Property Information

mobile view

| Serial Number: 49:310:0005 |

Serial Life: 1998... |

|

|

Total Photos: 2

Total Photos: 2

|

| |

|

|

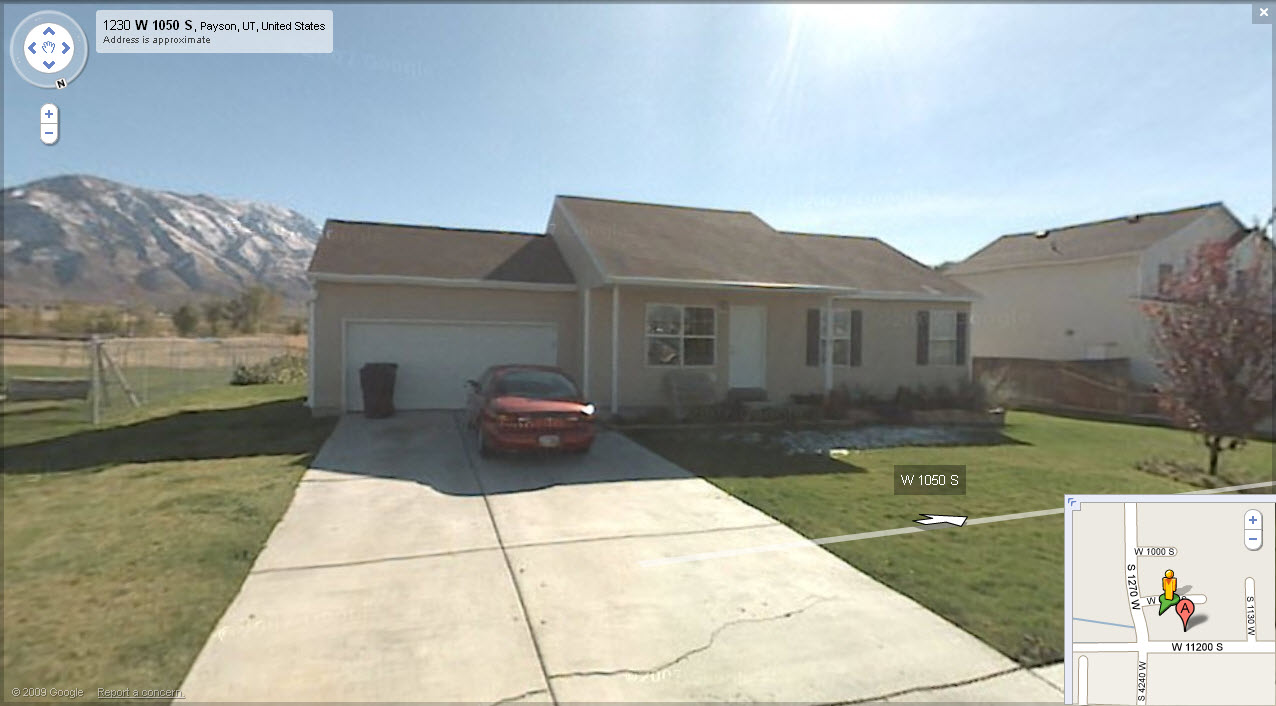

| Property Address: 1247 W 1050 SOUTH - PAYSON |

|

| Mailing Address: 1247 W 1050 S PAYSON, UT 84651-8634 |

|

| Acreage: 0.227 |

|

| Last Document:

81770-2003

|

|

| Subdivision Map Filing |

|

| Taxing Description:

LOT 5, PLAT A, PAYSON MEADOWS SUBDV. AREA 0.227 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| 2017... |

