Property Information

mobile view

| Serial Number: 24:046:8400 |

Serial Life: 2003... |

|

|

Total Photos: 7

Total Photos: 7

|

| |

|

|

| Property Address: 2070 N 300 WEST - SPANISH FORK |

|

| Mailing Address: 196 S MAIN PLEASANT GROVE, UT 84062 |

|

| Acreage: 0 |

|

| Last Document:

2614-1984

|

|

| Subdivision Map Filing |

|

| Taxing Description:

HANGAR #65, SP FORK-SPRINGVILLE AIRPORT, SEC 12, T8S, R2, SLM. ********** (BLDG ONLY) **********

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

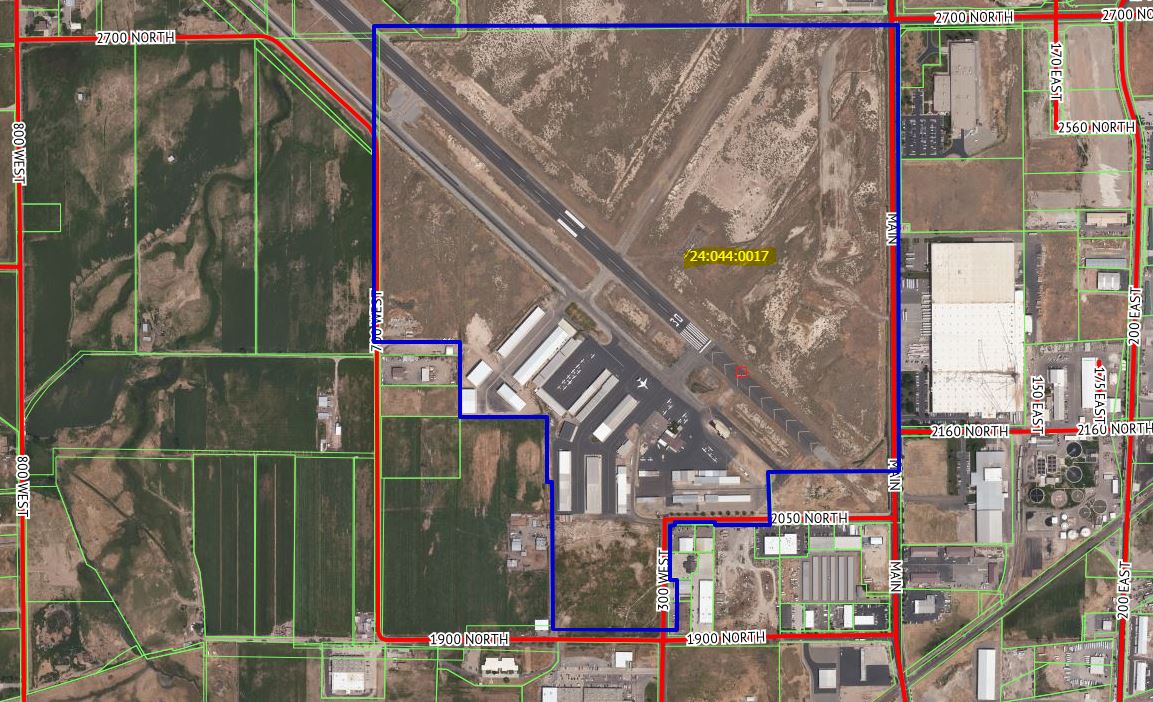

- Aerial Image

| 2023... |

|

JENSEN, PAUL G |

|

| 2014-2022 |

|

JENSEN, PAUL G |

|

| 2011-2013 |

|

PATTERSON, DOUG |

|

| 2011-2013 |

|

PATTERSON, KRISTIE K |

|

| 2006-2010 |

|

PATTERSON, DOUG |

|

| 2006-2010 |

|

PATTERSON, KRISTIE K |

|

| 2006NV |

|

PATTERSON, DOUG |

|

| 2006NV |

|

PATTERSON, KRISTIE K |

|

| 2004-2005 |

|

LONG, DUANE |

|

| 2003 |

|

COOK, LYNN |

|

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$0 |

$0 |

$0 |

$0 |

$151,700 |

$0 |

$0 |

$151,700 |

$0 |

$0 |

$0 |

$151,700 |

| 2023 |

$0 |

$0 |

$0 |

$0 |

$136,100 |

$0 |

$0 |

$136,100 |

$0 |

$0 |

$0 |

$136,100 |

| 2022 |

$0 |

$0 |

$0 |

$0 |

$125,200 |

$0 |

$0 |

$125,200 |

$0 |

$0 |

$0 |

$125,200 |

| 2021 |

$0 |

$0 |

$0 |

$0 |

$109,300 |

$0 |

$0 |

$109,300 |

$0 |

$0 |

$0 |

$109,300 |

| 2020 |

$0 |

$0 |

$0 |

$0 |

$109,300 |

$0 |

$0 |

$109,300 |

$0 |

$0 |

$0 |

$109,300 |

| 2019 |

$0 |

$0 |

$0 |

$0 |

$106,900 |

$0 |

$0 |

$106,900 |

$0 |

$0 |

$0 |

$106,900 |

| 2018 |

$0 |

$0 |

$0 |

$0 |

$97,600 |

$0 |

$0 |

$97,600 |

$0 |

$0 |

$0 |

$97,600 |

| 2017 |

$0 |

$0 |

$0 |

$0 |

$84,900 |

$0 |

$0 |

$84,900 |

$0 |

$0 |

$0 |

$84,900 |

| 2016 |

$0 |

$0 |

$0 |

$0 |

$81,300 |

$0 |

$0 |

$81,300 |

$0 |

$0 |

$0 |

$81,300 |

| 2015 |

$0 |

$0 |

$0 |

$0 |

$81,300 |

$0 |

$0 |

$81,300 |

$0 |

$0 |

$0 |

$81,300 |

| 2014 |

$0 |

$0 |

$0 |

$0 |

$81,300 |

$0 |

$0 |

$81,300 |

$0 |

$0 |

$0 |

$81,300 |

| 2013 |

$0 |

$0 |

$0 |

$0 |

$81,300 |

$0 |

$0 |

$81,300 |

$0 |

$0 |

$0 |

$81,300 |

| 2012 |

$0 |

$0 |

$0 |

$0 |

$33,000 |

$0 |

$0 |

$33,000 |

$0 |

$0 |

$0 |

$33,000 |

| 2011 |

$0 |

$0 |

$0 |

$0 |

$33,000 |

$0 |

$0 |

$33,000 |

$0 |

$0 |

$0 |

$33,000 |

| 2010 |

$0 |

$0 |

$0 |

$0 |

$33,000 |

$0 |

$0 |

$33,000 |

$0 |

$0 |

$0 |

$33,000 |

| 2009 |

$0 |

$0 |

$0 |

$0 |

$33,000 |

$0 |

$0 |

$33,000 |

$0 |

$0 |

$0 |

$33,000 |

| 2008 |

$0 |

$0 |

$0 |

$0 |

$33,000 |

$0 |

$0 |

$33,000 |

$0 |

$0 |

$0 |

$33,000 |

| 2007 |

$0 |

$0 |

$0 |

$0 |

$30,000 |

$0 |

$0 |

$30,000 |

$0 |

$0 |

$0 |

$30,000 |

| 2006 |

$0 |

$0 |

$0 |

$0 |

$30,000 |

$0 |

$0 |

$30,000 |

$0 |

$0 |

$0 |

$30,000 |

| 2005 |

