Property Information

mobile view

| Serial Number: 24:046:9000 |

Serial Life: 2004... |

|

|

Total Photos: 7

Total Photos: 7

|

| |

|

|

| Property Address: 2070 N 300 WEST - SPANISH FORK |

|

| Mailing Address: %WOOLLEY, KENNETH T 2755 E COTTONWOOD PKWY # 450 SALT LAKE CITY, UT 84121 |

|

| Acreage: 0.01 |

|

| Last Document:

14597-1995

|

|

| Subdivision Map Filing |

|

| Taxing Description:

HANGAR #69, SP FORK-SPRINGVILLE AIRPORT, SEC 12, T8S, R2E, SLM. ********** (BLDG ONLY) **********

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

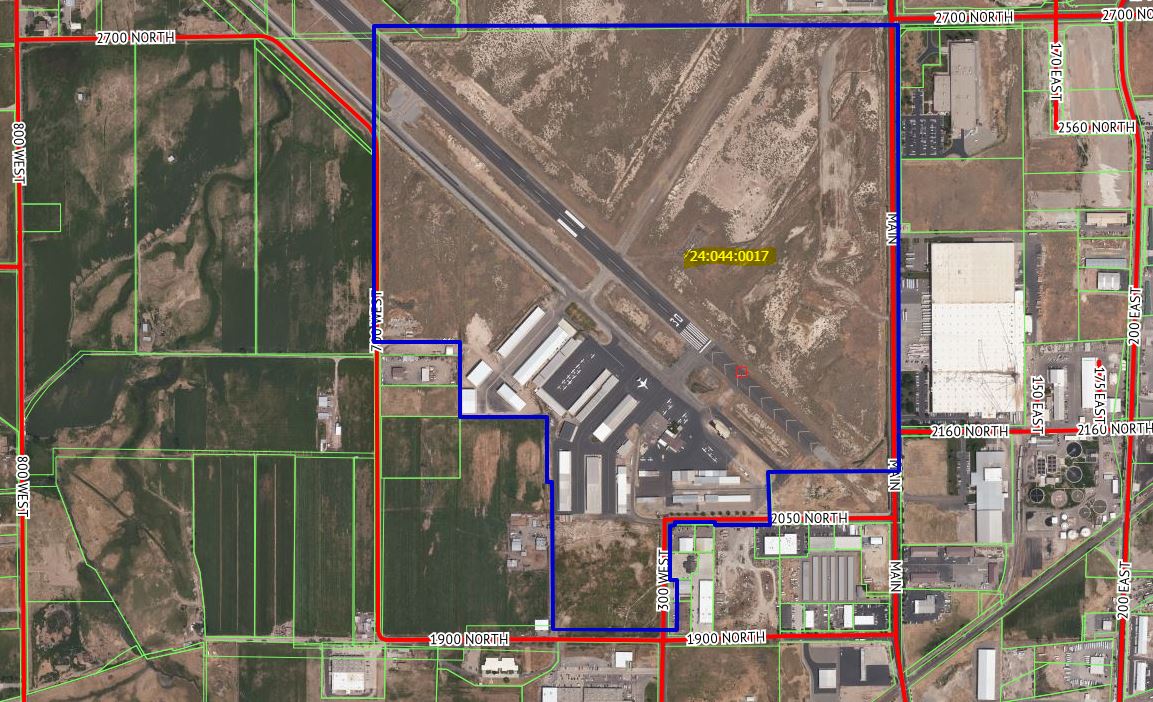

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$0 |

$0 |

$0 |

$0 |

$307,200 |

$0 |

$0 |

$307,200 |

$0 |

$0 |

$0 |

$307,200 |

| 2023 |

$0 |

$0 |

$0 |

$0 |

$271,800 |

$0 |

$0 |

$271,800 |

$0 |

$0 |

$0 |

$271,800 |

| 2022 |

$0 |

$0 |

$0 |

$0 |

$249,500 |

$0 |

$0 |

$249,500 |

$0 |

$0 |

$0 |

$249,500 |

| 2021 |

$0 |

$0 |

$0 |

$0 |

$221,000 |

$0 |

$0 |

$221,000 |

$0 |

$0 |

$0 |

$221,000 |

| 2020 |

$0 |

$0 |

$0 |

$0 |

$221,000 |

$0 |

$0 |

$221,000 |

$0 |

$0 |

$0 |

$221,000 |

| 2019 |

$0 |

$0 |

$0 |

$0 |

$216,200 |

$0 |

$0 |

$216,200 |

$0 |

$0 |

$0 |

$216,200 |

| 2018 |

$0 |

$0 |

$0 |

$0 |

$174,200 |

$0 |

$0 |

$174,200 |

$0 |

$0 |

$0 |

$174,200 |

| 2017 |

$0 |

$0 |

$0 |

$0 |

$174,200 |

$0 |

$0 |

$174,200 |

$0 |

$0 |

$0 |

$174,200 |

| 2016 |

$0 |

$0 |

$0 |

$0 |

$171,300 |

$0 |

$0 |

$171,300 |

$0 |

$0 |

$0 |

$171,300 |

| 2015 |

$0 |

$0 |

$0 |

$0 |

$171,300 |

$0 |

$0 |

$171,300 |

$0 |

$0 |

$0 |

$171,300 |

| 2014 |

$0 |

$0 |

$0 |

$0 |

$171,300 |

$0 |

$0 |

$171,300 |

$0 |

$0 |

$0 |

$171,300 |

| 2013 |

$0 |

$0 |

$0 |

$0 |

$171,300 |

$0 |

$0 |

$171,300 |

$0 |

$0 |

$0 |

$171,300 |

| 2012 |

$0 |

$0 |

$0 |

$0 |

$229,700 |

$0 |

$0 |

$229,700 |

$0 |

$0 |

$0 |

$229,700 |

| 2011 |

$0 |

$0 |

$0 |

$0 |

$229,700 |

$0 |

$0 |

$229,700 |

$0 |

$0 |

$0 |

$229,700 |

| 2010 |

$0 |

$0 |

$0 |

$0 |

$108,800 |

$0 |

$0 |

$108,800 |

$0 |

$0 |

$0 |

$108,800 |

| 2009 |

$0 |

$0 |

$0 |

$0 |

$108,800 |

$0 |

$0 |

$108,800 |

$0 |

$0 |

$0 |

$108,800 |

| 2008 |

$0 |

$0 |

$0 |

$0 |

$108,800 |

$0 |

$0 |

$108,800 |

$0 |

$0 |

$0 |

$108,800 |

| 2007 |

$0 |

$0 |

$0 |

$0 |

$98,920 |

$0 |

$0 |

$98,920 |

$0 |

$0 |

$0 |

$98,920 |

| 2006 |

$0 |

$0 |

$0 |

$0 |

$98,920 |

$0 |

$0 |

$98,920 |

$0 |

$0 |

$0 |

$98,920 |

| 2005 |

$0 |

$0 |

$0 |

$0 |

$98,920 |

$0 |

$0 |

$98,920 |

$0 |

$0 |

$0 |

$98,920 |

| 2004 |

$0 |

$0 |

$0 |

$0 |

$98,920 |

$0 |

$0 |

$98,920 |

