Property Information

mobile view

| Serial Number: 45:169:0001 |

Serial Life: 1995... |

|

|

Total Photos: 2

Total Photos: 2

|

| |

|

|

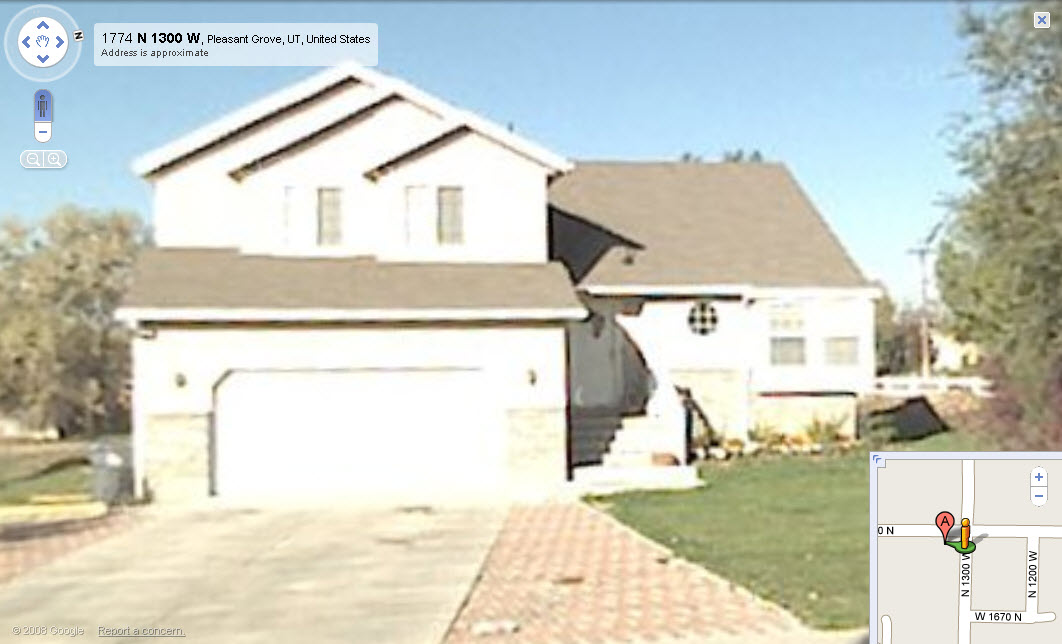

| Property Address: 1793 N 1300 WEST - PLEASANT GROVE |

|

| Mailing Address: 1793 N 1300 W PLEASANT GROVE, UT 84062-8945 |

|

| Acreage: 0 |

|

| Last Document:

17955-1994

|

|

| Subdivision Map Filing |

|

| Taxing Description:

LOT 1, PLAT A, LESLIE ESTATES SUBDV. AREA 0.455 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| 2000... |

