Property Information

mobile view

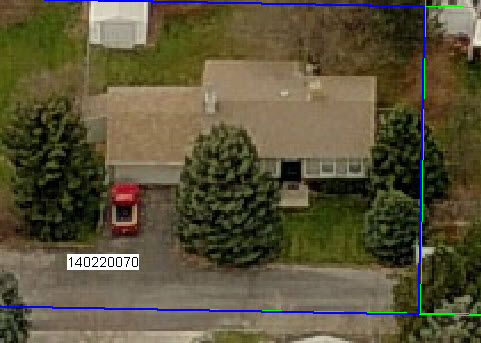

| Serial Number: 14:022:0070 |

Serial Life: 1981... |

|

|

Total Photos: 1

Total Photos: 1

|

| |

|

|

| Property Address: 1877 W 1100 NORTH - PLEASANT GROVE |

|

| Mailing Address: 1877 W 1100 N PLEASANT GROVE, UT 84062-4032 |

|

| Acreage: 0.48 |

|

| Last Document:

106715-2012

|

|

| Subdivision Map Filing |

|

| Taxing Description:

COM S 797.717 FT & W 1099.684 FT FR N1/4 COR SEC 19, T5S, R2E, SLM; S 0 DEG 41'W 177.307 FT; N 89 DEG 15'W 120 FT; N 0 DEG 41'E 174.223 FT; N 89 DEG 16'40"E 120.036 FT TO BEG. AREA .48 ACRES.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| 2022... |