|

MITCHELL, MARIE D |

|

| 2017NV |

|

MICHELL FAMILY TRUST 04-21-2016 |

|

| 2017NV |

|

MITCHELL, JESSE DAVID |

|

| 2017NV |

|

MITCHELL, MARIE D |

|

| 2004-2016 |

|

MITCHELL, JESSE D |

|

| 2004-2016 |

|

MITCHELL, MARIE D |

|

| 2000-2003 |

|

MITCHELL, JESSE D |

|

| 2000NV |

|

AMERICRAFT HOMES INC |

|

| 2000NV |

|

HIATT, RAY |

|

| 1998-1999 |

|

HIATT, RAY |

|

| 1998-1999 |

|

WOODS, CARRIE |

|

| 1998NV |

|

DALLIN, ELIZABETH L |

|

| 1998NV |

|

DALLIN, MARK B |

|

| 1998NV |

|

JOHNSON, LANA W |

|

| 1998NV |

|

WALDRON, DONNA M |

|

| 1998NV |

|

WALDRON, REX P |

|

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$0 |

$136,200 |

$0 |

$136,200 |

$0 |

$261,900 |

$0 |

$261,900 |

$0 |

$0 |

$0 |

$398,100 |

| 2023 |

$0 |

$136,200 |

$0 |

$136,200 |

$0 |

$265,500 |

$0 |

$265,500 |

$0 |

$0 |

$0 |

$401,700 |

| 2022 |

$0 |

$145,200 |

$0 |

$145,200 |

$0 |

$249,500 |

$0 |

$249,500 |

$0 |

$0 |

$0 |

$394,700 |

| 2021 |

$0 |

$103,700 |

$0 |

$103,700 |

$0 |

$189,000 |

$0 |

$189,000 |

$0 |

$0 |

$0 |

$292,700 |

| 2020 |

$0 |

$90,200 |

$0 |

$90,200 |

$0 |

$177,000 |

$0 |

$177,000 |

$0 |

$0 |

$0 |

$267,200 |

| 2019 |

$0 |

$90,200 |

$0 |

$90,200 |

$0 |

$153,900 |

$0 |

$153,900 |

$0 |

$0 |

$0 |

$244,100 |

| 2018 |

$0 |

$70,000 |

$0 |

$70,000 |

$0 |

$139,200 |

$0 |

$139,200 |

$0 |

$0 |

$0 |

$209,200 |

| 2017 |

$0 |

$64,900 |

$0 |

$64,900 |

$0 |

$125,600 |

$0 |

$125,600 |

$0 |

$0 |

$0 |

$190,500 |

| 2016 |

$0 |

$56,300 |

$0 |

$56,300 |

$0 |

$121,300 |

$0 |

$121,300 |

$0 |

$0 |

$0 |

$177,600 |

| 2015 |

$0 |

$50,500 |

$0 |

$50,500 |

$0 |

$120,800 |

$0 |

$120,800 |

$0 |

$0 |

$0 |

$171,300 |

| 2014 |

$0 |

$50,500 |

$0 |

$50,500 |

$0 |

$109,600 |

$0 |

$109,600 |

$0 |

$0 |

$0 |

$160,100 |

| 2013 |

$0 |

$49,300 |

$0 |

$49,300 |

$0 |

$95,300 |

$0 |

$95,300 |

$0 |

$0 |

$0 |

$144,600 |

| 2012 |

$0 |

$56,100 |

$0 |

$56,100 |

$0 |

$80,100 |

$0 |

$80,100 |

$0 |

$0 |

$0 |

$136,200 |

| 2011 |

$0 |

$37,200 |

$0 |

$37,200 |

$0 |

$106,900 |

$0 |

$106,900 |

$0 |

$0 |

$0 |

$144,100 |

| 2010 |

$0 |

$50,540 |

$0 |

$50,540 |

$0 |

$102,559 |

$0 |

$102,559 |

$0 |

$0 |

$0 |

$153,099 |

| 2009 |

$0 |

$51,400 |

$0 |

$51,400 |

$0 |

$105,600 |

$0 |

$105,600 |

$0 |

$0 |

$0 |

$157,000 |

| 2008 |

$0 |

$51,400 |

$0 |

$51,400 |

$0 |

$128,500 |

$0 |

$128,500 |

$0 |

$0 |

$0 |

$179,900 |

| 2007 |

$0 |

$53,000 |

$0 |

$53,000 |

$0 |

$132,500 |

$0 |

$132,500 |

$0 |

$0 |

$0 |

$185,500 |

| 2006 |

$0 |

$33,200 |

$0 |

$33,200 |

$0 |

$100,200 |

$0 |

$100,200 |

$0 |

$0 |

$0 |

$133,400 |

| 2005 |

$0 |

$31,651 |

$0 |

$31,651 |

$0 |

$95,451 |

$0 |

$95,451 |

$0 |

$0 |

$0 |

$127,102 |

| 2004 |

$0 |

$31,651 |

$0 |

$31,651 |

$0 |

$95,451 |

$0 |

$95,451 |

$0 |

$0 |

$0 |

$127,102 |

| 2003 |

$0 |

$31,651 |

$0 |

$31,651 |

$0 |

$95,451 |

$0 |

$95,451 |

$0 |

$0 |

$0 |

$127,102 |

| 2002 |

$0 |

$31,651 |

$0 |

$31,651 |

$0 |

$95,451 |

$0 |

$95,451 |

$0 |

$0 |

$0 |

$127,102 |

| 2001 |

$0 |

$36,380 |

$0 |

$36,380 |

$0 |

$86,774 |

$0 |

$86,774 |

$0 |

$0 |

$0 |

$123,154 |

| 2000 |

$0 |

$34,000 |

$0 |

$34,000 |

$0 |

$76,460 |

$0 |

$76,460 |

$0 |

$0 |

$0 |

$110,460 |

| 1999 |

$0 |

$34,000 |

$0 |

$34,000 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$34,000 |

| 1998 |

$0 |

$34,000 |

$0 |

$34,000 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$34,000 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2024 |

