Property Information

mobile view

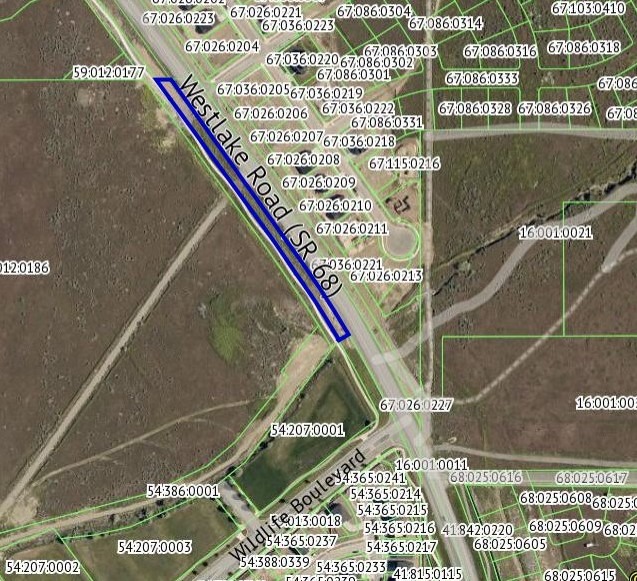

| Serial Number: 59:012:0187 |

Serial Life: 2020... |

|

|

Total Photos: 3

Total Photos: 3

|

| |

|

|

| Property Address: |

|

| Mailing Address: %BAILEY, ED 4492 S ENCLAVE VISTA LN SALT LAKE CITY, UT 84124 |

|

| Acreage: 0.716937 |

|

| Last Document:

135972-2019

|

|

| Subdivision Map Filing |

|

| Taxing Description:

COM N 557.57 FT & W 240.37 FT FR NE COR. SEC. 13, T6S, R1W, SLB&M.; ALONG A CURVE TO L (CHORD BEARS: N 31 DEG 21' 1" W 134.28 FT, RADIUS = 2679.77 FT); ALONG A CURVE TO L (CHORD BEARS: N 33 DEG 31' 38" W .78 FT, RADIUS = 30 FT); N 34 DEG 16' 5" W 231.65 FT; ALONG A CURVE TO L (CHORD BEARS: N 35 DEG 4' 18" W .84 FT, RADIUS = 30 FT); N 35 DEG 52' 31" W 511.27 FT; N 54 DEG 7' 29" E .09 FT; N 35 DEG 52' 31" W 72 FT; S 89 DEG 57' 55" E 44.57 FT; S 35 DEG 20' 34" E 685.03 FT; ALONG A CURVE TO R (CHORD BEARS: S 32 DEG 33' 8" E 242.72 FT, RADIUS = 3152.2 FT); S 59 DEG 35' 37" W 33.04 FT TO BEG. AREA 0.717 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$206,400 |

$0 |

$0 |

$206,400 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$206,400 |

| 2023 |

$224,800 |

$0 |

$0 |

$224,800 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$224,800 |

| 2022 |

$217,800 |

$0 |

$0 |

$217,800 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$217,800 |

| 2021 |

$216,100 |

$0 |

$0 |

$216,100 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$216,100 |

| 2020 |

$216,100 |

$0 |

$0 |

$216,100 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$216,100 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

039 - SARATOGA SPRINGS |

| 2024 |

$1,718.07 |

$0.00 |

$1,718.07 |

$0.00 |

|

$0.00

|

$0.00 |

039 - SARATOGA SPRINGS |

| 2023 |

$1,740.40 |

$0.00 |

$1,740.40 |

$0.00 |

|

$0.00

|

$0.00 |

039 - SARATOGA SPRINGS |

| 2022 |

$1,729.11 |

$0.00 |

$1,729.11 |

$0.00 |

|

$0.00

|

$0.00 |

039 - SARATOGA SPRINGS |

| 2021 |

$2,089.69 |

$0.00 |

$2,089.69 |

$0.00 |

|

$0.00

|

$0.00 |

039 - SARATOGA SPRINGS |

| 2020 |

$2,128.15 |

$0.00 |

$2,128.15 |

$0.00 |

|

$0.00

|

$0.00 |

039 - SARATOGA SPRINGS |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 102817-2021 |

06/02/2021 |

06/03/2021 |

QCD OIL |

THOMPSON, MARY J & JOHN H |

THOMPSON, JOHN HAROLD & MARY LOUISE JACOB TEE (ET AL) |

| 187537-2020 |

11/20/2020 |

11/25/2020 |

PERREPD |

THOMPSON, MARY J PERREP (ET AL) |

THOMPSON, MARY J & JOHN H (ET AL) |

| 186735-2020 |

11/20/2020 |

11/24/2020 |

AF DC |

JACOB, LEAH B DEC |

WHOM OF INTEREST |

| 122509-2020 |

08/13/2020 |

08/18/2020 |

R NI |

CITY OF SARATOGA SPRINGS |

WHOM OF INTEREST |

| 135972-2019 |

04/10/2019 |

12/20/2019 |

S PLAT |

CARDINAL LAND HOLDINGS LLC |

FOX HOLLOW OPEN SPACE 'A2' |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 11/22/2024 6:23:53 AM |