|

HAMMOND, CARRIE A |

|

| 2022... |

|

HAMMOND, HAL G |

|

| 2013-2021 |

|

HAMMOND, CARRIE ADELE |

|

| 2013-2021 |

|

HAMMOND, HAL G |

|

| 2013NV |

|

HAMMOND, HAL G |

|

| 2012 |

|

HAMMOND, IDA JEAN |

|

| 2009-2011 |

|

HAMMOND, HAL |

|

| 2009-2011 |

|

HAMMOND, IDA JEAN |

|

| 2005-2008 |

|

IDA JEAN HAMMOND LC |

|

| 1988-2004 |

|

HASKELL, ARNOLD E |

|

| 1988-2004 |

|

HASKELL, IDA H |

|

| 1985-1987 |

|

HASKELL, ARNOLD E |

|

| 1985-1987 |

|

HASKELL, IDA H |

|

| 1982-1984 |

|

HASKELL, ARNOLD E |

|

| 1982-1984 |

|

HASKELL, IDA H |

|

| 1981 |

|

HASKELL, ARNOLD E |

|

| 1981 |

|

HASKELL, IDA H |

|

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$0 |

$260,300 |

$0 |

$260,300 |

$0 |

$241,200 |

$0 |

$241,200 |

$0 |

$0 |

$0 |

$501,500 |

| 2023 |

$0 |

$260,300 |

$0 |

$260,300 |

$0 |

$252,900 |

$0 |

$252,900 |

$0 |

$0 |

$0 |

$513,200 |

| 2022 |

$0 |

$274,600 |

$0 |

$274,600 |

$0 |

$277,600 |

$0 |

$277,600 |

$0 |

$0 |

$0 |

$552,200 |

| 2021 |

$0 |

$171,600 |

$0 |

$171,600 |

$0 |

$210,300 |

$0 |

$210,300 |

$0 |

$0 |

$0 |

$381,900 |

| 2020 |

$0 |

$153,200 |

$0 |

$153,200 |

$0 |

$191,200 |

$0 |

$191,200 |

$0 |

$0 |

$0 |

$344,400 |

| 2019 |

$0 |

$144,700 |

$0 |

$144,700 |

$0 |

$166,300 |

$0 |

$166,300 |

$0 |

$0 |

$0 |

$311,000 |

| 2018 |

$0 |

$127,600 |

$0 |

$127,600 |

$0 |

$144,600 |

$0 |

$144,600 |

$0 |

$0 |

$0 |

$272,200 |

| 2017 |

$0 |

$119,100 |

$0 |

$119,100 |

$0 |

$144,600 |

$0 |

$144,600 |

$0 |

$0 |

$0 |

$263,700 |

| 2016 |

$0 |

$80,800 |

$0 |

$80,800 |

$0 |

$140,400 |

$0 |

$140,400 |

$0 |

$0 |

$0 |

$221,200 |

| 2015 |

$0 |

$76,600 |

$0 |

$76,600 |

$0 |

$140,400 |

$0 |

$140,400 |

$0 |

$0 |

$0 |

$217,000 |

| 2014 |

$0 |

$76,600 |

$0 |

$76,600 |

$0 |

$140,400 |

$0 |

$140,400 |

$0 |

$0 |

$0 |

$217,000 |

| 2013 |

$0 |

$72,200 |

$0 |

$72,200 |

$0 |

$122,100 |

$0 |

$122,100 |

$0 |

$0 |

$0 |

$194,300 |

| 2012 |

$0 |

$55,900 |

$0 |

$55,900 |

$0 |

$111,000 |

$0 |

$111,000 |

$0 |

$0 |

$0 |

$166,900 |

| 2011 |

$0 |

$52,200 |

$0 |

$52,200 |

$0 |

$121,700 |

$0 |

$121,700 |

$0 |

$0 |

$0 |

$173,900 |

| 2010 |

$0 |

$59,592 |

$0 |

$59,592 |

$0 |

$129,046 |

$0 |

$129,046 |

$0 |

$0 |

$0 |

$188,638 |

| 2009 |

$0 |

$103,300 |

$0 |

$103,300 |

$0 |

$88,200 |

$0 |

$88,200 |

$0 |

$0 |

$0 |

$191,500 |

| 2008 |

$0 |

$130,800 |

$0 |

$130,800 |

$0 |

$64,300 |

$0 |

$64,300 |

$0 |

$0 |

$0 |

$195,100 |

| 2007 |

$0 |

$130,800 |

$0 |

$130,800 |

$0 |

$64,300 |

$0 |

$64,300 |

$0 |

$0 |

$0 |

$195,100 |

| 2006 |

$0 |

$41,200 |

$0 |

$41,200 |

$0 |

$128,000 |

$0 |

$128,000 |

$0 |

$0 |

$0 |

$169,200 |

| 2005 |

$0 |

$41,159 |

$0 |

$41,159 |

$0 |

$98,554 |

$0 |

$98,554 |

$0 |

$0 |

$0 |

$139,713 |

| 2004 |

$0 |

$41,159 |

$0 |

$41,159 |

$0 |

$98,554 |

$0 |

$98,554 |

$0 |

$0 |

$0 |

$139,713 |

| 2003 |

$0 |

$41,159 |

$0 |

$41,159 |

$0 |

$98,554 |

$0 |

$98,554 |

$0 |

$0 |

$0 |

$139,713 |

| 2002 |

$0 |

$41,159 |

$0 |

$41,159 |

$0 |

$98,554 |

$0 |

$98,554 |

$0 |

$0 |

$0 |

$139,713 |

| 2001 |

$0 |

$41,159 |

$0 |

$41,159 |

$0 |

