Property Information

mobile view

| Serial Number: 06:061:0010 |

Serial Life: 1980... |

|

|

Total Photos: 15

Total Photos: 15

|

| |

|

|

| Property Address: 356 N MAIN - SPRINGVILLE |

|

| Mailing Address: 286 S MAIN ST MAPLETON, UT 84664-4517 |

|

| Acreage: 0.3 |

|

| Last Document:

0-0

|

|

| Subdivision Map Filing |

|

| Taxing Description:

COM. 41/2 FT N OF SW COR LOT 3, BLK 61, PLAT A, SPV. CITY SURVEY; N 78 FT; E 10 RDS, S 78 FT; W 10 RDS TO BEG. AREA .30 ACRE.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

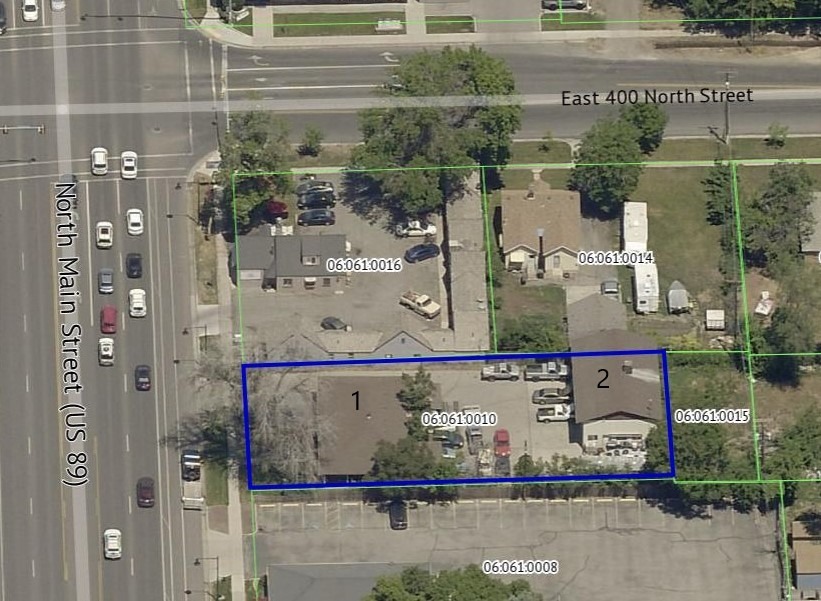

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$265,400 |

$0 |

$0 |

$265,400 |

$175,600 |

$0 |

$0 |

$175,600 |

$0 |

$0 |

$0 |

$441,000 |

| 2023 |

$230,400 |

$0 |

$0 |

$230,400 |

$183,800 |

$0 |

$0 |

$183,800 |

$0 |

$0 |

$0 |

$414,200 |

| 2022 |

$230,400 |

$0 |

$0 |

$230,400 |

$172,700 |

$0 |

$0 |

$172,700 |

$0 |

$0 |

$0 |

$403,100 |

| 2021 |

$199,800 |

$0 |

$0 |

$199,800 |

$134,000 |

$0 |

$0 |

$134,000 |

$0 |

$0 |

$0 |

$333,800 |

| 2020 |

$180,100 |

$0 |

$0 |

$180,100 |

$147,100 |

$0 |

$0 |

$147,100 |

$0 |

$0 |

$0 |

$327,200 |

| 2019 |

$154,500 |

$0 |

$0 |

$154,500 |

$148,100 |

$0 |

$0 |

$148,100 |

$0 |

$0 |

$0 |

$302,600 |

| 2018 |

$147,100 |

$0 |

$0 |

$147,100 |

$138,200 |

$0 |

$0 |

$138,200 |

$0 |

$0 |

$0 |

$285,300 |

| 2017 |

$141,500 |

$0 |

$0 |

$141,500 |

$144,600 |

$0 |

$0 |

$144,600 |

$0 |

$0 |

$0 |

$286,100 |

| 2016 |

$134,900 |

$0 |

$0 |

$134,900 |

$115,700 |

$0 |

$0 |

$115,700 |

$0 |

$0 |

$0 |

$250,600 |

| 2015 |

$130,900 |

$0 |

$0 |

$130,900 |

$115,700 |

$0 |

$0 |

$115,700 |

$0 |

$0 |

$0 |

$246,600 |

| 2014 |

$124,800 |

$0 |

$0 |

$124,800 |

$115,700 |

$0 |

$0 |

$115,700 |

$0 |

$0 |

$0 |

$240,500 |

| 2013 |

$116,600 |

$0 |

$0 |

$116,600 |

$115,700 |

$0 |

$0 |

$115,700 |

$0 |

$0 |

$0 |

$232,300 |

| 2012 |

$116,600 |

$0 |

$0 |

$116,600 |

$115,700 |

$0 |

$0 |

$115,700 |

$0 |

$0 |

$0 |

$232,300 |

| 2011 |

$116,600 |

$0 |

$0 |

$116,600 |

$115,700 |

$0 |

$0 |

$115,700 |

$0 |

$0 |

$0 |

$232,300 |

| 2010 |

$128,086 |

$0 |

$0 |

$128,086 |

$124,620 |

$0 |

$0 |

$124,620 |

$0 |

$0 |

$0 |

$252,706 |

| 2009 |

$130,700 |

$0 |

$0 |

$130,700 |

$134,000 |

$0 |

$0 |

$134,000 |

$0 |

$0 |

$0 |

$264,700 |

| 2008 |

$130,700 |

$0 |

$0 |

$130,700 |

$134,000 |

$0 |

$0 |

$134,000 |

$0 |

$0 |

$0 |

$264,700 |

| 2007 |

$71,500 |

$55,700 |

$0 |

$127,200 |

$58,400 |

$74,000 |

$0 |

$132,400 |

$0 |

$0 |

$0 |

$259,600 |

| 2006 |

$62,136 |

$48,400 |

$0 |

$110,536 |

$53,101 |

$67,300 |

$0 |

$120,401 |

$0 |

$0 |

$0 |

$230,937 |

| 2005 |

$62,136 |

$46,972 |

