Property Information

mobile view

| Serial Number: 18:003:0065 |

Serial Life: 2017... |

|

|

Total Photos: 49

Total Photos: 49

|

| |

|

|

| Property Address: 331 N 400 WEST - OREM

more see "Addrs" tab below..

|

|

| Mailing Address: %WOOD, JAMES F 4766 S HOLLADAY BLVD HOLLADAY, UT 84117 |

|

| Acreage: 21.147719 |

|

| Last Document:

22181-2016

|

|

| Subdivision Map Filing |

|

| Taxing Description:

COM N 89 DEG 52' 32" W 60.14 FT & S 78.93 FT FR N 1/4 COR. SEC. 15, T6S, R2E, SLB&M.; S 0 DEG 37' 0" E 900.45 FT; N 89 DEG 54' 4" W 644.54 FT; S 0 DEG 2' 40" E 158.87 FT; ALONG A CURVE TO L (CHORD BEARS: S 21 DEG 27' 22" E 36.51 FT, RADIUS = 51 FT); ALONG A CURVE TO R (CHORD BEARS: S 21 DEG 12' 55" E 36.19 FT, RADIUS = 50 FT); S 111.85 FT; S 89 DEG 52' 3" W 109.11 FT; N 338.85 FT; N 89 DEG 54' 1" W 319.05 FT; N 0 DEG 42' 9" W 424.35 FT; S 89 DEG 59' 50" E 105.15 FT; N 473.3 FT; N 89 DEG 56' 28" E 936.48 FT TO BEG. AREA 21.148 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

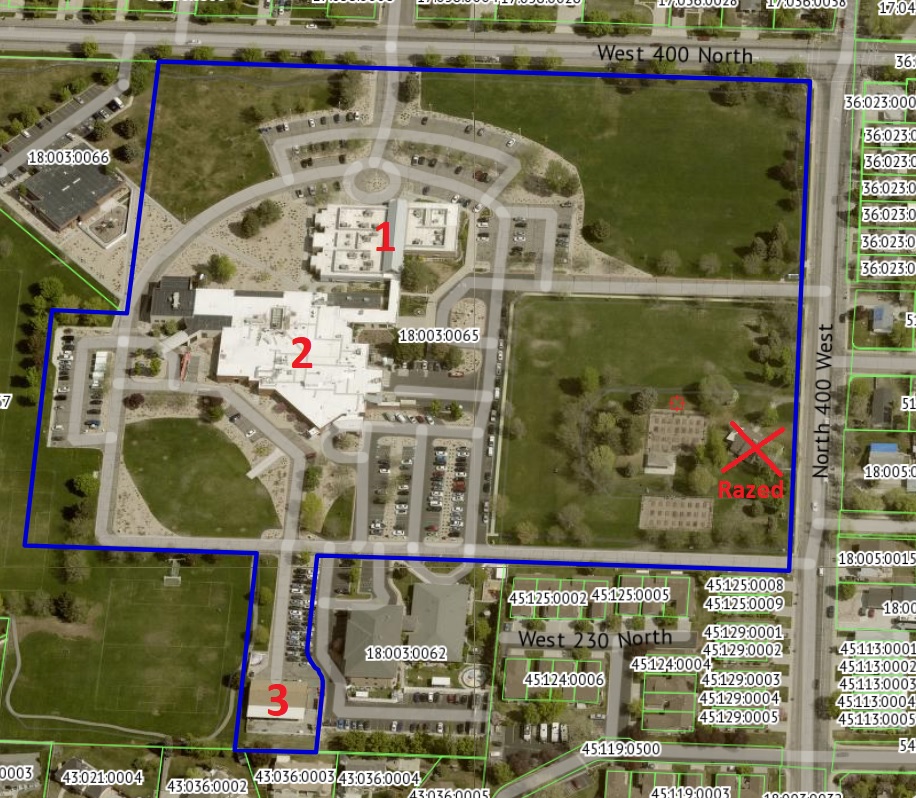

- Aerial Image

- Addrs

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$8,805,100 |

$0 |

$0 |

$8,805,100 |

$13,890,300 |

$0 |

$0 |

$13,890,300 |

$0 |

$0 |

$0 |

$22,695,400 |

| 2023 |

$8,764,100 |

$0 |

$0 |

$8,764,100 |

$13,090,400 |

$0 |

$0 |

$13,090,400 |

$0 |

$0 |

$0 |

$21,854,500 |

| 2022 |

$8,600,300 |

$0 |

$0 |

$8,600,300 |

$12,102,100 |

$0 |

$0 |

$12,102,100 |

$0 |

$0 |

$0 |

$20,702,400 |

| 2021 |

$8,147,400 |

$0 |

$0 |

$8,147,400 |

$10,406,500 |

$0 |

$0 |

$10,406,500 |

$0 |

$0 |

$0 |

$18,553,900 |

| 2020 |

$8,147,400 |

$0 |

$0 |

$8,147,400 |

$10,406,500 |

$0 |

$0 |

$10,406,500 |

$0 |

$0 |

$0 |

$18,553,900 |

| 2019 |

$7,834,000 |

$0 |

$0 |

$7,834,000 |

$10,447,100 |

$0 |

$0 |

$10,447,100 |

$0 |

$0 |

$0 |

$18,281,100 |

| 2018 |

$7,738,000 |

$0 |

$0 |

$7,738,000 |

$9,867,500 |

$0 |

$0 |

$9,867,500 |

$0 |

$0 |

$0 |

$17,605,500 |

| 2017 |

$7,369,600 |

$0 |

$0 |

$7,369,600 |

$9,334,400 |

$0 |

$0 |

$9,334,400 |

$0 |

$0 |

$0 |

$16,704,000 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2024 |

$53,824.86 |

$0.00 |

$53,824.86 |

$0.00 |

|

|

Click for Payoff

|

090 - OREM CITY |

| 2023 |

$48,224.36 |

$0.00 |

$48,224.36 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2022 |

$47,153.03 |

$0.00 |

$47,153.03 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2021 |

$50,728.59 |

$0.00 |

$50,728.59 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2020 |

$51,616.39 |

$0.00 |

$51,616.39 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2019 |

$48,906.51 |

$0.00 |

$48,906.51 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2018 |

$49,294.52 |

$0.00 |

$49,294.52 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2017 |

$48,020.16 |

$0.00 |

$48,020.16 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 167583-2021 |

|

09/29/2021 |

LS AGR |

IHC HEALTH SERVICES INC |

CVS PHARMACY LLC |

| 22181-2016 |

03/14/2016 |

03/16/2016 |

C QCD |

IHC HEALTH SERVICES INC |

IHC HEALTH SERVICES INC |

295 N 400 WEST - OREM

331 N 400 WEST - OREM

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 11/25/2024 10:24:09 PM |