Property Information

mobile view

| Serial Number: 46:601:0240 |

Serial Life: 2003... |

|

|

Total Photos: 3

Total Photos: 3

|

| |

|

|

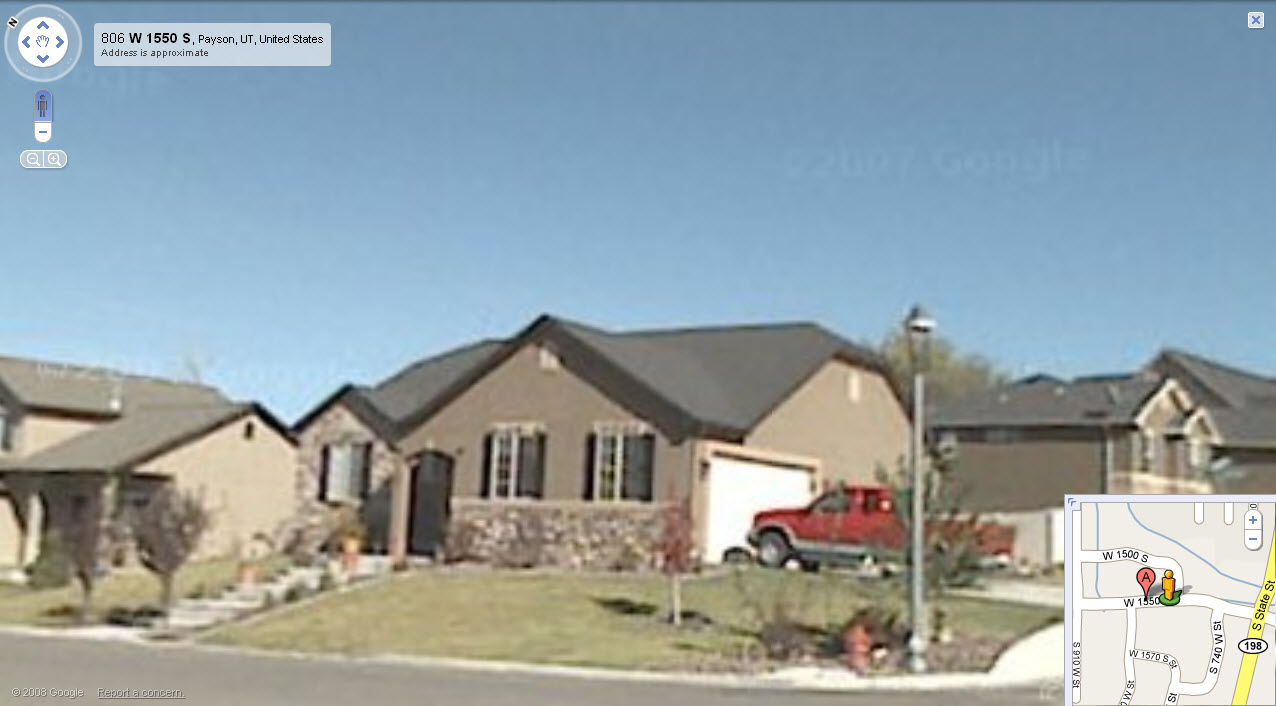

| Property Address: 1541 S 780 WEST - PAYSON |

|

| Mailing Address: 1541 S 780 W PAYSON, UT 84651-5132 |

|

| Acreage: 0.213 |

|

| Last Document:

68004-2010

|

|

| Subdivision Map Filing |

|

| Taxing Description:

LOT 240, PLAT C, MAPLES AT BROOKSIDE PRD AMENDED. AREA 0.213 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| 2025... |