|

WILSON, DANA L |

|

| 2000... |

|

WILSON, KEITH L |

|

| 1999 |

|

DEANS, DANNY L |

|

| 1996-1998 |

|

PARRY, ADRIAN B |

|

| 1996-1998 |

|

PARRY, RITA LEE |

|

| 1995 |

|

FARRER, MICHELE P |

|

| 1995 |

|

FARRER, SCOTT W |

|

| 1995NV |

|

WELCOME HOME REAL ESTATE AND INVESTMENTS INC |

|

| 1995NV |

|

OBERG, ROBERT H |

|

| 1995NV |

|

OBERG, WILLETTA |

|

| 1995NV |

|

OBERG, ROBERT H |

|

| 1995NV |

|

OBERG, WILLETTA |

|

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$0 |

$324,000 |

$0 |

$324,000 |

$0 |

$273,400 |

$0 |

$273,400 |

$0 |

$0 |

$0 |

$597,400 |

| 2023 |

$0 |

$294,500 |

$0 |

$294,500 |

$0 |

$293,900 |

$0 |

$293,900 |

$0 |

$0 |

$0 |

$588,400 |

| 2022 |

$0 |

$309,700 |

$0 |

$309,700 |

$0 |

$282,300 |

$0 |

$282,300 |

$0 |

$0 |

$0 |

$592,000 |

| 2021 |

$0 |

$199,800 |

$0 |

$199,800 |

$0 |

$204,600 |

$0 |

$204,600 |

$0 |

$0 |

$0 |

$404,400 |

| 2020 |

$0 |

$185,000 |

$0 |

$185,000 |

$0 |

$191,200 |

$0 |

$191,200 |

$0 |

$0 |

$0 |

$376,200 |

| 2019 |

$0 |

$172,400 |

$0 |

$172,400 |

$0 |

$191,200 |

$0 |

$191,200 |

$0 |

$0 |

$0 |

$363,600 |

| 2018 |

$0 |

$143,000 |

$0 |

$143,000 |

$0 |

$191,200 |

$0 |

$191,200 |

$0 |

$0 |

$0 |

$334,200 |

| 2017 |

$0 |

$126,100 |

$0 |

$126,100 |

$0 |

$172,700 |

$0 |

$172,700 |

$0 |

$0 |

$0 |

$298,800 |

| 2016 |

$0 |

$79,900 |

$0 |

$79,900 |

$0 |

$191,900 |

$0 |

$191,900 |

$0 |

$0 |

$0 |

$271,800 |

| 2015 |

$0 |

$79,900 |

$0 |

$79,900 |

$0 |

$179,500 |

$0 |

$179,500 |

$0 |

$0 |

$0 |

$259,400 |

| 2014 |

$0 |

$78,200 |

$0 |

$78,200 |

$0 |

$179,500 |

$0 |

$179,500 |

$0 |

$0 |

$0 |

$257,700 |

| 2013 |

$0 |

$63,200 |

$0 |

$63,200 |

$0 |

$158,100 |

$0 |

$158,100 |

$0 |

$0 |

$0 |

$221,300 |

| 2012 |

$0 |

$54,700 |

$0 |

$54,700 |

$0 |

$152,500 |

$0 |

$152,500 |

$0 |

$0 |

$0 |

$207,200 |

| 2011 |

$0 |

$51,100 |

$0 |

$51,100 |

$0 |

$164,800 |

$0 |

$164,800 |

$0 |

$0 |

$0 |

$215,900 |

| 2010 |

$0 |

$58,260 |

$0 |

$58,260 |

$0 |

$175,938 |

$0 |

$175,938 |

$0 |

$0 |

$0 |

$234,198 |

| 2009 |

$0 |

$101,600 |

$0 |

$101,600 |

$0 |

$135,300 |

$0 |

$135,300 |

$0 |

$0 |

$0 |

$236,900 |

| 2008 |

$0 |

$128,600 |

$0 |

$128,600 |

$0 |

$128,500 |

$0 |

$128,500 |

$0 |

$0 |

$0 |

$257,100 |

| 2007 |

$0 |

$128,600 |

$0 |

$128,600 |

$0 |

$128,500 |

$0 |

$128,500 |

$0 |

$0 |

$0 |

$257,100 |

| 2006 |

$0 |

$54,000 |

$0 |

$54,000 |

$0 |

$173,200 |

$0 |

$173,200 |

$0 |

$0 |

$0 |

$227,200 |

| 2005 |

$0 |

$54,030 |

$0 |

$54,030 |

$0 |

$118,444 |

$0 |

$118,444 |

$0 |

$0 |

$0 |

$172,474 |

| 2004 |

$0 |

$54,030 |

$0 |

$54,030 |

$0 |

$118,444 |

$0 |

$118,444 |

$0 |

$0 |

$0 |

$172,474 |

| 2003 |

$0 |

$54,030 |

$0 |

$54,030 |

$0 |

$118,444 |

$0 |

$118,444 |

$0 |

$0 |

$0 |

$172,474 |

| 2002 |

$0 |

$54,030 |

$0 |

$54,030 |

$0 |

$118,444 |

$0 |

$118,444 |

$0 |

$0 |

$0 |

$172,474 |

| 2001 |

$0 |

$54,030 |

$0 |

$54,030 |

$0 |

$118,444 |

$0 |

$118,444 |

$0 |

$0 |

$0 |

$172,474 |

| 2000 |

$0 |

$50,495 |

$0 |

$50,495 |

$0 |

$104,365 |

$0 |

$104,365 |

$0 |

$0 |

$0 |

$154,860 |

| 1999 |

$0 |

$50,495 |

$0 |

$50,495 |

$0 |

$62,089 |

$0 |

$62,089 |

$0 |

$0 |

$0 |

$112,584 |

| 1998 |

$0 |

$44,686 |

$0 |

$44,686 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$44,686 |

| 1997 |

$0 |

$44,686 |

$0 |

$44,686 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$44,686 |

| 1996 |

$0 |

$44,000 |

$0 |

$44,000 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$44,000 |

| 1995 |

$0 |

$40,000 |

$0 |

$40,000 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$40,000 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2024 |

