Property Valuation Information

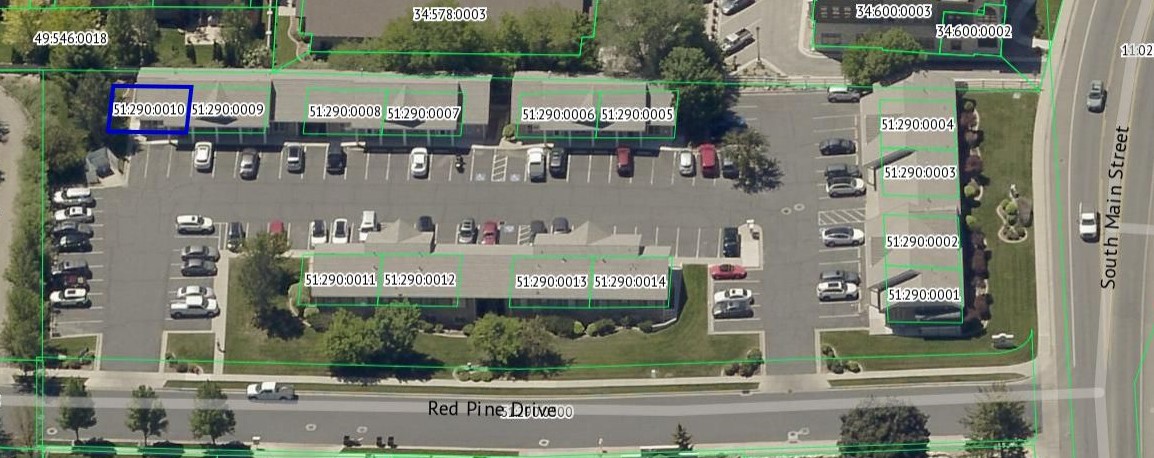

- Serial Number : 512900010

- Tax Year : 2024

- Owner Names : MSW PROPERTIES LLC

- Property Address : 90 E RED PINE DR - ALPINE

- Tax District : 040 - ALPINE CITY

- Acreage : 0.022

- Property Classification : COC - COMM CONDO

- Legal Description : UNIT 10, RIVER MEADOWS OFFICE PARK CONDOMINIUMS P. AREA 0.022 AC.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Non-Primary Residential | $288,000 |

$293,800 |

|||||||

| Total Property Market Value | $288,000 | $293,800 | |||||||