|

HOOPES, JOHN LAMRO |

|

| 2025... |

|

HOOPES, MYRNA GALE |

|

| 2025... |

|

JOHN AND MYRNA TRUST 01-29-2024 |

|

| 2019-2024 |

|

HOOPES, JOHN L |

|

| 2019-2024 |

|

HOOPES, MYRNA GALE |

|

| 2017-2018 |

|

HENRIE, JED E |

|

| 2017-2018 |

|

HENRIE, LINDA ANN |

|

| 2016 |

|

HENRIE, JED E |

|

| 2011-2015 |

|

WALKER, MELANIE JENAE |

|

| 2011-2015 |

|

WALKER, PRESTON WADE |

|

| 2007-2010 |

|

WALKER, PRESTON WADE |

|

| 2007NV |

|

WALKER, MELANIE JENAE |

|

| 2007NV |

|

WALKER, PRESTON WADE |

|

| 2006 |

|

BEDDOES, JONATHAN M |

|

| 2006 |

|

BEDDOES, LINDSAY N |

|

| 2006NV |

|

FLAKER, JOEL E |

|

| 2003-2005 |

|

KRISER HOMES AND COMMUNITIES INC |

|

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$0 |

$149,000 |

$0 |

$149,000 |

$0 |

$336,600 |

$0 |

$336,600 |

$0 |

$0 |

$0 |

$485,600 |

| 2023 |

$0 |

$149,000 |

$0 |

$149,000 |

$0 |

$334,800 |

$0 |

$334,800 |

$0 |

$0 |

$0 |

$483,800 |

| 2022 |

$0 |

$158,900 |

$0 |

$158,900 |

$0 |

$330,500 |

$0 |

$330,500 |

$0 |

$0 |

$0 |

$489,400 |

| 2021 |

$0 |

$113,500 |

$0 |

$113,500 |

$0 |

$252,300 |

$0 |

$252,300 |

$0 |

$0 |

$0 |

$365,800 |

| 2020 |

$0 |

$103,200 |

$0 |

$103,200 |

$0 |

$236,200 |

$0 |

$236,200 |

$0 |

$0 |

$0 |

$339,400 |

| 2019 |

$0 |

$85,400 |

$0 |

$85,400 |

$0 |

$227,500 |

$0 |

$227,500 |

$0 |

$0 |

$0 |

$312,900 |

| 2018 |

$0 |

$74,700 |

$0 |

$74,700 |

$0 |

$203,300 |

$0 |

$203,300 |

$0 |

$0 |

$0 |

$278,000 |

| 2017 |

$0 |

$67,600 |

$0 |

$67,600 |

$0 |

$184,200 |

$0 |

$184,200 |

$0 |

$0 |

$0 |

$251,800 |

| 2016 |

$0 |

$60,500 |

$0 |

$60,500 |

$0 |

$164,600 |

$0 |

$164,600 |

$0 |

$0 |

$0 |

$225,100 |

| 2015 |

$0 |

$53,400 |

$0 |

$53,400 |

$0 |

$143,100 |

$0 |

$143,100 |

$0 |

$0 |

$0 |

$196,500 |

| 2014 |

$0 |

$49,800 |

$0 |

$49,800 |

$0 |

$124,400 |

$0 |

$124,400 |

$0 |

$0 |

$0 |

$174,200 |

| 2013 |

$0 |

$42,400 |

$0 |

$42,400 |

$0 |

$111,200 |

$0 |

$111,200 |

$0 |

$0 |

$0 |

$153,600 |

| 2012 |

$0 |

$45,800 |

$0 |

$45,800 |

$0 |

$99,300 |

$0 |

$99,300 |

$0 |

$0 |

$0 |

$145,100 |

| 2011 |

$0 |

$36,300 |

$0 |

$36,300 |

$0 |

$117,100 |

$0 |

$117,100 |

$0 |

$0 |

$0 |

$153,400 |

| 2010 |

$0 |

$53,400 |

$0 |

$53,400 |

$0 |

$109,645 |

$0 |

$109,645 |

$0 |

$0 |

$0 |

$163,045 |

| 2009 |

$0 |

$53,400 |

$0 |

$53,400 |

$0 |

$113,800 |

$0 |

$113,800 |

$0 |

$0 |

$0 |

$167,200 |

| 2008 |

$0 |

$53,400 |

$0 |

$53,400 |

$0 |

$155,600 |

$0 |

$155,600 |

$0 |

$0 |

$0 |

$209,000 |

| 2007 |

$0 |

$55,000 |

$0 |

$55,000 |

$0 |

$160,400 |

$0 |

$160,400 |

$0 |

$0 |

$0 |

$215,400 |

| 2006 |

$0 |

$46,000 |

$0 |

$46,000 |

$0 |

$119,000 |

$0 |

$119,000 |

$0 |

$0 |

$0 |

$165,000 |

| 2005 |

$0 |

$35,002 |

$0 |

$35,002 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$35,002 |

| 2004 |

$0 |

$35,002 |

$0 |

$35,002 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$35,002 |

| 2003 |

$0 |

$35,002 |

$0 |

$35,002 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$35,002 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2024 |

