Property Information

mobile view

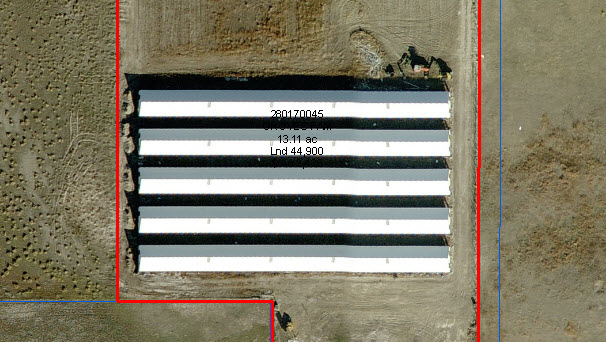

| Serial Number: 28:017:0045 |

Serial Life: 2002... |

|

|

Total Photos: 1

Total Photos: 1

|

| |

|

|

| Property Address: 5225 W 7300 SOUTH - WEST MOUNTAIN |

|

| Mailing Address: 1472 S 1000 W SALT LAKE CITY, UT 84104 |

|

| Acreage: 13.110112 |

|

| Last Document:

13644-2005

|

|

| Subdivision Map Filing |

|

| Taxing Description:

COM N 300 FT & E 2324.22 FT FR W 1/4 COR. SEC. 25, T8S, R1E, SLB&M.; N 640.5 FT; N 990 FT; E 58.58 FT; E 85.43 FT; N 0 DEG 18' 31" E 7.92 FT; S 89 DEG 35' 38" E 175.38 FT; S 0 DEG 11' 34" W 1935.95 FT; N 89 DEG 59' 48" W 179.3 FT; N 0 DEG 18' 31" E 298.75 FT; W 135.23 FT TO BEG. AREA 13.110 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$0 |

