Property Information

mobile view

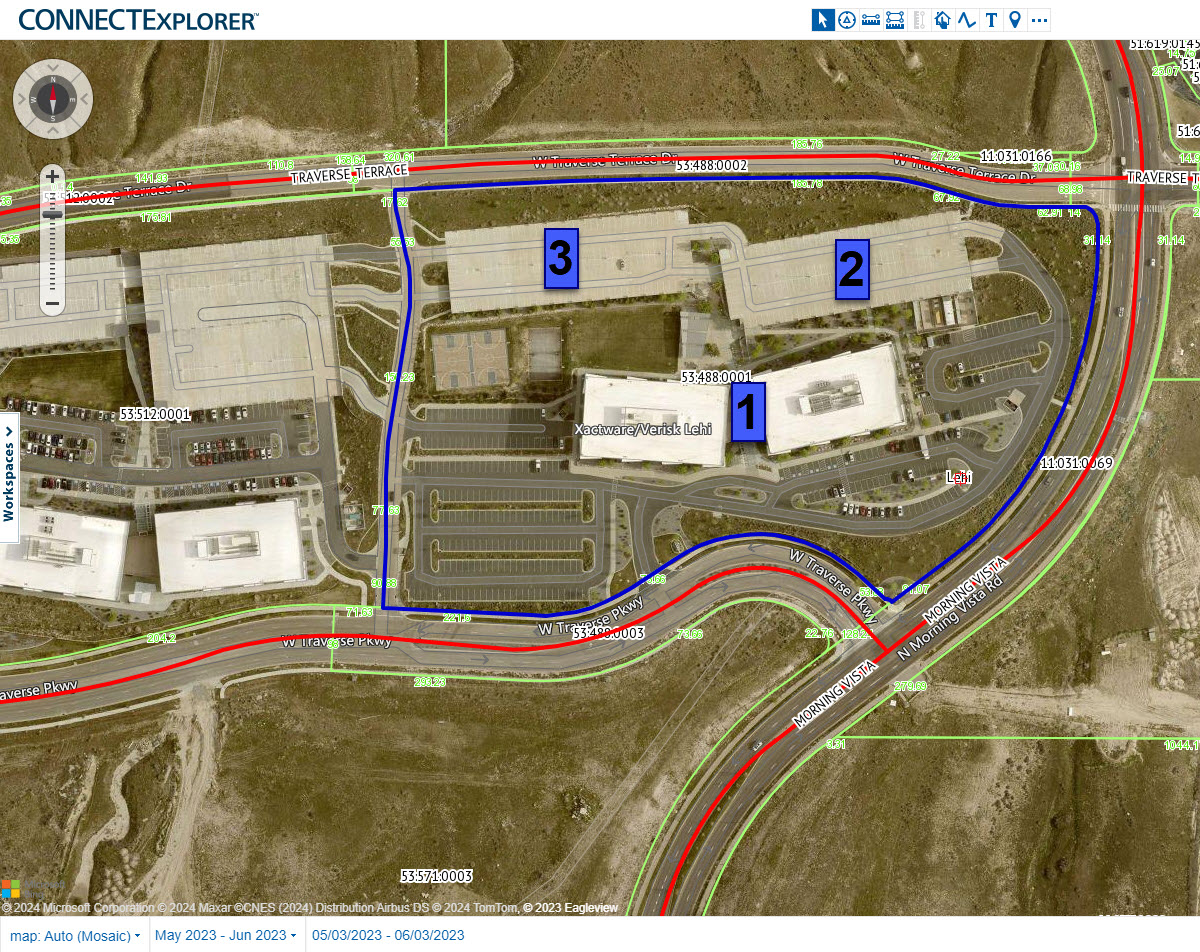

| Serial Number: 53:488:0001 |

Serial Life: 2013... |

|

|

Total Photos: 19

Total Photos: 19

|

| |

|

|

| Property Address: 1100 W TRAVERSE PKY - LEHI |

|

| Mailing Address: PO BOX 50277 IDAHO FALLS, ID 83405 |

|

| Acreage: 13.26768 |

|

| Last Document:

109407-2012

|

|

| Subdivision Map Filing |

|

| Taxing Description:

LOT 1, PLAT 1, TRAVERSE MOUNTAIN OFFICE PARK SUB AREA 13.268 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$8,701,300 |

$0 |

$0 |

$8,701,300 |

$48,985,500 |

$0 |

$0 |

$48,985,500 |

$0 |

$0 |

$0 |

$57,686,800 |

| 2023 |

$8,586,800 |

$0 |

$0 |

$8,586,800 |

$46,933,600 |

$0 |

$0 |

$46,933,600 |

$0 |

$0 |

$0 |

$55,520,400 |

| 2022 |

$8,472,300 |

$0 |

$0 |

$8,472,300 |

$38,190,200 |

$0 |

$0 |

$38,190,200 |

$0 |

$0 |

$0 |

$46,662,500 |

| 2021 |

$8,014,400 |

$0 |

$0 |

$8,014,400 |

$34,643,100 |

$0 |

$0 |

$34,643,100 |

$0 |

$0 |

$0 |

$42,657,500 |

| 2020 |

$8,014,400 |

$0 |

$0 |

$8,014,400 |

$35,962,400 |

$0 |

$0 |

$35,962,400 |

$0 |

$0 |

$0 |

$43,976,800 |

| 2019 |

$5,929,700 |

$0 |

$0 |

$5,929,700 |

$36,656,500 |

$0 |

$0 |

$36,656,500 |

$0 |

$0 |

$0 |

$42,586,200 |

| 2018 |

$3,953,100 |

$0 |

$0 |

$3,953,100 |

$36,146,800 |

$0 |

$0 |

$36,146,800 |

$0 |

$0 |

$0 |

$40,099,900 |

| 2017 |

$3,589,000 |

$0 |

$0 |

$3,589,000 |

$32,920,100 |

$0 |

$0 |

$32,920,100 |

$0 |

$0 |

$0 |

$36,509,100 |

| 2016 |

$3,589,000 |

$0 |

$0 |

$3,589,000 |

$32,920,100 |

$0 |

$0 |

$32,920,100 |

$0 |

$0 |

$0 |

$36,509,100 |

| 2015 |

$3,502,300 |

$0 |

$0 |

$3,502,300 |

$32,920,100 |

$0 |

$0 |

$32,920,100 |

$0 |

$0 |

$0 |

$36,422,400 |

| 2014 |

$3,184,500 |

$0 |

$0 |

$3,184,500 |

$32,920,100 |

$0 |

$0 |

$32,920,100 |

$0 |

$0 |

$0 |

$36,104,600 |

| 2013 |

$2,652,400 |

$0 |

$0 |

$2,652,400 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$2,652,400 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2024 |