$2,624.33 |

$0.00 |

$2,624.33 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2023 |

$2,607.42 |

$0.00 |

$2,607.42 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2022 |

$2,681.74 |

$0.00 |

$2,681.74 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2021 |

$2,272.24 |

$0.00 |

$2,272.24 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2020 |

$2,154.92 |

$0.00 |

$2,154.92 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2019 |

$1,937.79 |

$0.00 |

$1,937.79 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2018 |

$1,786.33 |

$0.00 |

$1,786.33 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2017 |

$1,654.54 |

$0.00 |

$1,654.54 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2016 |

$1,488.88 |

$0.00 |

$1,488.88 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2015 |

$1,308.68 |

$0.00 |

$1,308.68 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2014 |

$1,151.83 |

$0.00 |

$1,151.83 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2013 |

$1,063.10 |

$0.00 |

$1,063.10 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2012 |

$1,019.43 |

$0.00 |

$1,019.43 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2011 |

$1,052.18 |

$0.00 |

$1,052.18 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2010 |

$1,090.45 |

$0.00 |

$1,090.45 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2009 |

$1,059.10 |

$0.00 |

$1,059.10 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2008 |

$1,231.46 |

$0.00 |

$1,231.46 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2007 |

$1,258.86 |

$0.00 |

$1,258.86 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2006 |

$1,071.49 |

$0.00 |

$1,071.49 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2005 |

$439.94 |

$0.00 |

$439.94 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2004 |

$441.17 |

$0.00 |

$441.17 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2003 |

$400.42 |

$0.00 |

$400.42 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 9388-2024 |

02/14/2024 |

02/14/2024 |

WD |

HOOPES, JOHN L & MYRNA GALE |

HOOPES, JOHN LAMRO & MYRNA GALE TEE (ET AL) |

| 38433-2020 |

01/09/2020 |

03/25/2020 |

ADECCOV |

MAPLES AT BROOKSIDE INC THE |

WHOM OF INTEREST |

| 38172-2020 |

01/09/2020 |

03/25/2020 |

DECLCOV |

MAPLES AT BROOKSIDE HOMEOWNERS ASSOCIAITON |

WHOM OF INTEREST |

| 65956-2018 |

07/06/2018 |

07/16/2018 |

REC |

FIRST AMERICAN TITLE INSURANCE COMPANY TEE |

HENRIE, JED E |

| 65955-2018 |

07/06/2018 |

07/16/2018 |

SUB TEE |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC |

FIRST AMERICAN TITLE INSURANCE COMPANY SUBTEE |

| 40000-2018 |

04/30/2018 |

04/30/2018 |

WD |

HENRIE, JED E & LINDA ANN |

HOOPES, JOHN L & MYRNA GALE |

| 37210-2018 |

02/07/2018 |

04/23/2018 |

COVLAND |

MAPLES AT BROOKSIDE INC |

WHOM OF INTEREST |

| 51212-2016 |

06/01/2016 |

06/07/2016 |

WD |

HENRIE, JED E |

HENRIE, JED E & LINDA ANN |

| 79404-2015 |

08/31/2015 |

08/31/2015 |

REC |

FIRST AMERICAN TITLE INSURANCE COMPANY TEE |

WALKER, PRESTON WADE & MELANIE JENAE |

| 74117-2015 |

08/13/2015 |

08/14/2015 |

D TR |

HENRIE, JED E |

GRAYSTONE MORTGAGE LLC |

| 74103-2015 |

08/14/2015 |

08/14/2015 |

WD |

WALKER, PRESTON WADE & MELANIE JENAE |

HENRIE, JED E |

| 3187-2015 |

12/04/2014 |

01/14/2015 |

QCD |

UNITED STATES OF AMERICA |

SOUTH UTAH VALLEY ELECTRIC SERVICE DISTRICT |

| 87792-2013 |

06/12/2013 |

09/13/2013 |

WATERAG |

WALKER, PRESTON WADE |

STRAWBERRY WATER USERS ASSOCIATION (ET AL) |

