Property Information

| Serial Number: 08:059:0005 |

Serial Life: 1981... |

|

|

Total Photos: 1

Total Photos: 1

|

| |

|

|

| Property Address: 454 S 400 WEST - PAYSON |

|

| Mailing Address: 454 S 400 W PAYSON, UT 84651 |

|

| Acreage: 0.5 |

|

| Last Document:

67196-2007

|

|

| Subdivision Map Filing |

|

| Taxing Description:

COM S 11.2 RD FROM THE NE COR. BLK 8, PLAT J, PAYSON CITY SURVEY; S 94.38 FT; W 231 FT; N 94.38 FT; E 231 FT TO THE POB. AREA 0.501 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

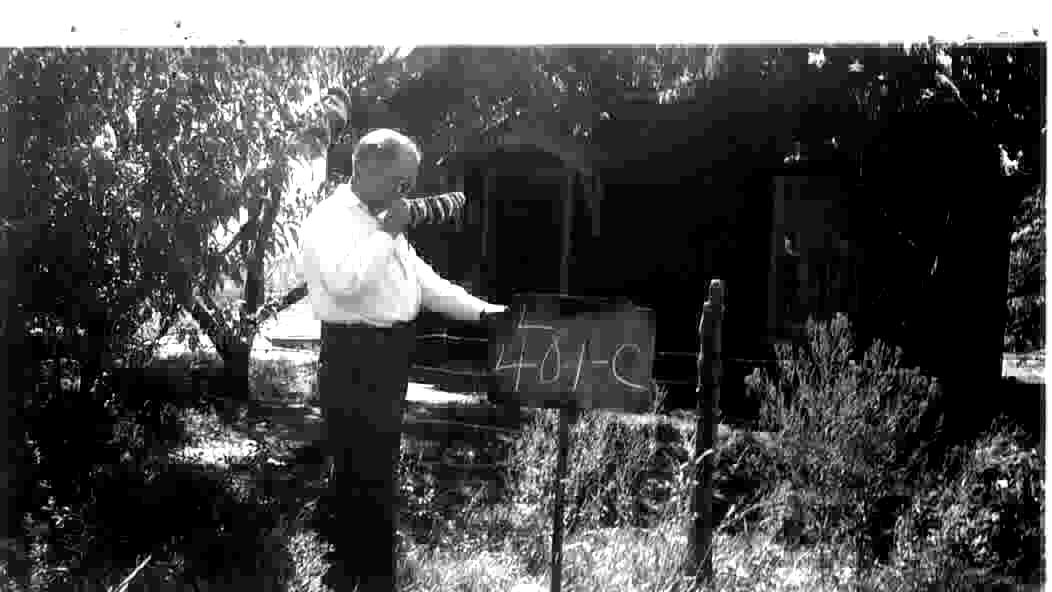

- Photos

- Documents

- Aerial Image

| 2023... |

|

WAYLAND, GARRETT |

|

| 2023NV |

|

TUTTLE, BRANT D |

|

| 2023NV |

|

TUTTLE, LORRAINE W |

|

| 2009-2022 |

|

TUTTLE, BRANT D |

|

| 2009-2022 |

|

TUTTLE, LORRAINE W |

|

| 2009NV |

|

TROTTER, CODY |

|

| 2001-2008 |

|

ERICKSEN, MARY ALENE |

|

| 1987-2000 |

|

ERICKSEN, MARY ALENE |

|

| 1987-2000 |

|

ERICKSEN, RONALD JAY |

|

| 1983-1986 |

|

ERICKSEN, MARY ALENE |

|

| 1983-1986 |

|

ERICKSEN, RONALD JAY |

|

| 1981-1982 |

|

ERICKSEN, MARY ALENE |

|

| 1981-1982 |

|

ERICKSEN, RONALD JAY |

|

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2025 |

$0 |

$147,800 |

$0 |

$147,800 |

$0 |

$399,100 |

$0 |

$399,100 |

$0 |

$0 |

$0 |

$546,900 |

| 2024 |

$0 |

$127,400 |

$0 |

$127,400 |

$0 |

$352,800 |

$0 |

$352,800 |

$0 |

$0 |

$0 |

$480,200 |

| 2023 |

$0 |

$127,400 |

$0 |

$127,400 |

$0 |

$370,300 |

$0 |

$370,300 |

$0 |

$0 |

$0 |

$497,700 |

| 2022 |

$0 |

$135,800 |

$0 |

$135,800 |

$0 |

$288,000 |

$0 |

$288,000 |

$0 |

$0 |

$0 |

$423,800 |

| 2021 |

$0 |

$108,600 |

$0 |

$108,600 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$108,600 |

| 2020 |

$0 |

$94,400 |

$0 |

$94,400 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$94,400 |

| 2019 |

$0 |

$81,600 |

$0 |

$81,600 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$81,600 |

| 2018 |

$0 |

$68,700 |

$0 |

$68,700 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$68,700 |

| 2017 |

$0 |

$66,100 |

$0 |

$66,100 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$66,100 |

| 2016 |

$0 |

$60,100 |

$0 |

$60,100 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$60,100 |

| 2015 |

$0 |

$55,800 |

$0 |

$55,800 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$55,800 |

| 2014 |

$0 |

$51,500 |

$0 |

$51,500 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$51,500 |

| 2013 |

$0 |

$41,900 |

$0 |

$41,900 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$41,900 |

| 2012 |

$0 |

$43,500 |

$0 |

$43,500 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$43,500 |

| 2011 |

$0 |

$44,500 |

$0 |

$44,500 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$44,500 |

| 2010 |

$0 |

$67,900 |

$0 |

$67,900 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$67,900 |

| 2009 |

$0 |

$67,900 |

$0 |

$67,900 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$67,900 |

| 2008 |

$0 |

