Property Information

mobile view

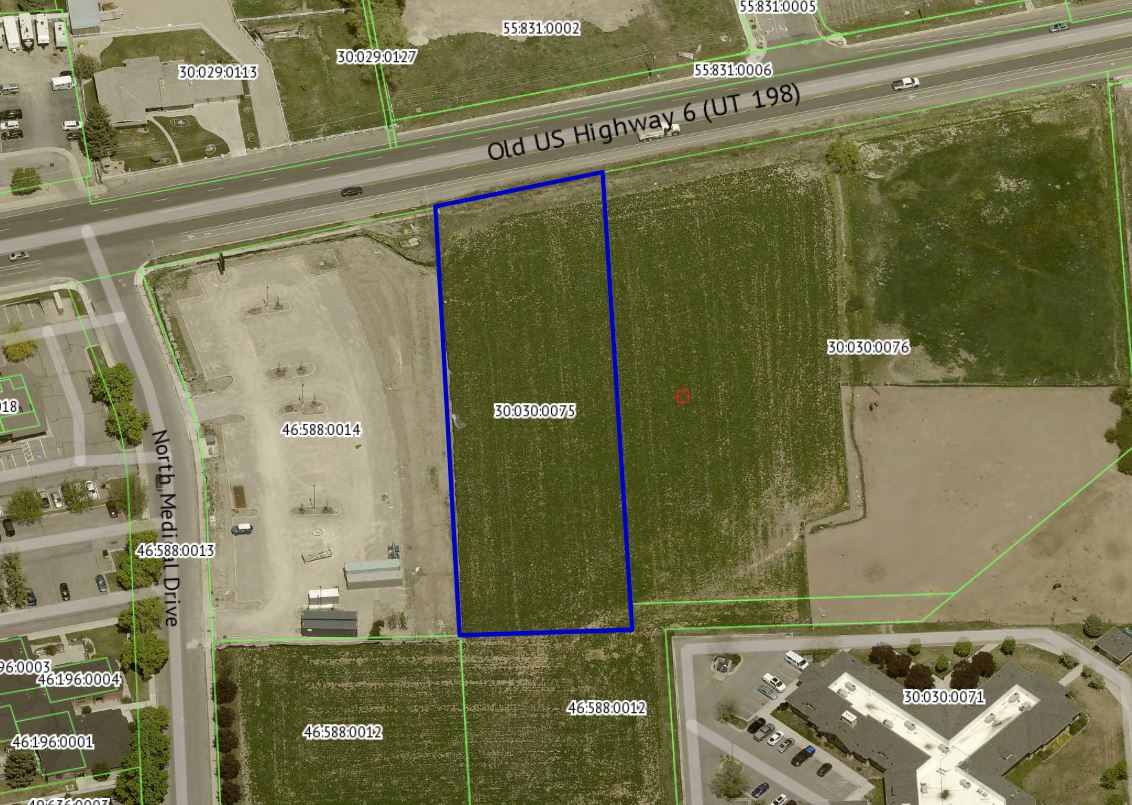

| Serial Number: 30:030:0075 |

Serial Life: 2008... |

|

|

Total Photos: 5

Total Photos: 5

|

| |

|

|

| Property Address: |

|

| Mailing Address: %DUCHARME MCMILLEN & ASSOCIATES PO BOX 80610 INDIANAPOLIS, IN 46280 |

|

| Acreage: 1.257851 |

|

| Last Document:

141793-2007

|

|

| Subdivision Map Filing |

|

| Taxing Description:

COM N 0 DEG 22' 32" W 915.33 FT & E 35.15 FT FR SW COR. SEC. 10, T9S, R2E, SLB&M.; N 89 DEG 42' 47" W 124.63 FT; N 0 DEG 4' 20" E 425.44 FT; N 77 DEG 26' 44" E 127.72 FT; S 0 DEG 4' 20" W 453.83 FT TO BEG. AREA 1.258 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$532,800 |

$0 |

$0 |

$532,800 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$532,800 |

| 2023 |

$501,000 |

$0 |

$0 |

$501,000 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$501,000 |

| 2022 |

$501,000 |

$0 |

$0 |

$501,000 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$501,000 |

| 2021 |

$443,800 |

$0 |

$0 |

$443,800 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$443,800 |

| 2020 |

$392,300 |

$0 |

$0 |

$392,300 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$392,300 |

| 2019 |

$324,400 |

$0 |

$0 |

$324,400 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$324,400 |

| 2018 |

$309,000 |

$0 |

$0 |

$309,000 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$309,000 |

| 2017 |

$297,500 |

$0 |

$0 |

$297,500 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$297,500 |

| 2016 |

$283,800 |

$0 |

$0 |

$283,800 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$283,800 |

| 2015 |

$273,400 |

$0 |

$0 |

$273,400 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$273,400 |

| 2014 |

$265,700 |

$0 |

$0 |

$265,700 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$265,700 |

| 2013 |

$253,300 |

$0 |

$0 |

$253,300 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$253,300 |

| 2012 |

$253,300 |

$0 |

$0 |

$253,300 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$253,300 |

| 2011 |

$275,478 |

$0 |

$0 |

$275,478 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$275,478 |

| 2010 |

$275,478 |

$0 |

$0 |

$275,478 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$275,478 |

| 2009 |

$281,100 |

$0 |

$0 |

$281,100 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$281,100 |

| 2008 |

$0 |

$0 |

$21,168 |

$21,168 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$21,168 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2024 |