$2,815.52 |

$0.00 |

$2,815.52 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2023 |

$2,648.83 |

($61.49) |

$2,587.34 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2022 |

$2,678.39 |

$0.00 |

$2,678.39 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2021 |

$2,184.83 |

$0.00 |

$2,184.83 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2020 |

$2,073.24 |

$0.00 |

$2,073.24 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2019 |

$1,937.61 |

$0.00 |

$1,937.61 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2018 |

$1,883.50 |

$0.00 |

$1,883.50 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2017 |

$1,739.70 |

$0.00 |

$1,739.70 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2016 |

$1,639.16 |

$0.00 |

$1,639.16 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2015 |

$1,651.98 |

$0.00 |

$1,651.98 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2014 |

$1,656.74 |

$0.00 |

$1,656.74 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2013 |

$1,542.01 |

$0.00 |

$1,542.01 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2012 |

$1,475.90 |

$0.00 |

$1,475.90 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2011 |

$1,528.72 |

$0.00 |

$1,528.72 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2010 |

$1,551.63 |

$0.00 |

$1,551.63 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2009 |

$1,447.71 |

$0.00 |

$1,447.71 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2008 |

$1,453.08 |

$0.00 |

$1,453.08 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2007 |

$1,395.53 |

$0.00 |

$1,395.53 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2006 |

$1,319.95 |

$0.00 |

$1,319.95 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2005 |

$1,162.52 |

$0.00 |

$1,162.52 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2004 |

$1,177.13 |

$0.00 |

$1,177.13 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2003 |

$1,167.36 |

$0.00 |

$1,167.36 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2002 |

$1,078.28 |

$0.00 |

$1,078.28 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2001 |

$1,064.25 |

$0.00 |

$1,064.25 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2000 |

$992.61 |

$0.00 |

$992.61 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1999 |

$729.55 |

$0.00 |

$729.55 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1998 |

$516.21 |

$0.00 |

$516.21 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1997 |

$497.58 |

$0.00 |

$497.58 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1996 |

$484.09 |

$0.00 |

$484.09 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1995 |

$495.08 |

$0.00 |

$495.08 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 112421-2016 |

10/17/2016 |

11/08/2016 |

REC |

ZB N A TEE |

WILSON, KEITH L & DANA |

| 105226-2016 |

10/17/2016 |

10/20/2016 |

RSUBTEE |

JPMORGAN CHASE BANK (ET AL) |

WILSON, KEITH L & DANA L |

| 96419-2016 |

09/26/2016 |

09/30/2016 |

D TR |

WILSON, KEITH L & DANA L |

ZB NA |

| 67722-2013 |

04/18/2013 |

07/15/2013 |

AS |

METLIFE BANK BY ATY |

JPMORGAN CHASE BANK |

| 107333-2008 |

07/25/2008 |

09/30/2008 |

AS |

FIRST HORIZON HOME LOANS |

METLIFE HOME LOANS |

| 159926-2007 |

10/18/2007 |

11/09/2007 |

D TR |

WILSON, KEITH L & DANA L |

ZIONS FIRST NATIONAL BANK |

| 141406-2003 |

08/14/2003 |

08/27/2003 |

RSUBTEE |

CHASE MANHATTAN MORTGAGE CORPORATION (ET AL) |

WILSON, KEITH L & DANA L |

| 107900-2003 |

07/11/2003 |

07/16/2003 |

D TR |

WILSON, KEITH L & DANA L |