$0 |

$0 |

$0 |

$0 |

$30,000 |

$0 |

$0 |

$30,000 |

$0 |

$0 |

$0 |

$30,000 |

| 2004 |

$0 |

$0 |

$0 |

$0 |

$30,000 |

$0 |

$0 |

$30,000 |

$0 |

$0 |

$0 |

$30,000 |

| 2003 |

$0 |

$0 |

$0 |

$0 |

$48,410 |

$0 |

$0 |

$48,410 |

$0 |

$0 |

$0 |

$48,410 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2024 |

$1,471.79 |

$0.00 |

$1,471.79 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2023 |

$1,318.95 |

$0.00 |

$1,318.95 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2022 |

$1,237.10 |

$0.00 |

$1,237.10 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2021 |

$1,227.44 |

$0.00 |

$1,227.44 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2020 |

$1,262.52 |

$0.00 |

$1,262.52 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2019 |

$1,173.66 |

$0.00 |

$1,173.66 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2018 |

$1,108.54 |

$0.00 |

$1,108.54 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2017 |

$986.71 |

$0.00 |

$986.71 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2016 |

$957.55 |

$0.00 |

$957.55 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2015 |

$969.10 |

$0.00 |

$969.10 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2014 |

$965.60 |

$0.00 |

$965.60 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2013 |

$1,012.35 |

$0.00 |

$1,012.35 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2012 |

$416.30 |

$0.00 |

$416.30 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2011 |

$407.02 |

$0.00 |

$407.02 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2010 |

$396.73 |

$0.00 |

$396.73 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2009 |

$375.54 |

$0.00 |

$375.54 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2008 |

$348.94 |

$0.00 |

$348.94 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2007 |

$317.88 |

$0.00 |

$317.88 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2006 |

$344.37 |

$0.00 |

$344.37 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2005 |

$369.81 |

$0.00 |

$369.81 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2004 |

$370.35 |

$0.00 |

$370.35 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2003 |

$540.21 |

($205.44) |

$334.77 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 105165-2013 |

08/15/2013 |

11/13/2013 |

AS I |

JENSEN, PAUL G |

JENSEN, PAUL G TEE |

| 114949-2008 |

10/20/2008 |

10/22/2008 |

CT |

STATE OF UTAH |

WHOM OF INTEREST |

| 107508-2008 |

09/30/2008 |

09/30/2008 |

RESOL |

BOARD OF COUNTY COMMISSIONERS UTAH COUNTY |

WHOM OF INTEREST |

| 37370-2006 |

03/24/2006 |

03/29/2006 |

WD |

LONG, DUANE FRANK & CINDIE W |

PATTERSON, DOUG & KRISTIE K |

| 100013-2002 |

03/31/2002 |

03/31/2002 |

BLDG |

COOK, LYNN |

|

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 12/26/2024 2:04:24 PM |