$0 |

$0 |

$0 |

$98,920 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2024 |

$2,980.45 |

$0.00 |

$2,980.45 |

$0.00 |

|

|

Click for Payoff

|

150 - SPANISH FORK CITY |

| 2023 |

$2,634.01 |

$0.00 |

$2,634.01 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2022 |

$2,465.31 |

$0.00 |

$2,465.31 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2021 |

$2,481.83 |

$0.00 |

$2,481.83 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2020 |

$2,552.77 |

$0.00 |

$2,552.77 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2019 |

$2,373.66 |

$0.00 |

$2,373.66 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2018 |

$1,978.56 |

$0.00 |

$1,978.56 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2017 |

$2,024.55 |

$0.00 |

$2,024.55 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2016 |

$2,017.57 |

$0.00 |

$2,017.57 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2015 |

$2,041.90 |

$0.00 |

$2,041.90 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2014 |

$2,034.53 |

$0.00 |

$2,034.53 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2013 |

$2,133.03 |

$0.00 |

$2,133.03 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2012 |

$2,897.67 |

$0.00 |

$2,897.67 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2011 |

$2,833.12 |

$0.00 |

$2,833.12 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2010 |

$1,307.99 |

$0.00 |

$1,307.99 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2009 |

$1,238.14 |

$0.00 |

$1,238.14 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2008 |

$1,150.45 |

$0.00 |

$1,150.45 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2007 |

$1,048.16 |

$0.00 |

$1,048.16 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2006 |

$1,135.50 |

$0.00 |

$1,135.50 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2005 |

$1,219.39 |

$0.00 |

$1,219.39 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2004 |

$1,221.17 |

$0.00 |

$1,221.17 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 107762-2013 |

11/12/2013 |

11/21/2013 |

SP WD |

PATEY, CHANDRA & MIKE |

CHAEL PROPERTIES LLC |

| 80321-2010 |

09/21/2010 |

09/22/2010 |

D TR |

PATEY, CHANDRA |

LESLIE BROOKS DDS DEFINED BENEFIT PENSION PLAN |

| 80320-2010 |

09/21/2010 |

09/22/2010 |

NI |

PATEY, CHANDRA |

WHOM OF INTEREST |

| 114949-2008 |

10/20/2008 |

10/22/2008 |

CT |

STATE OF UTAH |

WHOM OF INTEREST |

| 107508-2008 |

09/30/2008 |

09/30/2008 |

RESOL |

BOARD OF COUNTY COMMISSIONERS UTAH COUNTY |

WHOM OF INTEREST |

| 53485-2003 |

04/08/2003 |

04/08/2003 |

BLDG |

BROOKS, RANDY |

|

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 11/3/2024 11:57:11 AM |