$70,000 |

$0 |

$70,000 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$70,000 |

| 2007 |

$0 |

$70,000 |

$0 |

$70,000 |

$0 |

$40,500 |

$0 |

$40,500 |

$0 |

$0 |

$0 |

$110,500 |

| 2006 |

$0 |

$43,500 |

$0 |

$43,500 |

$0 |

$31,300 |

$0 |

$31,300 |

$0 |

$0 |

$0 |

$74,800 |

| 2005 |

$0 |

$41,388 |

$0 |

$41,388 |

$0 |

$29,849 |

$0 |

$29,849 |

$0 |

$0 |

$0 |

$71,237 |

| 2004 |

$0 |

$41,388 |

$0 |

$41,388 |

$0 |

$29,849 |

$0 |

$29,849 |

$0 |

$0 |

$0 |

$71,237 |

| 2003 |

$0 |

$41,388 |

$0 |

$41,388 |

$0 |

$29,849 |

$0 |

$29,849 |

$0 |

$0 |

$0 |

$71,237 |

| 2002 |

$0 |

$41,388 |

$0 |

$41,388 |

$0 |

$29,849 |

$0 |

$29,849 |

$0 |

$0 |

$0 |

$71,237 |

| 2001 |

$0 |

$47,572 |

$0 |

$47,572 |

$0 |

$27,135 |

$0 |

$27,135 |

$0 |

$0 |

$0 |

$74,707 |

| 2000 |

$0 |

$44,460 |

$0 |

$44,460 |

$0 |

$23,604 |

$0 |

$23,604 |

$0 |

$0 |

$0 |

$68,064 |

| 1999 |

$0 |

$44,460 |

$0 |

$44,460 |

$0 |

$23,604 |

$0 |

$23,604 |

$0 |

$0 |

$0 |

$68,064 |

| 1998 |

$0 |

$44,460 |

$0 |

$44,460 |

$0 |

$23,604 |

$0 |

$23,604 |

$0 |

$0 |

$0 |

$68,064 |

| 1997 |

$0 |

$44,460 |

$0 |

$44,460 |

$0 |

$23,604 |

$0 |

$23,604 |

$0 |

$0 |

$0 |

$68,064 |

| 1996 |

$0 |

$33,100 |

$0 |

$33,100 |

$0 |

$17,573 |

$0 |

$17,573 |

$0 |

$0 |

$0 |

$50,673 |

| 1995 |

$0 |

$30,091 |

$0 |

$30,091 |

$0 |

$17,573 |

$0 |

$17,573 |

$0 |

$0 |

$0 |

$47,664 |

| 1994 |

$0 |

$17,597 |

$0 |

$17,597 |

$0 |

$14,172 |

$0 |

$14,172 |

$0 |

$0 |

$0 |

$31,769 |

| 1993 |

$0 |

$17,597 |

$0 |

$17,597 |

$0 |

$14,172 |

$0 |

$14,172 |

$0 |

$0 |

$0 |

$31,769 |

| 1992 |

$0 |

$16,144 |

$0 |

$16,144 |

$0 |

$13,002 |

$0 |

$13,002 |

$0 |

$0 |

$0 |

$29,146 |

| 1991 |

$0 |

$14,161 |

$0 |

$14,161 |

$0 |

$11,405 |

$0 |

$11,405 |

$0 |

$0 |

$0 |

$25,566 |

| 1990 |

$0 |

$14,161 |

$0 |

$14,161 |

$0 |

$11,405 |

$0 |

$11,405 |

$0 |

$0 |

$0 |

$25,566 |

| 1989 |

$0 |

$14,161 |

$0 |

$14,161 |

$0 |

$11,405 |

$0 |

$11,405 |

$0 |

$0 |

$0 |

$25,566 |

| 1988 |

$0 |

$14,162 |

$0 |

$14,162 |

$0 |

$11,405 |

$0 |

$11,405 |

$0 |

$0 |

$0 |

$25,567 |

| 1987 |

$0 |

$14,600 |

$0 |

$14,600 |

$0 |

$11,758 |

$0 |

$11,758 |

$0 |

$0 |

$0 |

$26,358 |

| 1986 |

$0 |

$14,600 |

$0 |

$14,600 |

$0 |

$11,759 |

$0 |

$11,759 |

$0 |

$0 |

$0 |

$26,359 |

| 1985 |

$0 |

$14,600 |

$0 |

$14,600 |

$0 |

$11,758 |

$0 |

$11,758 |

$0 |

$0 |

$0 |

$26,358 |

| 1984 |

$0 |

$14,750 |

$0 |

$14,750 |

$0 |

$11,875 |

$0 |

$11,875 |

$0 |

$0 |

$0 |

$26,625 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax Area |

| 2026 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2025 |

$2,991.41 |

$0.00 |

$2,991.41 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2024 |

$2,595.14 |

$0.00 |

$2,595.14 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2023 |

$2,682.33 |

$0.00 |

$2,682.33 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2022 |