$2,151.45 |

$0.00 |

$2,151.45 |

$0.00 |

|

|

Click for Payoff

|

170 - PAYSON CITY |

| 2023 |

$2,164.94 |

$0.00 |

$2,164.94 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2022 |

$2,162.82 |

$0.00 |

$2,162.82 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2021 |

$1,818.16 |

$0.00 |

$1,818.16 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2020 |

$1,696.51 |

$0.00 |

$1,696.51 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2019 |

$1,511.71 |

$0.00 |

$1,511.71 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2018 |

$1,344.25 |

$0.00 |

$1,344.25 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2017 |

$1,251.75 |

$0.00 |

$1,251.75 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2016 |

$1,174.70 |

$0.00 |

$1,174.70 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2015 |

$1,140.85 |

$0.00 |

$1,140.85 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2014 |

$1,058.60 |

$0.00 |

$1,058.60 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2013 |

$1,000.81 |

$0.00 |

$1,000.81 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2012 |

$956.90 |

$0.00 |

$956.90 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2011 |

$988.39 |

$0.00 |

$988.39 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2010 |

$1,023.92 |

$0.00 |

$1,023.92 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2009 |

$994.49 |

$0.00 |

$994.49 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2008 |

$1,060.00 |

$0.00 |

$1,060.00 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2007 |

$1,084.12 |

$0.00 |

$1,084.12 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2006 |

$866.28 |

$0.00 |

$866.28 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2005 |

$878.65 |

$0.00 |

$878.65 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2004 |

$881.10 |

$0.00 |

$881.10 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2003 |

$799.72 |

$0.00 |

$799.72 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2002 |

$780.57 |

$0.00 |

$780.57 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2001 |

$770.35 |

$0.00 |

$770.35 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2000 |

$683.53 |

$0.00 |

$683.53 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1999 |

$363.15 |

$0.00 |

$363.15 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1998 |

$354.18 |

$0.00 |

$354.18 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 184386-2020 |

11/17/2020 |

11/20/2020 |

REC |

MORAN, KEVIN P TEE |

MITCHELL, MARIE D |

| 184385-2020 |

11/10/2020 |

11/20/2020 |

SUB TEE |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC |

MORAN, KEVIN P SUBTEE |

| 129223-2016 |

12/12/2016 |

12/22/2016 |

REC |

RIVERS, ROD TEE |

MITCHELL, JESSE D |

| 129222-2016 |

11/18/2016 |

12/22/2016 |

SUB TEE |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC |

RIVERS, ROD SUCTEE |

| 111450-2016 |

10/31/2016 |

11/04/2016 |

D TR |

MITCHELL, MARIE D |

UTAH COMMUNITY FEDERAL CREDIT UNION |

| 101855-2016 |

10/06/2016 |

10/13/2016 |

R LP |

MITCHELL, JESSE D & MARIE D |

FOUNDATION FOR AFFORDABLE HOUSING THE (ET AL) |

| 93087-2016 |

09/14/2016 |

09/22/2016 |

J |

FOUNDATION FOR AFFORDABLE HOUSING THE |

MITCHELL, JESSE D & MARIE D |

| 61670-2016 |

06/22/2016 |

07/06/2016 |

WD |

MITCHELL, JESSE DAVID & MARIE D TEE (ET AL) |

MITCHELL, MARIE D |

| 48078-2016 |

04/21/2016 |