FIRST HORIZON HOME LOAN CORPORATION |

| 116864-2002 |

08/15/2002 |

10/03/2002 |

REC |

LUNDBERG, J SCOTT TEE |

WILSON, KEITH L & DANA L |

| 116863-2002 |

09/29/2002 |

10/03/2002 |

SUB TEE |

WASHINGTON MUTUAL BANK |

LUNDBERG, J SCOTT SUCTEE |

| 95688-2002 |

07/22/2002 |

08/20/2002 |

AS |

M&T MORTGAGE CORPORATION |

CHASE MANHATTAN MORTGAGE CORPORATION |

| 75193-2002 |

06/28/2002 |

07/03/2002 |

D TR |

WILSON, KEITH L & DANA L |

M&T MORTGAGE CORPORATION |

| 69416-2002 |

03/28/2002 |

06/19/2002 |

REC |

WELLS FARGO FINANCIAL NATIONAL BANK SUCTEE |

WILSON, KEITH L & DANA L |

| 69415-2002 |

03/28/2002 |

06/19/2002 |

SUB TEE |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC |

WELLS FARGO FINANCIAL NATIONAL BANK SUCTEE |

| 138348-2001 |

12/26/2001 |

12/31/2001 |

D TR |

WILSON, KEITH L & DANA L |

NEW LINE MORTGAGE DIV OF (ET AL) |

| 69355-2001 |

06/29/2001 |

07/16/2001 |

AS |

WASHINGTON MUTUAL HOME LOANS INC SUC TO (ET AL) |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC |

| 84003-2000 |

08/08/2000 |

10/25/2000 |

EAS |

WILSON, KEITH L & DANA L |

QWEST CORPORATION |

| 89608-1999 |

08/05/1999 |

08/10/1999 |

REC |

FIRST AMERICAN TITLE COMPANY OF UTAH TEE |

DEANS, DANNY L |

| 82578-1999 |

07/16/1999 |

07/21/1999 |

REC |

WESTERN COMMUNITY BANK TEE |

DEANS, DANNY L |

| 78711-1999 |

07/09/1999 |

07/09/1999 |

REC |

FIRST AMERICAN TITLE COMPANY OF UTAH TEE |

DEANS, DANNY L |

| 78185-1999 |

07/07/1999 |

07/08/1999 |

AS |

FIRST COLONY MORTGAGE CORP |

PROVIDENT FUNDING ASSOCIATES LP |

| 78184-1999 |

07/07/1999 |

07/08/1999 |

D TR |

WILSON, KEITH L & DANA L |

FIRST COLONY MORTGAGE CORP |

| 78183-1999 |

07/06/1999 |

07/08/1999 |

WD |

DEANS, DANNY L |

WILSON, KEITH L & DANA L |

| 92555-1998 |

09/10/1998 |

09/11/1998 |

D TR |

DEANS, DANNY L |

PARRY, ADRIAN B & RITA LEE |

| 92554-1998 |

09/08/1998 |

09/11/1998 |

D TR |

DEANS, DANNY L |

WESTERN COMMUNITY BANK |

| 92553-1998 |

09/10/1998 |

09/11/1998 |

WD |

PARRY, ADRIAN B & RITA LEE |

DEANS, DANNY L |

| 77694-1995 |

11/10/1995 |

11/10/1995 |

PRO COV |

WELCOME HOME REAL ESTATE & INVESTMENTS INC |

WHOM OF INTEREST |

| 76846-1995 |

11/06/1995 |

11/08/1995 |

RESOL |

UTAH COUNTY COMMISSIONERS |

WHOM OF INTEREST |

| 44953-1995 |

07/10/1995 |

07/14/1995 |

REC |

CENTRAL BANK AND TRUST COMPANY TEE |

FARRER, SCOTT W & MICHELLE P |

| 40559-1995 |

06/26/1995 |

06/27/1995 |

WD |

FARRER, SCOTT W & MICHELE P |

PARRY, ADRIAN B & RITA LEE |

| 40558-1995 |

06/22/1995 |

06/27/1995 |

REC |

SECURITY TITLE AND ABSTRACT COMPANY TEE |

FARRER, SCOTT W & MICHELE P |

| 73004-1994 |

09/07/1994 |

09/15/1994 |

REC |

ZIONS FIRST NATIONAL BANK TEE |

OBERG, KEVEN R & KAREN B |

| 66066-1994 |

08/12/1994 |

08/18/1994 |

TR D |

FARRER, SCOTT W & MICHELE P |

WELCOME HOME REAL ESTATE AND INVESTMENT INC |

| 66064-1994 |

08/12/1994 |

08/18/1994 |

D TR |

FARRER, SCOTT W & MICHELE P |

CENTRAL BANK |

| 66063-1994 |

08/12/1994 |

08/18/1994 |

WD |

WELCOME HOME REAL ESTATE AND INVESTMENT INC (ET AL) |

FARRER, SCOTT W & MICHELE P |

| 44967-1994 |

05/10/1994 |

05/27/1994 |

QCD |

OBERG, ROBERT H & WILLETTA |

WELCOME HOME REAL ESTATE AND INVESTMENTS INC |

| 44923-1994 |

05/27/1994 |

05/27/1994 |

PRO COV |

WELCOME HOME REAL ESTATE & INVESTMENTS INC |

WHOM OF INTEREST |

| 17955-1994 |

01/04/1994 |

03/03/1994 |

S PLAT |

LINES, LEON L (ET AL) |

LESLIE ESTATES PLAT A |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 11/26/2024 5:19:28 PM |