$2,322.28 |

$0.00 |

$2,322.28 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2021 |

$1,226.53 |

$0.00 |

$1,226.53 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2020 |

$1,089.75 |

$0.00 |

$1,089.75 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2019 |

$918.82 |

$0.00 |

$918.82 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2018 |

$802.62 |

$0.00 |

$802.62 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2017 |

$789.70 |

$0.00 |

$789.70 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2016 |

$722.76 |

$0.00 |

$722.76 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2015 |

$675.68 |

$0.00 |

$675.68 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2014 |

$619.13 |

$0.00 |

$619.13 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2013 |

$527.27 |

$0.00 |

$527.27 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2012 |

$555.67 |

$0.00 |

$555.67 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2011 |

$554.96 |

$0.00 |

$554.96 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2010 |

$825.66 |

$0.00 |

$825.66 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2009 |

$782.00 |

$0.00 |

$782.00 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2008 |

$749.91 |

$0.00 |

$749.91 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2007 |

$645.80 |

$0.00 |

$645.80 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2006 |

$485.74 |

$0.00 |

$485.74 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2005 |

$492.45 |

$0.00 |

$492.45 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2004 |

$493.82 |

$0.00 |

$493.82 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2003 |

$448.22 |

$0.00 |

$448.22 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2002 |

$437.48 |

$0.00 |

$437.48 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2001 |

$467.31 |

$0.00 |

$467.31 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2000 |

$421.18 |

$0.00 |

$421.18 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1999 |

$399.84 |

$0.00 |

$399.84 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1998 |

$389.96 |

$0.00 |

$389.96 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1997 |

$430.13 |

$0.00 |

$430.13 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1996 |

$315.46 |

$0.00 |

$315.46 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1995 |

$296.57 |

$0.00 |

$296.57 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1994 |

$304.00 |

$0.00 |

$304.00 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1993 |

$276.10 |

$0.00 |

$276.10 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1992 |

$247.34 |

$0.00 |

$247.34 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1991 |

$228.39 |

$0.00 |

$228.39 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1990 |

$228.67 |

$0.00 |

$228.67 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1989 |

$229.87 |

$0.00 |

$229.87 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1988 |

