Property Information

mobile view

| Serial Number: 24:046:9607 |

Serial Life: 2007... |

|

|

Total Photos: 9

Total Photos: 9

|

| |

|

|

| Property Address: 303 W 3000 NORTH - SPRINGVILLE |

|

| Mailing Address: 7800 E DORADO PL STE 250 GREENWOOD VILLAGE, CO 80111 |

|

| Acreage: 0 |

|

| Last Document:

176064-2006

|

|

| Subdivision Map Filing |

|

| Taxing Description:

SECTION 1, TOWNSHIP 8 S RANGE 2 E - BLDG ONLY. HOST SERIAL NUMBER 24:004:0015

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

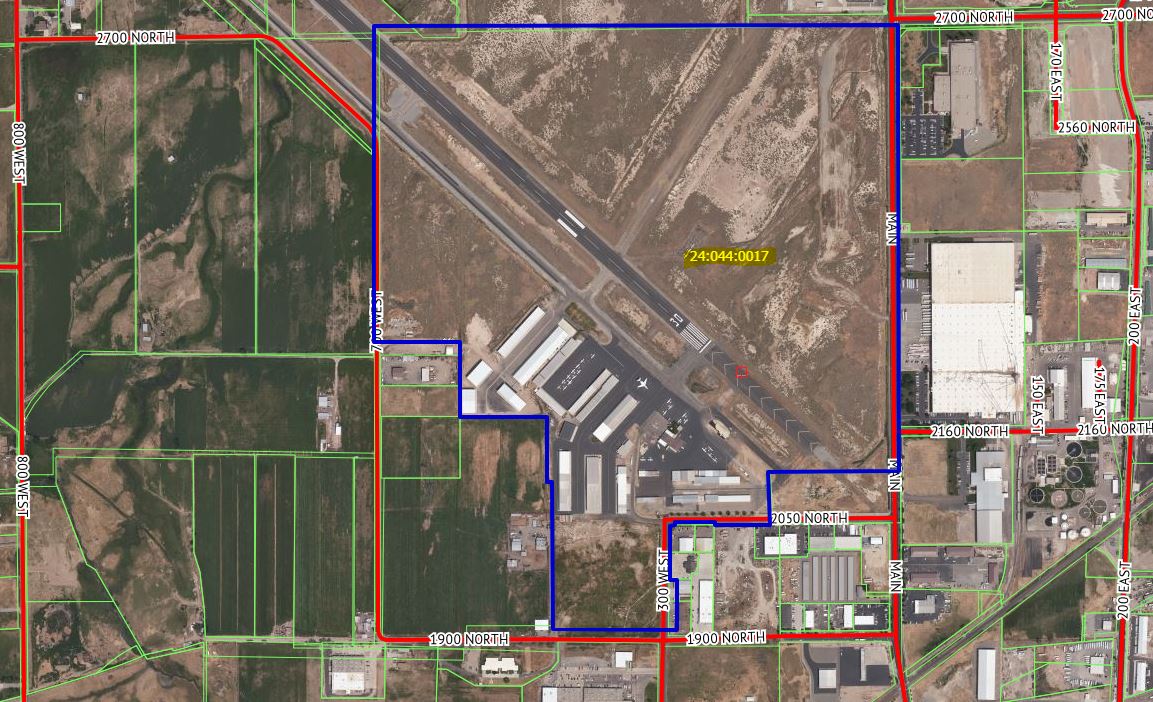

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$0 |

$0 |

$0 |

$0 |

$7,066,900 |

$0 |

$0 |

$7,066,900 |

$0 |

$0 |

$0 |

$7,066,900 |

| 2023 |

$0 |

$0 |

$0 |

$0 |

$6,369,900 |

$0 |

$0 |

$6,369,900 |

$0 |

$0 |

$0 |

$6,369,900 |

| 2022 |

$0 |

$0 |

$0 |

$0 |

$5,704,600 |

$0 |

$0 |

$5,704,600 |

$0 |

$0 |

$0 |

$5,704,600 |

| 2021 |

$0 |

$0 |

$0 |

$0 |

$5,481,500 |

$0 |

$0 |

$5,481,500 |

$0 |

$0 |

$0 |

$5,481,500 |

| 2020 |

$0 |

$0 |

$0 |

$0 |

$5,481,500 |

$0 |

$0 |

$5,481,500 |

$0 |

$0 |

$0 |

$5,481,500 |

| 2019 |

$0 |

$0 |

$0 |

$0 |

$5,481,500 |

$0 |

$0 |

$5,481,500 |

$0 |

$0 |

$0 |

$5,481,500 |

| 2018 |

$0 |

$0 |

$0 |

$0 |

$4,728,100 |

$0 |

$0 |

$4,728,100 |

$0 |

$0 |

$0 |

$4,728,100 |

| 2017 |

$0 |

$0 |

$0 |

$0 |

$4,048,100 |

$0 |

$0 |

$4,048,100 |

$0 |

$0 |

$0 |

$4,048,100 |

| 2016 |

$0 |

$0 |

$0 |

$0 |

$2,910,600 |

$0 |

$0 |

$2,910,600 |

$0 |

$0 |

$0 |

$2,910,600 |

| 2015 |

$0 |

$0 |

$0 |

$0 |

$2,910,600 |

$0 |

$0 |

$2,910,600 |

$0 |

$0 |

$0 |

$2,910,600 |

| 2014 |

$0 |

$0 |

$0 |

$0 |

$2,910,600 |

$0 |

$0 |

$2,910,600 |

$0 |

$0 |

$0 |

$2,910,600 |

| 2013 |

$0 |

$0 |

$0 |

$0 |

$2,910,600 |

$0 |

$0 |

$2,910,600 |

$0 |

$0 |

$0 |

$2,910,600 |

| 2012 |

$0 |

$0 |

$0 |

$0 |

$2,910,600 |

$0 |

$0 |

$2,910,600 |

$0 |

$0 |

$0 |

$2,910,600 |

| 2011 |

$0 |

$0 |

$0 |

$0 |

$2,910,600 |

$0 |

$0 |

$2,910,600 |

$0 |

$0 |

$0 |

$2,910,600 |

| 2010 |

$0 |

$0 |

$0 |

$0 |

$3,063,792 |

$0 |

$0 |

$3,063,792 |

$0 |

$0 |

$0 |

$3,063,792 |

| 2009 |

$0 |

$0 |

$0 |

$0 |

$3,294,400 |

$0 |

$0 |

$3,294,400 |

$0 |

$0 |

$0 |

$3,294,400 |

| 2008 |

$0 |

$0 |

$0 |

$0 |

$3,294,400 |

$0 |

$0 |

$3,294,400 |

$0 |

$0 |

$0 |

$3,294,400 |

| 2007 |

$0 |

$0 |

$0 |

$0 |

$2,322,000 |

$0 |

$0 |

$2,322,000 |

$0 |

$0 |

$0 |

$2,322,000 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2024 |