$0 |

$109,108 |

$53,101 |

$65,317 |

$0 |

$118,418 |

$0 |

$0 |

$0 |

$227,526 |

| 2004 |

$62,136 |

$46,972 |

$0 |

$109,108 |

$53,101 |

$65,317 |

$0 |

$118,418 |

$0 |

$0 |

$0 |

$227,526 |

| 2003 |

$62,136 |

$46,972 |

$0 |

$109,108 |

$53,101 |

$65,317 |

$0 |

$118,418 |

$0 |

$0 |

$0 |

$227,526 |

| 2002 |

$62,136 |

$46,972 |

$0 |

$109,108 |

$53,101 |

$65,317 |

$0 |

$118,418 |

$0 |

$0 |

$0 |

$227,526 |

| 2001 |

$53,290 |

$52,191 |

$0 |

$105,481 |

$45,541 |

$65,317 |

$0 |

$110,858 |

$0 |

$0 |

$0 |

$216,339 |

| 2000 |

$49,804 |

$48,777 |

$0 |

$98,581 |

$45,541 |

$56,817 |

$0 |

$102,358 |

$0 |

$0 |

$0 |

$200,939 |

| 1999 |

$49,804 |

$48,777 |

$0 |

$98,581 |

$45,541 |

$56,817 |

$0 |

$102,358 |

$0 |

$0 |

$0 |

$200,939 |

| 1998 |

$47,888 |

$48,777 |

$0 |

$96,665 |

$43,789 |

$56,817 |

$0 |

$100,606 |

$0 |

$0 |

$0 |

$197,271 |

| 1997 |

$40,583 |

$48,777 |

$0 |

$89,360 |

$37,109 |

$56,817 |

$0 |

$93,926 |

$0 |

$0 |

$0 |

$183,286 |

| 1996 |

$40,583 |

$36,526 |

$0 |

$77,109 |

$37,109 |

$42,547 |

$0 |

$79,656 |

$0 |

$0 |

$0 |

$156,765 |

| 1995 |

$40,583 |

$33,205 |

$0 |

$73,788 |

$37,109 |

$42,547 |

$0 |

$79,656 |

$0 |

$0 |

$0 |

$153,444 |

| 1994 |

$23,733 |

$19,418 |

$0 |

$43,151 |

$37,109 |

$34,312 |

$0 |

$71,421 |

$0 |

$0 |

$0 |

$114,572 |

| 1993 |

$23,733 |

$19,418 |

$0 |

$43,151 |

$37,109 |

$34,312 |

$0 |

$71,421 |

$0 |

$0 |

$0 |

$114,572 |

| 1992 |

$21,773 |

$17,815 |

$0 |

$39,588 |

$34,045 |

$31,479 |

$0 |

$65,524 |

$0 |

$0 |

$0 |

$105,112 |

| 1991 |

$19,099 |

$15,627 |

$0 |

$34,726 |

$34,045 |

$27,613 |

$0 |

$61,658 |

$0 |

$0 |

$0 |

$96,384 |

| 1990 |

$19,099 |

$15,627 |

$0 |

$34,726 |

$34,045 |

$27,613 |

$0 |

$61,658 |

$0 |

$0 |

$0 |

$96,384 |

| 1989 |

$0 |

$34,726 |

$0 |

$34,726 |

$0 |

$27,613 |

$0 |

$27,613 |

$0 |

$0 |

$0 |

$62,339 |

| 1988 |

$0 |

$34,727 |

$0 |

$34,727 |

$0 |

$27,613 |

$0 |

$27,613 |

$0 |

$0 |

$0 |

$62,340 |

| 1987 |

$0 |

$35,800 |

$0 |

$35,800 |

$0 |

$28,467 |

$0 |

$28,467 |

$0 |

$0 |

$0 |

$64,267 |

| 1986 |

$0 |

$35,801 |

$0 |

$35,801 |

$0 |

$28,467 |

$0 |

$28,467 |

$0 |

$0 |

$0 |

$64,268 |

| 1985 |

$0 |

$35,800 |

$0 |

$35,800 |

$0 |

$28,467 |

$0 |

$28,467 |

$0 |

$0 |

$0 |

$64,267 |

| 1984 |

$0 |

$36,158 |

$0 |

$36,158 |

$0 |

$28,750 |

$0 |

$28,750 |

$0 |

$0 |

$0 |

$64,908 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2024 |

$4,304.60 |

$0.00 |

$4,304.60 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2023 |

$4,038.86 |

$0.00 |

$4,038.86 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2022 |

$4,002.38 |

$0.00 |

