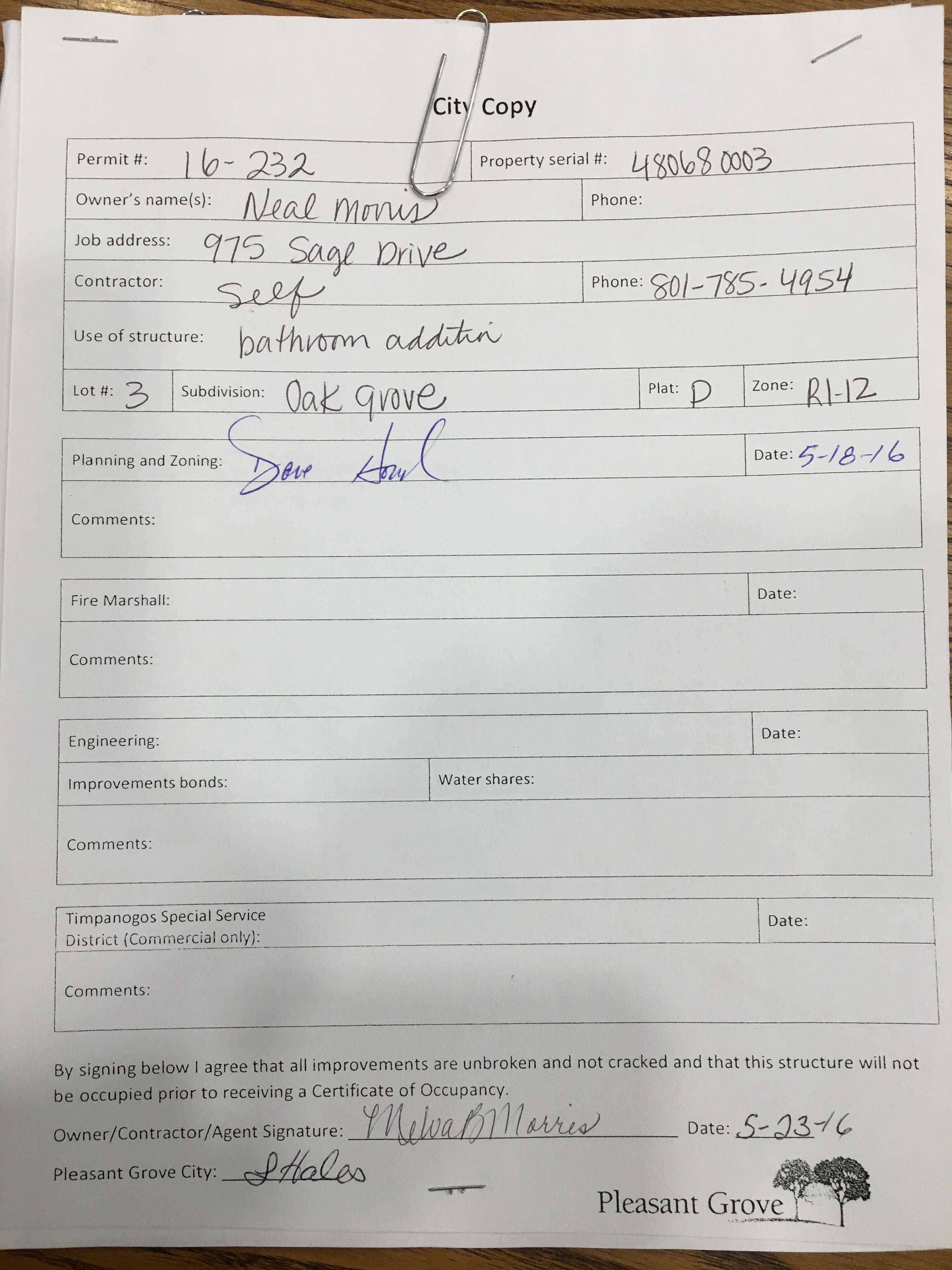

- Serial Number : 480680003

- Tax Year : 2024

- Owner Names : MORRIS, NEAL RAY & MELVA B

- Property Address : 975 N SAGE DR - PLEASANT GROVE

- Tax District : 070 - PLEASANT GROVE CITY

- Acreage : 0.31

- Property Classification : RP - RES PRIMARY

- Legal Description : LOT 3, PLAT D, OAK GROVE SUB.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Primary Residential | $597,200 |

$603,300 |

|||||||

| Total Property Market Value | $597,200 | $603,300 | |||||||