$68,980.01 |

$0.00 |

$68,980.01 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2023 |

$62,112.89 |

$0.00 |

$62,112.89 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2022 |

$56,640.97 |

$0.00 |

$56,640.97 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2021 |

$63,574.44 |

$0.00 |

$63,574.44 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2020 |

$65,575.18 |

$0.00 |

$65,575.18 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2019 |

$64,413.11 |

$0.00 |

$64,413.11 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2018 |

$58,236.01 |

$0.00 |

$58,236.01 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2017 |

$51,629.47 |

$0.00 |

$51,629.47 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2016 |

$37,864.00 |

$0.00 |

$37,864.00 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2015 |

$37,037.39 |

$0.00 |

$37,037.39 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2014 |

$37,278.96 |

$0.00 |

$37,278.96 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2013 |

$38,972.93 |

$0.00 |

$38,972.93 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2012 |

$39,537.59 |

$0.00 |

$39,537.59 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2011 |

$38,568.36 |

$0.00 |

$38,568.36 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2010 |

$40,138.74 |

$0.00 |

$40,138.74 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2009 |

$39,012.28 |

$0.00 |

$39,012.28 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2008 |

$36,086.86 |

$0.00 |

$36,086.86 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2007 |

$25,209.95 |

$0.00 |

$25,209.95 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 66185-2011 |

09/19/2011 |

09/19/2011 |

CT |

ZIONS FIRST NATIONAL BANK (ET AL) |

WHOM OF INTEREST |

| 65922-2011 |

09/12/2011 |

09/19/2011 |

SUB AGR |

SAN MIGUEL VALLEY CORPORATION (ET AL) |

ZIONS FIRST NATIONAL BANK |

| 65920-2011 |

09/02/2011 |

09/19/2011 |

D TR |

SAN MIGUEL VALLEY CORPORATION |

ZIONS FIRST NATIONAL BANK |

| 24966-2011 |

03/29/2011 |

03/30/2011 |

DEED |

ZIONS FIRST NATIONAL BANK |

SAN MIGUEL VALLEY CORPORATION |

| 24965-2011 |

03/29/2011 |

03/30/2011 |

AS LS |

ZIONS FIRST NATIONAL BANK |

SAN MIGUEL VALLEY CORPORATION |

| 20237-2011 |

03/11/2011 |

03/11/2011 |

TEE D |

SPENCE, MICHAEL W SUCTEE (ET AL) |

ZIONS FIRST NATIONAL BANK |

| 176064-2006 |

12/26/2006 |

12/29/2006 |

N ABO |

WHOM OF INTEREST |

ROCKY MOUNTAIN COMPOSITES INC |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 3/5/2025 10:53:50 PM |