$98,554 |

$0 |

$98,554 |

$0 |

$0 |

$0 |

$139,713 |

| 2000 |

$0 |

$38,466 |

$0 |

$38,466 |

$0 |

$92,150 |

$0 |

$92,150 |

$0 |

$0 |

$0 |

$130,616 |

| 1999 |

$0 |

$38,466 |

$0 |

$38,466 |

$0 |

$92,150 |

$0 |

$92,150 |

$0 |

$0 |

$0 |

$130,616 |

| 1998 |

$0 |

$34,041 |

$0 |

$34,041 |

$0 |

$81,549 |

$0 |

$81,549 |

$0 |

$0 |

$0 |

$115,590 |

| 1997 |

$0 |

$34,041 |

$0 |

$34,041 |

$0 |

$81,549 |

$0 |

$81,549 |

$0 |

$0 |

$0 |

$115,590 |

| 1996 |

$0 |

$30,798 |

$0 |

$30,798 |

$0 |

$73,780 |

$0 |

$73,780 |

$0 |

$0 |

$0 |

$104,578 |

| 1995 |

$0 |

$27,998 |

$0 |

$27,998 |

$0 |

$73,780 |

$0 |

$73,780 |

$0 |

$0 |

$0 |

$101,778 |

| 1994 |

$0 |

$16,373 |

$0 |

$16,373 |

$0 |

$59,500 |

$0 |

$59,500 |

$0 |

$0 |

$0 |

$75,873 |

| 1993 |

$0 |

$16,373 |

$0 |

$16,373 |

$0 |

$59,500 |

$0 |

$59,500 |

$0 |

$0 |

$0 |

$75,873 |

| 1992 |

$0 |

$15,021 |

$0 |

$15,021 |

$0 |

$54,587 |

$0 |

$54,587 |

$0 |

$0 |

$0 |

$69,608 |

| 1991 |

$0 |

$13,176 |

$0 |

$13,176 |

$0 |

$47,883 |

$0 |

$47,883 |

$0 |

$0 |

$0 |

$61,059 |

| 1990 |

$0 |

$13,176 |

$0 |

$13,176 |

$0 |

$47,883 |

$0 |

$47,883 |

$0 |

$0 |

$0 |

$61,059 |

| 1989 |

$0 |

$13,176 |

$0 |

$13,176 |

$0 |

$47,883 |

$0 |

$47,883 |

$0 |

$0 |

$0 |

$61,059 |

| 1988 |

$0 |

$13,177 |

$0 |

$13,177 |

$0 |

$48,335 |

$0 |

$48,335 |

$0 |

$0 |

$0 |

$61,512 |

| 1987 |

$0 |

$13,583 |

$0 |

$13,583 |

$0 |

$45,800 |

$0 |

$45,800 |

$0 |

$0 |

$0 |

$59,383 |

| 1986 |

$0 |

$13,584 |

$0 |

$13,584 |

$0 |

$45,801 |

$0 |

$45,801 |

$0 |

$0 |

$0 |

$59,385 |

| 1985 |

$0 |

$0 |

$4,556 |

$4,556 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$4,556 |

| 1984 |

$0 |

$13,717 |

$0 |

$13,717 |

$0 |

$46,267 |

$0 |

$46,267 |

$0 |

$0 |

$0 |

$59,984 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2024 |

$2,363.54 |

$0.00 |

$2,363.54 |

$0.00 |

|

|

Click for Payoff

|

070 - PLEASANT GROVE CITY |

| 2023 |

$2,310.30 |

($53.63) |

$2,256.67 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2022 |

$2,498.32 |

$0.00 |

$2,498.32 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2021 |

$2,063.27 |

$0.00 |

$2,063.27 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2020 |

$1,897.99 |

$0.00 |

$1,897.99 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2019 |

$1,657.30 |

$0.00 |

$1,657.30 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2018 |

$1,534.08 |

$0.00 |

$1,534.08 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2017 |

$1,535.34 |

$0.00 |

$1,535.34 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2016 |

$1,334.00 |

$0.00 |

$1,334.00 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2015 |

$1,381.95 |

$0.00 |

$1,381.95 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2014 |

$1,395.08 |

$0.00 |

$1,395.08 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2013 |

$1,353.87 |

$0.00 |

$1,353.87 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2012 |

$1,188.84 |

$0.00 |

$1,188.84 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2011 |

$1,231.33 |

$0.00 |

$1,231.33 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2010 |

$1,249.78 |

$0.00 |

