Property Information

mobile view

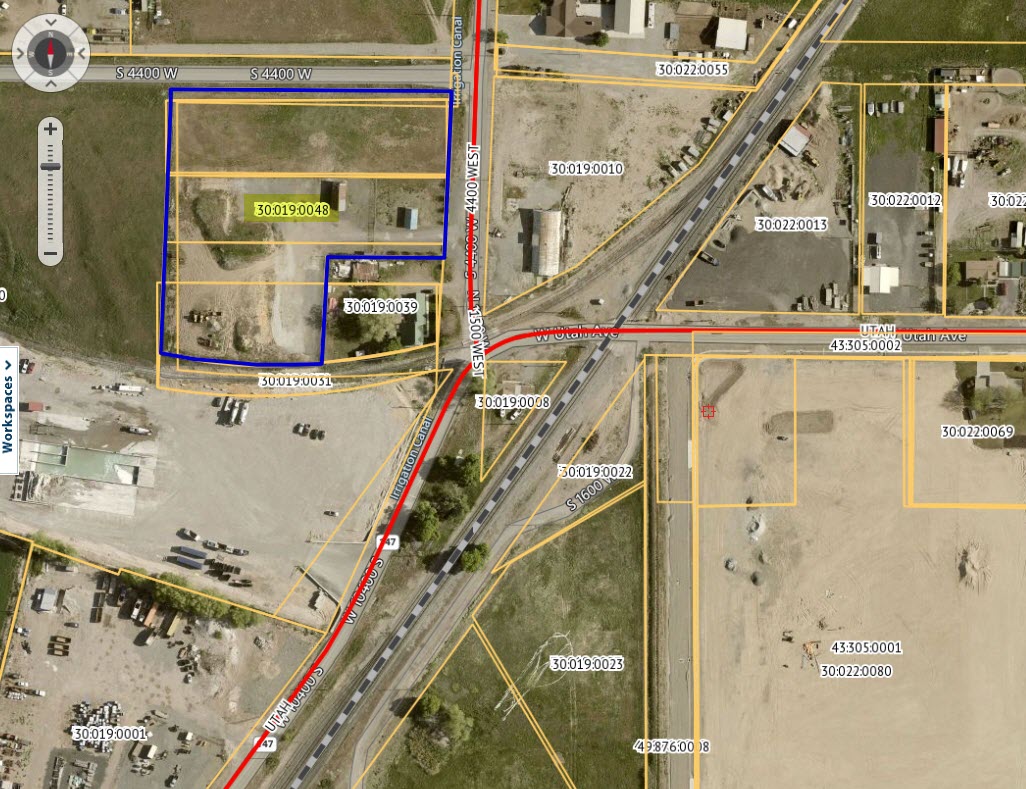

| Serial Number: 30:019:0048 |

Serial Life: 2015... |

|

|

Total Photos: 11

Total Photos: 11

|

| |

|

|

| Property Address: 10232 S 4400 WEST - PAYSON DISTR |

|

| Mailing Address: 5825 S TRAILSIDE DR PARK CITY, UT 84098 |

|

| Acreage: 3.414875 |

|

| Last Document:

5356-2023

|

|

| Subdivision Map Filing |

|

| Taxing Description:

COM N 0 DEG 25' 39" W 1299.45 FT & W 311.03 FT FR S 1/4 COR. SEC. 7, T9S, R2E, SLB&M.; S 1 DEG 27' 20" E 14 FT; S 2 DEG 44' 20" W 240.16 FT; N 89 DEG 28' 15" W 179.15 FT; S 3 DEG 8' 16" W 163.04 FT; ALONG A CURVE TO R (CHORD BEARS: N 86 DEG 5' 59" W 246.3 FT, RADIUS = 930.46 FT); N 2 DEG 21' 9" E 384.58 FT; W .64 FT; N 2 DEG 35' 6" E 18.56 FT; S 89 DEG 23' 45" E 428.95 FT TO BEG. AREA 3.415 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$371,300 |