$0 |

$585,300 |

$585,300 |

$0 |

$0 |

$268,600 |

$268,600 |

$3,081 |

$0 |

$3,081 |

$853,900 |

| 2023 |

$0 |

$0 |

$585,300 |

$585,300 |

$0 |

$0 |

$268,600 |

$268,600 |

$2,832 |

$0 |

$2,832 |

$853,900 |

| 2022 |

$0 |

$0 |

$624,100 |

$624,100 |

$0 |

$0 |

$268,600 |

$268,600 |

$2,858 |

$0 |

$2,858 |

$892,700 |

| 2021 |

$0 |

$0 |

$367,100 |

$367,100 |

$0 |

$0 |

$244,200 |

$244,200 |

$2,806 |

$0 |

$2,806 |

$611,300 |

| 2020 |

$0 |

$0 |

$327,800 |

$327,800 |

$0 |

$0 |

$244,200 |

$244,200 |

$2,792 |

$0 |

$2,792 |

$572,000 |

| 2019 |

$0 |

$0 |

$222,900 |

$222,900 |

$0 |

$0 |

$244,200 |

$244,200 |

$2,806 |

$0 |

$2,806 |

$467,100 |

| 2018 |

$0 |

$0 |

$222,900 |

$222,900 |

$0 |

$0 |

$229,200 |

$229,200 |

$3,133 |

$0 |

$3,133 |

$452,100 |

| 2017 |

$0 |

$0 |

$222,900 |

$222,900 |

$0 |

$0 |

$221,400 |

$221,400 |

$3,291 |

$0 |

$3,291 |

$444,300 |

| 2016 |

$0 |

$0 |

$222,900 |

$222,900 |

$0 |

$0 |

$200,000 |

$200,000 |

$3,225 |

$0 |

$3,225 |

$422,900 |

| 2015 |

$0 |

$0 |

$222,900 |

$222,900 |

$0 |

$0 |

$200,000 |

$200,000 |

$3,199 |

$0 |

$3,199 |

$422,900 |

| 2014 |

$0 |

$0 |

$222,900 |

$222,900 |

$0 |

$0 |

$200,000 |

$200,000 |

$3,317 |

$0 |

$3,317 |

$422,900 |

| 2013 |

$0 |

$0 |

$230,500 |

$230,500 |

$0 |

$0 |

$74,200 |

$74,200 |

$3,369 |

$0 |

$3,369 |

$304,700 |

| 2012 |

$0 |

$0 |

$44,900 |

$44,900 |

$0 |

$0 |

$74,186 |

$74,186 |

$3,343 |

$0 |

$3,343 |

$119,086 |

| 2011 |

$0 |

$0 |

$44,900 |

$44,900 |

$0 |

$0 |

$0 |

$0 |

$3,278 |

$0 |

$3,278 |

$44,900 |

| 2010 |

$0 |

$0 |

$44,900 |

$44,900 |

$0 |

$0 |

$0 |

$0 |

$3,278 |

$0 |

$3,278 |

$44,900 |

| 2009 |

$0 |

$0 |

$44,900 |

$44,900 |

$0 |

$0 |

$0 |

$0 |

$3,278 |

$0 |

$3,278 |

$44,900 |

| 2008 |

$0 |

$0 |

$44,900 |

$44,900 |

$0 |

$0 |

$0 |

$0 |

$3,146 |

$0 |

$3,146 |

$44,900 |

| 2007 |

$0 |

$0 |

$44,900 |

$44,900 |

$0 |

$0 |

$0 |

$0 |

$3,146 |

$0 |

$3,146 |

$44,900 |

| 2006 |

$0 |

$0 |

$37,442 |

$37,442 |

$0 |

$0 |

$0 |

$0 |

$3,015 |

$0 |

$3,015 |

$37,442 |

| 2005 |

$0 |

$0 |

$37,442 |

$37,442 |

$0 |

$0 |

$0 |

$0 |

$3,015 |

$0 |

$3,015 |

$37,442 |

| 2004 |

$0 |

$0 |

$37,442 |

$37,442 |

$0 |

$0 |

$0 |

$0 |

$3,015 |

$0 |

$3,015 |

$37,442 |

| 2003 |

$0 |

$0 |

$37,442 |

$37,442 |

$0 |

$0 |

$0 |

$0 |

$2,556 |

$0 |

$2,556 |

$37,442 |

| 2002 |

$0 |

$0 |

$37,442 |

$37,442 |

$0 |

$0 |

$0 |

$0 |

$2,556 |

$0 |

$2,556 |

$37,442 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

160 - BENJAMIN CEMETERY S/A 6-7-8 |

| 2024 |

$2,738.00 |

$0.00 |

$2,738.00 |

$0.00 |

|

|

Click for Payoff

|

160 - BENJAMIN CEMETERY S/A 6-7-8 |

| 2023 |

$2,733.32 |

$0.00 |

$2,733.32 |

$0.00 |

|

|

Click for Payoff

|

160 - BENJAMIN CEMETERY S/A 6-7-8 |

| 2022 |

$2,785.16 |

$0.00 |

$2,785.16 |

$0.00 |

|

|

Click for Payoff

|

160 - BENJAMIN CEMETERY S/A 6-7-8 |

| 2021 |

$2,953.20 |

$0.00 |

$2,953.20 |

$0.00 |

|

$0.00

|

$0.00 |

160 - BENJAMIN CEMETERY S/A 6-7-8 |

| 2020 |

$3,042.69 |

$0.00 |

$3,042.69 |

$0.00 |

|

$0.00

|

$0.00 |

160 - BENJAMIN CEMETERY S/A 6-7-8 |

| 2019 |

$2,984.82 |

$0.00 |

$2,984.82 |

$0.00 |

|

$0.00

|

$0.00 |

160 - BENJAMIN CEMETERY S/A 6-7-8 |

| 2018 |

$2,935.99 |

$0.00 |

$2,935.99 |

$0.00 |

|

$0.00

|

$0.00 |

160 - BENJAMIN CEMETERY S/A 6-7-8 |

| 2017 |

$2,923.68 |

$0.00 |

$2,923.68 |

$0.00 |

|

$0.00

|

$0.00 |

160 - BENJAMIN CEMETERY S/A 6-7-8 |

| 2016 |

$2,729.51 |

$0.00 |

$2,729.51 |

$0.00 |

|

$0.00

|

$0.00 |

160 - BENJAMIN CEMETERY S/A 6-7-8 |

| 2015 |

$8,370.80 |

($5,618.47) |

$2,752.33 |

$0.00 |

|

$0.00

|

$0.00 |