$1,249.78 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2009 |

$1,170.27 |

$0.00 |

$1,170.27 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2008 |

$1,102.67 |

$0.00 |

$1,102.67 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2007 |

$1,058.99 |

$0.00 |

$1,058.99 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2006 |

$982.99 |

$0.00 |

$982.99 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2005 |

$941.70 |

$0.00 |

$941.70 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2004 |

$953.53 |

$0.00 |

$953.53 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2003 |

$945.62 |

$0.00 |

$945.62 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2002 |

$873.46 |

$0.00 |

$873.46 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2001 |

$862.09 |

$0.00 |

$862.09 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2000 |

$837.21 |

$0.00 |

$837.21 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1999 |

$846.41 |

$0.00 |

$846.41 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1998 |

$734.42 |

$0.00 |

$734.42 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1997 |

$707.91 |

$0.00 |

$707.91 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1996 |

$632.81 |

$0.00 |

$632.81 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1995 |

$692.84 |

$0.00 |

$692.84 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1994 |

$782.37 |

$0.00 |

$782.37 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1993 |

$668.13 |

$0.00 |

$668.13 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1992 |

$613.62 |

$0.00 |

$613.62 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1991 |

$569.39 |

$0.00 |

$569.39 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1990 |

$548.62 |

$0.00 |

$548.62 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1989 |

$556.98 |

$0.00 |

$556.98 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1988 |

$569.66 |

$0.00 |

$569.66 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1987 |

$542.36 |

$0.00 |

$542.36 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1986 |

$531.39 |

$0.00 |

$531.39 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1985 |

$54.84 |

$481.18 |

$536.02 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1984 |

$531.86 |

$0.00 |

$531.86 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 59759-2023 |

09/06/2023 |

09/11/2023 |

D TR |

HAMMOND, HAL G (ET AL) |

DISCOVER BANK |

| 205533-2021 |

12/09/2021 |

12/13/2021 |

REC |

FIRST AMERICAN TITLE INSURANCE COMPANY TEE |

HAMMOND, HAL G & CARRIE ADELE |

| 205532-2021 |

12/09/2021 |

12/13/2021 |

SUB TEE |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC |

FIRST AMERICAN TITLE INSURANCE COMPANY SUBTEE |

| 171581-2021 |

10/01/2021 |

10/06/2021 |

D TR |

HAMMOND, HAL G & CARRIE A |

UNITED WHOLESALE MORTGAGE LLC |

| 171580-2021 |

10/04/2021 |

10/06/2021 |

SP WD |

HAMMOND, HAL G & CARRIE ADELE |

HAMMOND, HAL G & CARRIE A |

| 27982-2018 |

03/20/2018 |

03/26/2018 |

D TR |

HAMMOND, HAL G & CARRIE ADELE |

CALIBER HOME LOANS INC |

| 15006-2018 |

01/30/2018 |

02/14/2018 |

REC |

RIVERS, ROD TEE |

HAMMOND, HAL G |

| 15005-2018 |

01/26/2018 |

02/14/2018 |

SUB TEE |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC |

RIVERS, ROD SUCTEE |

| 122334-2017 |

12/08/2017 |

12/08/2017 |

D TR |

HAMMOND, HAL G & CARRIE ADELE |

KANE, BRIAN |

| 42266-2016 |

05/04/2016 |

05/12/2016 |

REC |

ZB N A TEE |

JEPPERSON, DENNIS G & KATHRYN G |

| 106715-2012 |

12/03/2012 |

12/04/2012 |

SP WD |

HAMMOND, HAL G |

HAMMOND, HAL G & CARRIE ADELE |

| 106714-2012 |

12/03/2012 |

12/04/2012 |

D TR |

HAMMOND, HAL G |

STEARNS LENDING INC |

| 106713-2012 |

12/03/2012 |

12/04/2012 |

WD |

HAMMOND, IDA JEAN |

HAMMOND, HAL G |

| 58560-2011 |

08/15/2011 |

08/18/2011 |

WD |

HAMMOND, HAL |

HAMMOND, IDA JEAN |

| 100013-2008 |

08/15/2008 |

09/10/2008 |

WD |

IDA JEAN HAMMOND LC |

HAMMOND, HAL & IDA JEAN |

| 82813-2004 |

07/15/2004 |

07/19/2004 |

WD |

HASKELL, ARNOLD E & IDA H |

IDA JEAN HAMMOND LC |

| 39759-2000 |

05/12/2000 |

05/19/2000 |

D TR |

JEPPERSON, DENNIS G & KATHRYN G |

ZIONS FIRST NATIONAL BANK |

| 58225-1996 |

07/10/1996 |

07/16/1996 |

REC |

BANK OF AMERICAN FORK TEE |

JEPPERSON, DENNIS G & KATHRYN G |

| 76846-1995 |

11/06/1995 |

11/08/1995 |

RESOL |

UTAH COUNTY COMMISSIONERS |

WHOM OF INTEREST |

| 53965-1995 |

08/11/1995 |

08/18/1995 |

D TR |

LANDMARK BUILDERS LC |

BANK OF AMERICAN FORK |

| 50705-1995 |

08/02/1995 |

08/07/1995 |

REC |

BANK OF AMERICAN FORK TEE |

JEPPERSON, DENNIS G & KATHRYN G |

| 49597-1995 |

07/31/1995 |

08/02/1995 |

D TR |

JEPPERSON, KATHRYN G TEE |

BANK OF AMERICAN FORK |

| 29902-1994 |

04/11/1994 |

04/11/1994 |

REC |

PROVO LAND TITLE COMPANY TEE |

HASKELL, ARNOLD E & IDA H |

| 29901-1994 |

03/30/1994 |

04/11/1994 |

SUB TEE |

FIRST SECURITY BANK OF UTAH |

PROVO LAND TITLE COMPANY SUCTEE |

| 58072-1992 |

10/28/1992 |

10/29/1992 |

QCD |

JEPPERSON, DENNIS G & KATHRYN G |

JEPPERSON, DENNIS G & KATHRYN G TEE |

| 30237-1990 |

09/11/1990 |

09/13/1990 |

REL |

DESERET BANK FKA (ET AL) |

ODEKIRK, WARREN L & DOROTHY M |

| 30071-1990 |

|

09/12/1990 |

REL |

DESERET BANK FKA (ET AL) |

ODEKIRK, WARREN L & DOROTHY M |

| 27134-1988 |

09/08/1988 |

09/13/1988 |

REC |

DESERET BANK TEE |

HASKELL, ARNOLD E & IDA H |

| 33611-1986 |

10/01/1986 |

10/03/1986 |

TR D |

JEPPERSON DENNIS G FAMILY TRUST (ET AL) |

BANK OF AMERICAN FORK |

| 22791-1986 |

06/17/1986 |

07/17/1986 |

REC |

DESERET BANK TEE |

HASKELL, LYNN E & HAREN R |

| 37255-1985 |

12/18/1985 |

12/19/1985 |

TR D |

HASKELL, ARNOLD E & IDA H |

DESERET BANK |

| 12718-1984 |

04/27/1984 |

04/30/1984 |

TR D |

HASKELL, ARNOLD E & IDA H |

DESERET BANK |

| 12717-1984 |

04/27/1984 |

04/30/1984 |

REC |

DESERET BANK FKA (ET AL) |

DAY, DONALD E JR & ELLA E |

| 12716-1984 |

04/27/1984 |

04/30/1984 |

WD |

HASKELL, ARNOLD E & IDA H |

HAMMOND, GAIL C & JEAN H |

| 39050-1983 |

12/03/1983 |

12/23/1983 |

WD |

HASKELL, LYNN E & KAREN R |

JEPPERSON, DENNIS G & KATHRYN G |

| 37022-1983 |

12/03/1983 |

12/06/1983 |

WD |

HASKELL, LYNN E & KAREN R |

JEPPERSON, DENNIS G & KATHRYN G |

| 19381-1983 |

06/23/1983 |

06/30/1983 |

REL |

GRANITE DISTRICT CREDIT UNION |

HASKELL, LYNN E & KAREN R |

| 19089-1983 |

06/21/1983 |

06/28/1983 |

TR D |

HASKELL, LYNN E & KAREN R |

DESERET BANK |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 11/6/2024 12:40:28 PM |