$4,002.38 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2021 |

$3,871.41 |

$0.00 |

$3,871.41 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2020 |

$3,914.29 |

$0.00 |

$3,914.29 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2019 |

$3,555.85 |

$0.00 |

$3,555.85 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2018 |

$3,514.04 |

$0.00 |

$3,514.04 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2017 |

$3,648.92 |

$0.00 |

$3,648.92 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2016 |

$3,260.06 |

$0.00 |

$3,260.06 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2015 |

$3,137.99 |

$0.00 |

$3,137.99 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2014 |

$3,080.32 |

$0.00 |

$3,080.32 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2013 |

$3,110.50 |

$0.00 |

$3,110.50 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2012 |

$3,155.56 |

$0.00 |

$3,155.56 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2011 |

$3,078.21 |

$0.00 |

$3,078.21 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2010 |

$3,310.70 |

$0.00 |

$3,310.70 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2009 |

$3,134.58 |

$0.00 |

$3,134.58 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2008 |

$2,899.52 |

$0.00 |

$2,899.52 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2007 |

$2,184.81 |

$0.00 |

$2,184.81 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2006 |

$2,171.86 |

$0.00 |

$2,171.86 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2005 |

$2,283.07 |

$0.00 |

$2,283.07 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2004 |

$2,278.12 |

$0.00 |

$2,278.12 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2003 |

$2,064.48 |

$0.00 |

$2,064.48 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2002 |

$2,016.69 |

$0.00 |

$2,016.69 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2001 |

$1,906.60 |

$0.00 |

$1,906.60 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2000 |

$1,769.10 |

$0.00 |

$1,769.10 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1999 |

$1,682.11 |

$0.00 |

$1,682.11 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1998 |

$1,605.95 |

$0.00 |

$1,605.95 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1997 |

$1,618.90 |

$0.00 |

$1,618.90 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1996 |

$1,426.80 |

$0.00 |

$1,426.80 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1995 |

$1,397.30 |

$0.00 |

$1,397.30 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1994 |

$1,409.74 |

$0.00 |

$1,409.74 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1993 |

$1,252.78 |

$0.00 |

$1,252.78 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1992 |

$1,123.63 |

$0.00 |

$1,123.63 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1991 |