| 97096-2010 |

10/25/2010 |

11/08/2010 |

REC |

CITICORP TRUST BANK TEE |

WALKER, PRESTON WADE |

| 97095-2010 |

10/25/2010 |

11/08/2010 |

SUB TEE |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC |

CITICORP TRUST BANK SUCTEE |

| 77905-2010 |

08/26/2010 |

09/15/2010 |

REC |

FIRST AMERICAN TITLE INSURANCE COMPANY TEE |

WALKER, PRESTON WADE |

| 77904-2010 |

08/25/2010 |

09/15/2010 |

SUB TEE |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC |

FIRST AMERICAN TITLE INSURANCE COMPANY SUCTEE |

| 68005-2010 |

08/09/2010 |

08/13/2010 |

D TR |

WALKER, MELANIE JENAE & PRESTON WADE |

PROVIDENT FUNDING ASSOCIATES LP |

| 68004-2010 |

08/09/2010 |

08/13/2010 |

WD |

WALKER, PRESTON WADE & MELANIE JENAE |

WALKER, PRESTON WADE & MELANIE JENAE |

| 114949-2008 |

10/20/2008 |

10/22/2008 |

CT |

STATE OF UTAH |

WHOM OF INTEREST |

| 107508-2008 |

09/30/2008 |

09/30/2008 |

RESOL |

BOARD OF COUNTY COMMISSIONERS UTAH COUNTY |

WHOM OF INTEREST |

| 79606-2008 |

06/05/2008 |

07/14/2008 |

REC |

FAR WEST BANK TEE |

KRISER HOMES AND COMMUNITIES INC |

| 164453-2006 |

11/28/2006 |

12/06/2006 |

CT |

STATE OF UTAH |

WHOM OF INTEREST |

| 44271-2006 |

03/24/2006 |

04/13/2006 |

RSUBTEE |

FIRST FRANKLIN FINANCIAL CORPORATION (ET AL) |

BEDDOES, JONATHAN M & LINDSAY N |

| 44270-2006 |

04/03/2006 |

04/13/2006 |

RSUBTEE |

FIRST FRANKLIN FINANCIAL CORPORATION (ET AL) |

BEDDOES, JONATHAN M & LINDSAY N |

| 29920-2006 |

03/08/2006 |

03/14/2006 |

WD |

WALKER, PRESTON WADE |

WALKER, PRESTON WADE & MELANIE JENAE |

| 29906-2006 |

03/09/2006 |

03/14/2006 |

D TR |

WALKER, PRESTON WADE |

LEHMAN BROTHERS BANK |

| 29905-2006 |

03/08/2006 |

03/14/2006 |

D TR |

WALKER, PRESTON WADE |

LEHMAN BROTHERS BANK |

| 29789-2006 |

03/08/2006 |

03/14/2006 |

WD |

BEDDOES, JONATHAN M & LINDSAY N |

WALKER, PRESTON WADE |

| 136613-2005 |

11/07/2005 |

11/28/2005 |

AS |

FIRST FRANKLIN |

FIRST FRANKLIN FINANCIAL CORPORATION |

| 136612-2005 |

11/07/2005 |

11/28/2005 |

AS |

FIRST FRANKLIN |

FIRST FRANKLIN FINANCIAL CORPORATION |

| 134181-2005 |

10/03/2005 |

11/21/2005 |

REC |

FIRST UTAH BANK TEE |

FLAKER, JOEL E |

| 101639-2005 |

09/08/2005 |

09/09/2005 |

D TR |

BEDDOES, JONATHAN M & LINDSAY N |

FIRST FRANKLIN |

| 101638-2005 |

09/08/2005 |

09/09/2005 |

D TR |

BEDDOES, JONATHAN M & LINDSAY N |

FIRST FRANKLIN |

| 101637-2005 |

09/08/2005 |

09/09/2005 |

WD |

FLAKER, JOEL E |

BEDDOES, JONATHAN M & LINDSAY N |

| 28465-2005 |

03/15/2005 |

03/18/2005 |

TR D |

FLAKER, JOEL E |

KRISER HOMES AND COMMUNITIES INC |

| 28464-2005 |

03/15/2005 |

03/18/2005 |

D TR |

FLAKER, JOEL E |

FIRST UTAH BANK |

| 28463-2005 |

03/15/2005 |

03/18/2005 |

WD |

KRISER HOMES AND COMMUNITIES INC |

FLAKER, JOEL E |

| 176632-2003 |

11/03/2003 |

11/04/2003 |

D TR |

KRISER HOMES AND COMMUNITIES INC |

FAR WEST BANK |

| 124408-2003 |

07/10/2003 |

08/06/2003 |

REC |

FAR WEST BANK TEE |

KRISER HOMES & COMMUNITIES INC |

| 74231-2003 |

05/16/2003 |

05/19/2003 |

W FARM |

UTAH COUNTY ASSESSOR |

WHOM OF INTEREST |

| 50298-2003 |

04/01/2003 |

04/02/2003 |

QCD |

CAPITAL LAND INVESTMENTS LLC |

KRISER HOMES AND COMMUNITIES |

| 82542-2002 |

07/19/2002 |

07/22/2002 |

ADECCOV |

MAPLES AT BROOKSIDE INC |

WHOM OF INTEREST |

| 82541-2002 |

07/18/2002 |

07/22/2002 |

S PLAT |

KRISER HOMES & COMMUNITIES INC (ET AL) |

MAPLES AT BROOKSIDE THE PRD PLAT C AMD |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 12/25/2024 1:28:28 AM |