05/31/2016 |

WD |

MITCHELL, JESSE D & MARIE D |

MITCHELL, JESSE DAVID & MARIE D TEE (ET AL) |

| 4171-2015 |

01/05/2015 |

01/20/2015 |

LP |

MITCHELL, JESSE D & MARIE D |

FOUNDATION FOR AFFORDABLE HOUSING THE (ET AL) |

| 3187-2015 |

12/04/2014 |

01/14/2015 |

QCD |

UNITED STATES OF AMERICA |

SOUTH UTAH VALLEY ELECTRIC SERVICE DISTRICT |

| 109395-2012 |

12/11/2012 |

12/12/2012 |

REC |

PRO-TITLE AND ESCROW INC TEE |

MITCHELL, JESSE D & MARIE D |

| 114949-2008 |

10/20/2008 |

10/22/2008 |

CT |

STATE OF UTAH |

WHOM OF INTEREST |

| 107508-2008 |

09/30/2008 |

09/30/2008 |

RESOL |

BOARD OF COUNTY COMMISSIONERS UTAH COUNTY |

WHOM OF INTEREST |

| 74544-2008 |

06/12/2008 |

06/27/2008 |

D TR |

MITCHELL, JESSE D & MARIE D |

NEBO CREDIT UNION |

| 143013-2003 |

08/20/2003 |

08/29/2003 |

REC |

WELLS FARGO FINANCIAL NATIONAL BANK TEE |

MITCHELL, JESSE D |

| 143012-2003 |

08/20/2003 |

08/29/2003 |

SUC TEE |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC |

WELLS FARGO FINANCIAL NATIONAL BANK SUCTEE |

| 109838-2003 |

04/11/2003 |

07/17/2003 |

RSUBTEE |

WASHINGTON MUTUAL BANK (ET AL) |

MITCHELL, JESSE D |

| 81770-2003 |

05/23/2003 |

05/30/2003 |

QCD |

MITCHELL, JESSE D |

MITCHELL, JESSE D & MARIE D |

| 81769-2003 |

05/13/2003 |

05/30/2003 |

SUB AGR |

FOUNDATIONN FOR AFFORDABLE HOUSING THE |

AMERICAN UNION MORTGAGE |

| 81768-2003 |

05/28/2003 |

05/30/2003 |

D TR |

MITCHELL, JESSE D |

SECURTIYNATIONAL MORTGAGE |

| 39144-2003 |

02/24/2003 |

03/17/2003 |

REC |

PRO-TITLE AND ESCROW INC TEE |

AMERICRAFT HOMES INC |

| 29808-2003 |

02/11/2003 |

02/28/2003 |

SUB AGR |

FOUNDATION FOR AFFORDABLE HOUSING THE |

AMERICAN UNION MORTGAGE |

| 29807-2003 |

02/24/2003 |

02/28/2003 |

D TR |

MITCHELL, JESSE D |

NEW LINE MORTGAGE DIV OF (ET AL) |

| 104833-1999 |

09/23/1999 |

09/27/1999 |

REC |

PRO-TITLE AND ESCROW INC TEE |

AMERICRAFT HOMES INC |

| 54362-1999 |

05/05/1999 |

05/10/1999 |

TR D |

MITCHELL, JESSE D |

FOUNDATION FOR AFFORDABLE HOUSING THE |

| 54361-1999 |

05/05/1999 |

05/10/1999 |

AS |

FIRST COLONY MORTGAGE CORP |

NORTH AMERICAN MORTGAGE COMPANY |

| 54360-1999 |

05/05/1999 |

05/10/1999 |

D TR |

MITCHELL, JESSE D |

FIRST COLONY MORTGAGE CORP |

| 54359-1999 |

05/05/1999 |

05/10/1999 |

WD |

AMERICRAFT HOMES INC |

MITCHELL, JESSE D |

| 18297-1999 |

02/12/1999 |

02/16/1999 |

D TR |

AMERICRAFT HOMES INC |

WASHINGTON MUTUAL BANK |

| 18296-1999 |

02/12/1999 |

02/16/1999 |

WD |

HIATT, RAY |

AMERICRAFT HOMES INC |

| 17019-1999 |

02/11/1999 |

02/11/1999 |

C WD |

WOODS, CARRIE & CARRIE L AKA |

HIATT, RAY |

| 7690-1999 |

01/21/1999 |

01/22/1999 |

REC |

TITLE WEST TITLE CO TEE |

DALLIN, MARK B & ELIZABETH L (ET AL) |

| 2586-1999 |

01/07/1999 |

01/08/1999 |

WD |

WOODS, CARRIE & CARRIE L AKA |

HIATT, RAY |

| 81558-1997 |

10/17/1997 |

10/17/1997 |

AF |

PAYSON CITY |

WHOM OF INTEREST |

| 80951-1997 |

08/04/1997 |

10/15/1997 |

WD |

JOHNSON, LANA W |

WOODS, CARRIE 50%INT |

| 80950-1997 |

06/18/1997 |

10/15/1997 |

WD |

WALDRON, REX P & DONNA M |

JOHNSON, LANA W 10%INT |

| 80949-1997 |

06/18/1997 |

10/15/1997 |

WD |

WALDRON, REX P & DONNA M |

HIATT, RAY 50%INT |

| 77590-1997 |

01/15/1997 |

10/02/1997 |

S PLAT |

JOHNSON, LANA (ET AL) |

PAYSON MEADOWS PLAT A |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 11/5/2024 8:46:56 AM |