$5,235.29 |

$0.00 |

$5,235.29 |

$0.00 |

|

|

Click for Payoff

|

170 - PAYSON CITY |

| 2023 |

$4,909.30 |

$0.00 |

$4,909.30 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2022 |

$4,991.46 |

$0.00 |

$4,991.46 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2021 |

$5,012.28 |

$0.00 |

$5,012.28 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2020 |

$4,528.71 |

$0.00 |

$4,528.71 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2019 |

$3,652.74 |

$0.00 |

$3,652.74 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2018 |

$3,610.05 |

$0.00 |

$3,610.05 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2017 |

$3,554.23 |

$0.00 |

$3,554.23 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2016 |

$3,412.98 |

$0.00 |

$3,412.98 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2015 |

$3,310.60 |

$0.00 |

$3,310.60 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2014 |

$3,194.25 |

$0.00 |

$3,194.25 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2013 |

$3,187.53 |

$0.00 |

$3,187.53 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2012 |

$3,235.65 |

$0.00 |

$3,235.65 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2011 |

$3,435.49 |

$0.00 |

$3,435.49 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2010 |

$3,349.81 |

$0.00 |

$3,349.81 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2009 |

$3,237.43 |

$0.00 |

$3,237.43 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2008 |

$226.77 |

$0.00 |

$226.77 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 127604-2021 |

07/14/2021 |

07/20/2021 |

R/W EAS |

MOUNTAIN VIEW HOSPITAL INC |

PAYSON CITY CORPORATION |

| 128123-2020 |

08/25/2020 |

08/26/2020 |

AGR |

MOUNTAIN VIEW HOSPITAL INC |

MOUNTAIN VIEW NURSING AND REHABILITATION INC DBA (ET AL) |

| 16430-2020 |

02/07/2020 |

02/07/2020 |

AF |

UTAH COUNTY |

WHOM OF INTEREST |

| 34129-2015 |

04/22/2015 |

04/23/2015 |

REC |

PROVO LAND TITLE COMPANY TEE |

BAR K DEVELOPMENT |

| 3187-2015 |

12/04/2014 |

01/14/2015 |

QCD |

UNITED STATES OF AMERICA |

SOUTH UTAH VALLEY ELECTRIC SERVICE DISTRICT |

| 130057-2008 |

12/12/2008 |

12/12/2008 |

R FARM |

UTAH COUNTY TREASURER |

C A HOLDAWAY FARMS (ET AL) |

| 130056-2008 |

12/12/2008 |

12/12/2008 |

R FARM |

UTAH COUNTY TREASURER |

C A HOLDAWAY FARMS (ET AL) |

| 114949-2008 |

10/20/2008 |

10/22/2008 |

CT |

STATE OF UTAH |

WHOM OF INTEREST |

| 107508-2008 |

09/30/2008 |

09/30/2008 |

RESOL |

BOARD OF COUNTY COMMISSIONERS UTAH COUNTY |

WHOM OF INTEREST |

| 48763-2008 |

04/24/2008 |

04/24/2008 |

REC |

FIDELITY TITLE CO INC TEE |

HOLDAWAY, W RICHARD & YVONNE S |

| 48762-2008 |

04/24/2008 |

04/24/2008 |

SUB TEE |

HOLDAWAY, BOYD F |

FIDELITY TITLE CO INC SUCTEE |

| 42141-2008 |

04/07/2008 |

04/10/2008 |

DECLCOV |

MOUNTAIN VIEW HOSPITAL INC |

WHOM OF INTEREST |

| 42140-2008 |

04/07/2008 |

04/10/2008 |

QCD |

MOUNTAINVIEW HOSPITAL INC |

MOUNTAIN VIEW HOSPITAL INC |

| 40444-2008 |

04/07/2008 |

04/07/2008 |

W FARM |

UTAH COUNTY ASSESSOR |

WHOM OF INTEREST |

| 40443-2008 |

04/07/2008 |

04/07/2008 |

W FARM |

UTAH COUNTY ASSESSOR |

WHOM OF INTEREST |

| 151702-2007 |

09/26/2007 |

10/23/2007 |

P REC |

PROVO LAND TITLE COMPANY TEE |

BAR K DEVELOPMENT |

| 147541-2007 |

10/12/2007 |

10/12/2007 |

P REC |

METRO NATIONAL TITLE TEE |

BAR K DEVELOPMENT |

| 147540-2007 |

10/01/2007 |

10/12/2007 |

SUB TEE |

PLEASANT FLATS PROPERTIES LC |

METRO NATIONAL TITLE SUCTEE |

| 143811-2007 |

10/01/2007 |

10/03/2007 |

SP WD |

BAR K DEVELOPMENT LC |

MOUNTAIN VIEW HOSPITAL INC |

| 141793-2007 |

09/26/2007 |

09/28/2007 |

WD |

BAR K DEVELOPMENT LC (ET AL) |

BAR K DEVELOPMENT LC |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 11/5/2024 9:25:58 AM |