Property Information

mobile view

| Serial Number: 24:046:9600 |

Serial Life: 2004... |

|

|

Total Photos: 7

Total Photos: 7

|

| |

|

|

| Property Address: 2070 N 300 WEST - SPANISH FORK |

|

| Mailing Address: 11085 S CONESTOGA DR SPANISH FORK, UT 84660-9206 |

|

| Acreage: 0 |

|

| Last Document:

0-0

|

|

| Subdivision Map Filing |

|

| Taxing Description:

HANGAR #75, SP FORK-SPRINGVILLE AIRPORT, SEC 12, T8S, R2E, SLM. ********** (BLDG ONLY) **********

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

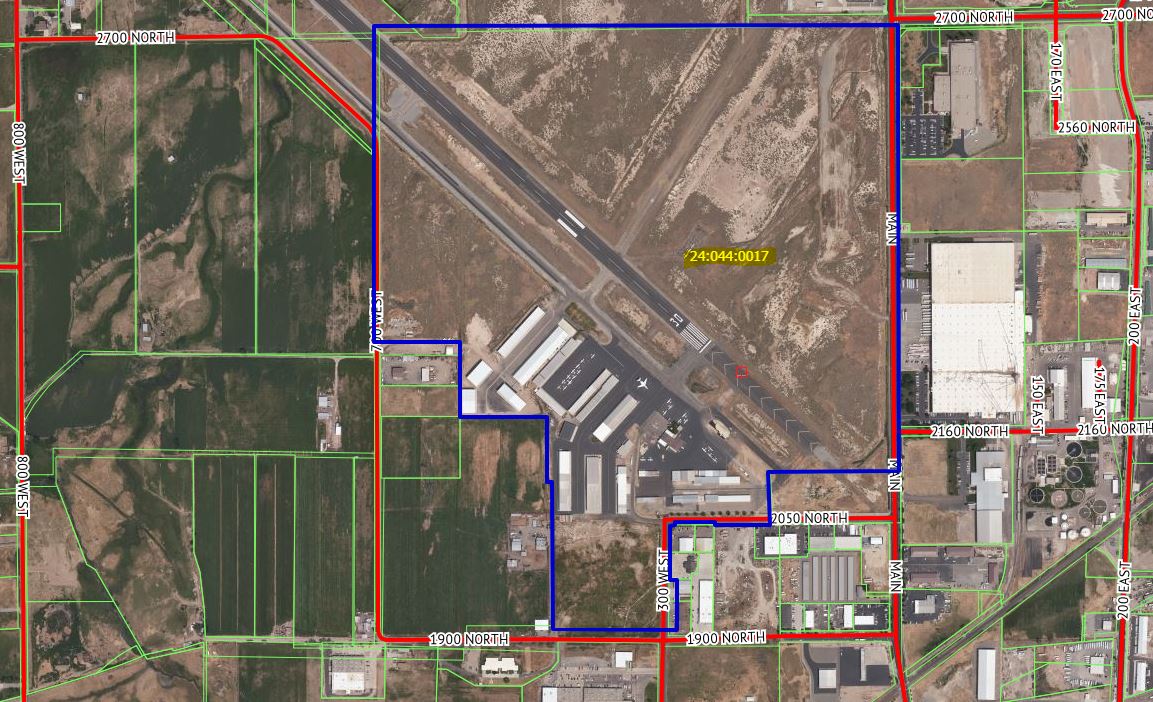

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$0 |

$0 |

$0 |

$0 |

$322,700 |

$0 |

$0 |

$322,700 |

$0 |

$0 |

$0 |

$322,700 |

| 2023 |

$0 |

$0 |

$0 |

$0 |

$286,800 |

$0 |

$0 |

$286,800 |

$0 |

$0 |

$0 |

$286,800 |

| 2022 |

$0 |

$0 |

$0 |

$0 |

$260,300 |

$0 |

$0 |

$260,300 |

$0 |

$0 |

$0 |

$260,300 |

| 2021 |

$0 |

$0 |

$0 |

$0 |

$215,200 |

$0 |

$0 |

$215,200 |

$0 |

$0 |

$0 |

$215,200 |

| 2020 |

$0 |

$0 |

$0 |

$0 |

$215,200 |

$0 |

$0 |

$215,200 |

$0 |

$0 |

$0 |

$215,200 |

| 2019 |

$0 |

$0 |

$0 |

$0 |

$214,400 |

$0 |

$0 |

$214,400 |

$0 |

$0 |

$0 |

$214,400 |

| 2018 |

$0 |

$0 |

$0 |

$0 |

$190,100 |

$0 |

$0 |

$190,100 |

$0 |

$0 |

$0 |

$190,100 |

| 2017 |

$0 |

$0 |

$0 |

$0 |

$165,300 |

$0 |

$0 |

$165,300 |

$0 |

$0 |

$0 |

$165,300 |

| 2016 |

$0 |

$0 |

$0 |

$0 |

$156,100 |

$0 |

$0 |

$156,100 |

$0 |

$0 |

$0 |

$156,100 |

| 2015 |

$0 |

$0 |

$0 |

$0 |

$121,100 |

$0 |

$0 |

$121,100 |

$0 |

$0 |

$0 |

$121,100 |

| 2014 |

$0 |

$0 |

$0 |

$0 |

$121,100 |

$0 |

$0 |

$121,100 |

$0 |

$0 |

$0 |

$121,100 |

| 2013 |

$0 |

$0 |

$0 |

$0 |

$121,100 |

$0 |

$0 |

$121,100 |

$0 |

$0 |

$0 |

$121,100 |

| 2012 |

$0 |

$0 |

$0 |

$0 |

$77,400 |

$0 |

$0 |

$77,400 |

$0 |

$0 |

$0 |

$77,400 |

| 2011 |

$0 |

$0 |

$0 |

$0 |

$77,400 |

$0 |

$0 |

$77,400 |

$0 |

$0 |

$0 |

$77,400 |

| 2010 |

$0 |

$0 |

$0 |

$0 |

$77,400 |

$0 |

$0 |

$77,400 |

$0 |

$0 |

$0 |

$77,400 |

| 2009 |

$0 |

$0 |

$0 |

$0 |

$77,400 |

$0 |

$0 |

$77,400 |

$0 |

$0 |

$0 |

$77,400 |

| 2008 |

$0 |

$0 |

$0 |

$0 |

$77,400 |

$0 |

$0 |

$77,400 |

$0 |

$0 |

$0 |

$77,400 |

| 2007 |

$0 |

$0 |

$0 |

$0 |

$70,390 |

$0 |

$0 |

$70,390 |

$0 |

$0 |

$0 |

$70,390 |

| 2006 |

$0 |

$0 |

$0 |

$0 |

$70,390 |

$0 |

$0 |

$70,390 |

$0 |

$0 |

$0 |

$70,390 |

| 2005 |