$229.87 |

$0.00 |

$229.87 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1987 |

$237.67 |

$0.00 |

$237.67 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1986 |

$225.06 |

$0.00 |

$225.06 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1985 |

$219.10 |

$0.00 |

$219.10 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1984 |

$207.04 |

$0.00 |

$207.04 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 25820-2022 |

12/07/2021 |

02/28/2022 |

WD |

TUTTLE, BRANT D & LORRAINE W |

WAYLAND, GARRETT |

| 179404-2021 |

10/20/2021 |

10/21/2021 |

RSUBTEE |

THAYER COUNTY BANK (ET AL) |

TUTTLE, BRANT D & LORRAINE W |

| 129049-2021 |

07/21/2021 |

07/22/2021 |

WD |

WAYLAND, GARRETT |

WAYLAND, GARRETT & HAILEY ROSE |

| 129048-2021 |

07/21/2021 |

07/22/2021 |

D TR |

WAYLAND, GARRETT |

CITY CREEK MORTGAGE CORP |

| 129047-2021 |

07/20/2021 |

07/22/2021 |

WD |

TUTTLE, BRANT D & LORRAINE W |

WAYLAND, GARRETT |

| 3187-2015 |

12/04/2014 |

01/14/2015 |

QCD |

UNITED STATES OF AMERICA |

SOUTH UTAH VALLEY ELECTRIC SERVICE DISTRICT |

| 114949-2008 |

10/20/2008 |

10/22/2008 |

CT |

STATE OF UTAH |

WHOM OF INTEREST |

| 107508-2008 |

09/30/2008 |

09/30/2008 |

RESOL |

BOARD OF COUNTY COMMISSIONERS UTAH COUNTY |

WHOM OF INTEREST |

| 3184-2008 |

01/09/2008 |

01/09/2008 |

CORR AF |

BARTLETT TITLE INSURANCE AGENCY INC (ET AL) |

WHOM OF INTEREST |

| 101138-2007 |

06/11/2007 |

07/12/2007 |

REC |

EXECUTIVE TITLE INSURANCE AGENCY INC TEE |

ERICKSEN, MARY ALENE |

| 88262-2007 |

06/13/2007 |

06/18/2007 |

REC |

BARTLETT TITLE INSURANCE AGENCY INC TEE |

ERICKSEN, MARY ALENE |

| 86120-2007 |

06/07/2007 |

06/13/2007 |

REC |

WESTERN COMMUNITY BANK TEE |

TROTTER, CODY |

| 67384-2007 |

05/04/2007 |

05/07/2007 |

D TR |

TUTTLE, BRANT D & LORRAINE W |

THAYER COUNTY BANK |

| 67196-2007 |

05/03/2007 |

05/07/2007 |

WD |

TROTTER, CODY |

TUTTLE, BRANT D & LORRAINE W |

| 411-2007 |

12/28/2006 |

01/02/2007 |

D TR |

TROTTER, CODY |

WESTERN COMMUNITY BANK |

| 367-2007 |

12/29/2006 |

01/02/2007 |

WD |

ERICKSEN, RONALD WAYNE PERREP (ET AL) |

TROTTER, CODY |

| 143849-2004 |

12/16/2004 |

12/23/2004 |

TR D |

ERICKSEN, MARY A |

WELLS FARGO FINANCIAL UTAH INC |

| 96817-2000 |

12/06/2000 |

12/06/2000 |

TR D |

ERICKSEN, MARY A |

COURTYARD MORTGAGE |

| 96816-2000 |

12/06/2000 |

12/06/2000 |

AF DC |

ERICKSEN, RONALD J & RONALD JAY AKA |

WHOM OF INTEREST |

| 35822-1991 |

09/09/1991 |

09/09/1991 |

REC |

WESTERN STATES TITLE COMPANY TEE |

ERICKSEN, RONALD JAY & MARY ALENE |

| 28063-1986 |

08/25/1986 |

08/26/1986 |

NA AGR |

ERICKSEN, RONALD JAY & MARY ALENE |

OREM GENEVA FEDERAL CREDIT UNION |

| 28062-1986 |

08/25/1986 |

08/26/1986 |

D TR |

ERICKSEN, RONALD JAY & MARY ALENE |

OREM GENEVA FEDERAL CREDIT UNION |

| 12193-1982 |

05/14/1982 |

05/17/1982 |

REL |

GENEVA FEDERAL CREDIT UNION |

ERICKSEN, RONALD JAY & MARY ALENE |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 2/22/2026 11:17:09 AM |