$492,933.71 |

$0.00 |

$492,933.71 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2023 |

$436,945.55 |

$0.00 |

$436,945.55 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2022 |

$378,806.18 |

$0.00 |

$378,806.18 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2021 |

$416,465.17 |

$0.00 |

$416,465.17 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2020 |

$434,358.85 |

$0.00 |

$434,358.85 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2019 |

$404,611.49 |

$0.00 |

$404,611.49 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2018 |

$403,004.00 |

$0.00 |

$403,004.00 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2017 |

$379,585.11 |

$0.00 |

$379,585.11 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2016 |

$409,120.97 |

$0.00 |

$409,120.97 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2015 |

$429,966.43 |

$0.00 |

$429,966.43 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2014 |

$428,742.13 |

$0.00 |

$428,742.13 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2013 |

$34,152.30 |

$0.00 |

$34,152.30 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 12288-2024 |

02/26/2024 |

02/28/2024 |

REC |

MASSMUTUAL ASCEND LIFE INSURANCE COMPANY |

TMCV #1 LLC |

| 31803-2023 |

04/30/2023 |

05/18/2023 |

A D TR |

TMCV #1 LLC BY (ET AL) |

GREAT AMERICAN LIFE INSURANCE COMPANY |

| 194883-2021 |

11/03/2021 |

11/19/2021 |

RES COV |

TRAVERSE MOUNTAIN COMMERCIAL VENTURE LLC |

R E PLUS 1300WTP LLC |

| 172217-2021 |

10/05/2021 |

10/07/2021 |

SUB TEE |

WCN/GAN PARTNERS LTD |

ROMERO, JEROME SUCTEE |

| 50060-2018 |

04/02/2018 |

05/30/2018 |

AS |

EXXON MOBIL CORPORATION (ET AL) |

XTO ENERGY INC |

| 6372-2018 |

01/19/2018 |

01/19/2018 |

PERREPD |

BIRDSLEY, GALEN & LEXIA DENAE OLSEN PERREP (ET AL) |

GENESIS AGGREGATES B LLC |

| 6371-2018 |

01/19/2018 |

01/19/2018 |

MNRL D |

GILLMOR HOLDINGS LLC |

GENESIS AGGREGATES G LLC |

| 129074-2017 |

12/20/2017 |

12/27/2017 |

PERREPD |

GILLMOR, JAMES S PERREP (ET AL) |

GENESIS AGGREGATES B LLC (ET AL) |

| 92351-2016 |

09/20/2016 |

09/21/2016 |

AGR R |

PERRY HOMES UTAH INC (ET AL) |

TRAVERSE MOUNTAIN COMMERCIAL VENTURE LLC |

| 90962-2015 |

10/01/2015 |

10/05/2015 |

ADECCOV |

TMCV #1 LLC BY (ET AL) |

WHOM OF INTEREST |

| 9207-2015 |

02/04/2015 |

02/05/2015 |

EAS |

TRAVERSE MOUNTAIN COMMERCIAL VENTURE LLC |

LEHI CITY |

| 17244-2014 |

03/05/2014 |

03/14/2014 |

REC |

WELLS FARGO BANK NORTHWEST TEE |

TMCV #1 LLC |

| 17243-2014 |

03/05/2014 |

03/14/2014 |

SUB TEE |

WELLS FARGO BANK |

WELLS FARGO BANK NORTHWEST SUCTEE |

| 12153-2014 |

02/21/2014 |

02/24/2014 |

SUB AGR |

XACTWARE SOLUTIONS INC |

TMCV #1 LLC (ET AL) |

| 12152-2014 |

02/19/2014 |

02/24/2014 |

AS LS |

TMCY #1 LLC BY (ET AL) |

GREAT AMERICAN LIFE INSURANCE COMPANY |

| 12151-2014 |

02/19/2014 |

02/24/2014 |

D TR |

TMCV #1 LLC BY (ET AL) |

GREAT AMERICAN LIFE INSURANCE COMPANY |

| 11505-2014 |

02/19/2014 |

02/20/2014 |

DECLCOV |

TMCY #1 LLC (ET AL) |

WHOM OF INTEREST |

| 76805-2013 |

08/01/2013 |

08/12/2013 |

N |

SMITH HARTVIGSEN PLLC |

WHOM OF INTEREST |

| 112648-2012 |

12/18/2012 |

12/21/2012 |

SUB AGR |

WELLS FARGO BANK |

WELLS FARGO BANK |

| 112647-2012 |

12/19/2012 |

12/21/2012 |

D TR |

TMCV #1 LLC BY (ET AL) |

WELLS FARGO BANK |

| 109407-2012 |

09/25/2012 |

12/12/2012 |

S PLAT |

TRAVERSE MOUNTAIN COMMERCIAL VENTURE LLC (ET AL) |

TRAVERSE MOUNTAIN OFFICE PARK PLAT 1 |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 11/13/2024 1:18:40 AM |