160 - BENJAMIN CEMETERY S/A 6-7-8 |

| 2014 |

$8,366.21 |

($5,614.31) |

$2,751.90 |

$0.00 |

|

$0.00

|

$0.00 |

160 - BENJAMIN CEMETERY S/A 6-7-8 |

| 2013 |

$1,092.09 |

$0.00 |

$1,092.09 |

$0.00 |

|

$0.00

|

$0.00 |

160 - BENJAMIN CEMETERY S/A 6-7-8 |

| 2012 |

$1,105.02 |

$0.00 |

$1,105.02 |

$0.00 |

|

$0.00

|

$0.00 |

160 - BENJAMIN CEMETERY S/A 6-7-8 |

| 2011 |

$45.88 |

$0.00 |

$45.88 |

$0.00 |

|

$0.00

|

$0.00 |

160 - BENJAMIN CEMETERY S/A 6-7-8 |

| 2010 |

$44.83 |

$0.00 |

$44.83 |

$0.00 |

|

$0.00

|

$0.00 |

160 - BENJAMIN CEMETERY S/A 6-7-8 |

| 2009 |

$42.92 |

$0.00 |

$42.92 |

$0.00 |

|

$0.00

|

$0.00 |

160 - BENJAMIN CEMETERY S/A 6-7-8 |

| 2008 |

$36.90 |

$0.00 |

$36.90 |

$0.00 |

|

$0.00

|

$0.00 |

160 - BENJAMIN CEMETERY S/A 6-7-8 |

| 2007 |

$36.54 |

$0.00 |

$36.54 |

$0.00 |

|

$0.00

|

$0.00 |

160 - BENJAMIN CEMETERY S/A 6-7-8 |

| 2006 |

$38.44 |

$0.00 |

$38.44 |

$0.00 |

|

$0.00

|

$0.00 |

160 - BENJAMIN CEMETERY S/A 6-7-8 |

| 2005 |

$40.64 |

$0.00 |

$40.64 |

$0.00 |

|

$0.00

|

$0.00 |

160 - BENJAMIN CEMETERY S/A 6-7-8 |

| 2004 |

$40.64 |

$0.00 |

$40.64 |

$0.00 |

|

$0.00

|

$0.00 |

160 - BENJAMIN CEMETERY S/A 6-7-8 |

| 2003 |

$31.66 |

$0.00 |

$31.66 |

$0.00 |

|

$0.00

|

$0.00 |

160 - BENJAMIN CEMETERY S/A 6-7-8 |

| 2002 |

$30.88 |

$0.00 |

$30.88 |

$0.00 |

|

$0.00

|

$0.00 |

160 - BENJAMIN CEMETERY S/A 6-7-8 |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 60194-2024 |

09/04/2024 |

09/04/2024 |

ATY LN |

WAYMAN, JAMES (ET AL) |

ANDERSON LIFE MARSHALL & JOHNSON LC ATY |

| 4103-2022 |

01/05/2022 |

01/11/2022 |

REC |

FARM SERVICE AGENCY TEE |

GROVES FAMILY PROPERTIES LTD |

| 4102-2022 |

01/05/2022 |

01/11/2022 |

REC |

FARM SERVICE AGENCY TEE |

GROVES FAMILY PROPERTIES LTD |

| 4101-2022 |

01/05/2022 |

01/11/2022 |

REC |

FARM SERVICE AGENCY TEE |

GROVES FAMILY PROPERTIES LTD |

| 203360-2021 |

12/07/2021 |

12/07/2021 |

R NI |

WAYMAN, JAMES & JAMES A AKA (ET AL) |

WHOM OF INTEREST |

| 203358-2021 |

12/06/2021 |

12/07/2021 |

WD |

GROVES, LYLE |

WAYMAN, JAMES A (ET AL) |

| 191129-2021 |

10/13/2021 |

11/12/2021 |

QCD |

GROVES FAMILY PROPERTIES LTD BY (ET AL) |

GROVES, LYLE |

| 128015-2021 |

07/20/2021 |

07/20/2021 |

NI |

WAYMAN, JAMES |

WHOM OF INTEREST |

| 32421-2017 |

04/04/2017 |

04/05/2017 |

D TR |

GROVES FAMILY PROPERTIES LTD |

UNITED STATES DEPARTMENT OF AGRICULTURE |

| 111529-2015 |

12/11/2015 |

12/14/2015 |

D TR |

GROVES FAMILY PROPERTIES LTD |

UNITED STATES DEPARTMENT OF AGRICULTURE |

| 63130-2015 |

07/09/2015 |

07/15/2015 |

CORR AF |

OLD REPUBLIC TITLE COMPANY OF UTAH |

WHOM OF INTEREST |

| 3187-2015 |

12/04/2014 |

01/14/2015 |

QCD |

UNITED STATES OF AMERICA |

SOUTH UTAH VALLEY ELECTRIC SERVICE DISTRICT |

| 102474-2013 |

10/29/2013 |

11/04/2013 |

D TR |

GROVES FAMILY PROPERTIES LTD |

UNITED STATES OF AMERICA FARM SERVICE AGENCY |

| 101829-2010 |

11/22/2010 |

11/22/2010 |

FARM |

GROVES FAMILY PROPERTIES LTD |

WHOM OF INTEREST |

| 50963-2009 |

05/04/2009 |

05/08/2009 |

CT |

STATE OF UTAH |

WHOM OF INTEREST |

| 42373-2009 |

04/21/2009 |

04/21/2009 |

RESOL |

BOARD OF COUNTY COMMISSIONERS UTAH COUNTY |

WHOM OF INTEREST |

| 114949-2008 |

10/20/2008 |

10/22/2008 |

CT |

STATE OF UTAH |

WHOM OF INTEREST |

| 107508-2008 |

09/30/2008 |

09/30/2008 |

RESOL |

BOARD OF COUNTY COMMISSIONERS UTAH COUNTY |

WHOM OF INTEREST |

| 13644-2005 |

02/08/2005 |

02/09/2005 |

WD |

KUNZE, DOUGLAS H & DARLENE |

GROVES FAMILY PROPERTIES LTD |

| 72548-2001 |

07/18/2001 |

07/23/2001 |

QCD |

KUNZE, DOUGLAS H & DARLENE |

KUNZE, DOUGLAS H & DARLENE |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 1/6/2025 8:11:22 PM |