$0 |

$0 |

$371,300 |

$49,500 |

$0 |

$0 |

$49,500 |

$0 |

$0 |

$0 |

$420,800 |

| 2023 |

$337,100 |

$0 |

$0 |

$337,100 |

$6,600 |

$0 |

$0 |

$6,600 |

$0 |

$0 |

$0 |

$343,700 |

| 2022 |

$337,100 |

$0 |

$0 |

$337,100 |

$6,000 |

$0 |

$0 |

$6,000 |

$0 |

$0 |

$0 |

$343,100 |

| 2021 |

$334,900 |

$0 |

$0 |

$334,900 |

$52,700 |

$0 |

$0 |

$52,700 |

$0 |

$0 |

$0 |

$387,600 |

| 2020 |

$381,800 |

$0 |

$0 |

$381,800 |

$5,800 |

$0 |

$0 |

$5,800 |

$0 |

$0 |

$0 |

$387,600 |

| 2019 |

$370,700 |

$0 |

$0 |

$370,700 |

$5,800 |

$0 |

$0 |

$5,800 |

$0 |

$0 |

$0 |

$376,500 |

| 2018 |

$336,900 |

$0 |

$0 |

$336,900 |

$4,700 |

$0 |

$0 |

$4,700 |

$0 |

$0 |

$0 |

$341,600 |

| 2017 |

$229,100 |

$0 |

$0 |

$229,100 |

$4,800 |

$0 |

$0 |

$4,800 |

$0 |

$0 |

$0 |

$233,900 |

| 2016 |

$218,700 |

$0 |

$0 |

$218,700 |

$4,700 |

$0 |

$0 |

$4,700 |

$0 |

$0 |

$0 |

$223,400 |

| 2015 |

$211,200 |

$0 |

$0 |

$211,200 |

$4,700 |

$0 |

$0 |

$4,700 |

$0 |

$0 |

$0 |

$215,900 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2024 |

$4,209.68 |

$0.00 |

$4,209.68 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2023 |

$3,435.63 |

$0.00 |

$3,435.63 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2022 |

$3,492.41 |

$0.00 |

$3,492.41 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2021 |

$4,593.84 |

$0.00 |

$4,593.84 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2020 |

$4,731.43 |

$0.00 |

$4,731.43 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2019 |

$4,504.07 |

$0.00 |

$4,504.07 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2018 |

$4,271.37 |

$0.00 |

$4,271.37 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2017 |

$3,008.42 |

$0.00 |

$3,008.42 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2016 |

$2,963.62 |

$0.00 |

$2,963.62 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2015 |

$2,888.31 |

$0.00 |

$2,888.31 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 8956-2023 |

02/14/2023 |

02/14/2023 |

REC |

NBH BANK TEE |

NEFF, BRETT |

| 5359-2023 |

01/27/2023 |

01/30/2023 |

AGR |

BES LLC BY (ET AL) |

ZIONS BANCORPORATION DBA (ET AL) |

| 5358-2023 |

01/27/2023 |

01/30/2023 |

ASSIGN |

BES LLC |

ZIONS BANCORPORATION DBA (ET AL) |

| 5357-2023 |

01/27/2023 |

01/30/2023 |

D TR |

BES LLC |

ZIONS BANCORPORATION DBA (ET AL) |

| 5356-2023 |

01/27/2023 |

01/30/2023 |

WD W |

NEFF, BRETT |

BES LLC |

| 110228-2020 |

07/29/2020 |

07/30/2020 |

MOD AGR |

NEFF, BRETT |

ROCK CANYON BANK |

| 3187-2015 |

12/04/2014 |

01/14/2015 |

QCD |

UNITED STATES OF AMERICA |

SOUTH UTAH VALLEY ELECTRIC SERVICE DISTRICT |

| 6018-2014 |

01/28/2014 |

01/28/2014 |

WD |

NEFF, BRETT |

NEFF, BRETT |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 11/26/2024 4:12:28 AM |