$0 |

$0 |

$0 |

$0 |

$70,390 |

$0 |

$0 |

$70,390 |

$0 |

$0 |

$0 |

$70,390 |

| 2004 |

$0 |

$0 |

$0 |

$0 |

$70,390 |

$0 |

$0 |

$70,390 |

$0 |

$0 |

$0 |

$70,390 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2024 |

$3,130.84 |

$0.00 |

$3,130.84 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2023 |

$2,779.38 |

$0.00 |

$2,779.38 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2022 |

$2,572.02 |

$0.00 |

$2,572.02 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2021 |

$2,416.70 |

$0.00 |

$2,416.70 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2020 |

$2,485.78 |

$0.00 |

$2,485.78 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2019 |

$2,353.90 |

$0.00 |

$2,353.90 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2018 |

$2,159.16 |

$0.00 |

$2,159.16 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2017 |

$1,921.12 |

$0.00 |

$1,921.12 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2016 |

$1,838.55 |

$0.00 |

$1,838.55 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2015 |

$1,443.51 |

$0.00 |

$1,443.51 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2014 |

$1,438.30 |

$0.00 |

$1,438.30 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2013 |

$1,507.94 |

$0.00 |

$1,507.94 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2012 |

$976.40 |

$0.00 |

$976.40 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2011 |

$954.65 |

$0.00 |

$954.65 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2010 |

$930.50 |

$0.00 |

$930.50 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2009 |

$880.81 |

$0.00 |

$880.81 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2008 |

$818.43 |

$0.00 |

$818.43 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2007 |

$745.85 |

$0.00 |

$745.85 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2006 |

$808.01 |

$0.00 |

$808.01 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2005 |

$867.70 |

$0.00 |

$867.70 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2004 |

$868.96 |

$0.00 |

$868.96 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 114949-2008 |

10/20/2008 |

10/22/2008 |

CT |

STATE OF UTAH |

WHOM OF INTEREST |

| 107508-2008 |

09/30/2008 |

09/30/2008 |

RESOL |

BOARD OF COUNTY COMMISSIONERS UTAH COUNTY |

WHOM OF INTEREST |

| 100018-2003 |

07/02/2003 |

07/02/2003 |

BLDG |

MERRILL, KEITH |

|

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 12/12/2024 11:51:19 AM |