$1,020.13 |

$0.00 |

$1,020.13 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1990 |

$964.93 |

$0.00 |

$964.93 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1989 |

$540.53 |

$0.00 |

$540.53 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1988 |

$537.68 |

$0.00 |

$537.68 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1987 |

$562.20 |

$0.00 |

$562.20 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1986 |

$538.37 |

$0.00 |

$538.37 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1985 |

$521.79 |

$0.00 |

$521.79 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 1984 |

$515.55 |

$0.00 |

$515.55 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 15420-2023 |

03/13/2023 |

03/13/2023 |

REC |

FIRST AMERICAN TITLE INSURANCE COMPANY TEE |

SHEPHERD, MITCHEL KAIMI BENNETT & TAEYLAR NANCY-TRACY |

| 15281-2023 |

03/13/2023 |

03/13/2023 |

RSUBTEE |

WELLS FARGO BANK (ET AL) |

PERRY, RONALD D & MARY B (ET AL) |

| 4804-2023 |

01/26/2023 |

01/26/2023 |

WD |

PERRY, RONALD D |

R&M PERRY LLC |

| 4803-2023 |

01/26/2023 |

01/26/2023 |

AF DC |

PERRY, MARY BETH & MARY BETH LARSEN AKA |

WHOM OF INTEREST |

| 140580-2005 |

11/25/2005 |

12/06/2005 |

REC |

WELLS FARGO BANK NORTHWEST SUBTEE |

PERRY, RONALD D & MARY BETH |

| 140579-2005 |

11/25/2005 |

12/06/2005 |

SUB TEE |

WELLS FARGO BANK |

WELLS FARGO BANK NORTHWEST SUBTEE |

| 130804-2005 |

10/28/2005 |

11/15/2005 |

D TR |

PERRY, RONALD D & MARY BETH |

WELLS FARGO BANK |

| 12502-2002 |

01/04/2002 |

02/01/2002 |

REC |

WELLS FARGO FINANCIAL NATIONAL BANK TEE |

PERRY, RONALD D & MARY BETH |

| 12501-2002 |

01/04/2002 |

02/01/2002 |

SUB TEE |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC |

WELLS FARGO FINANCIAL NATIONAL BANK SUCTEE |

| 83823-1997 |

10/10/1997 |

10/24/1997 |

REC |

PRO-TITLE AND ESCROW INC TEE |

PERRY, RONALD D & MARY BETH |

| 83822-1997 |

06/23/1997 |

10/24/1997 |

SUB TEE |

FEDERAL NATIONAL MORTGAGE ASSOCIATION BY (ET AL) |

PRO-TITLE AND ESCROW INC SUBTEE |

| 29677-1997 |

03/25/1997 |

04/21/1997 |

SUB AGR |

FIRST SECURITY BANK OF UTAH |

FIRST SECURITY BANK OF UTAH |

| 23526-1997 |

03/25/1997 |

03/31/1997 |

SUB AGR |

FIRST SECURITY BANK OF UTAH |

FIRST SECURITY BANK OF UTAH |

| 23525-1997 |

03/26/1997 |

03/31/1997 |

D TR |

PERRY, RONALD D & MARY BETH |

FIRST SECURITY BANK |

| 8631-1996 |

01/30/1996 |

02/01/1996 |

REC |

PROVO LAND TITLE COMPANY TEE |

PERRY, RONALD D & MARY BETH |

| 5206-1996 |

01/19/1996 |

01/22/1996 |

REC |

PROVO ABSTRACT COMPANY TEE |

PERRY, RONALD D & MARY BETH |

| 4679-1996 |

01/08/1996 |

01/18/1996 |

RC |

FIRST SECURITY BANK OF UTAH |

WHOM OF INTEREST |

| 4678-1996 |

01/08/1996 |

01/18/1996 |

TR D |

PERRY, RONALD D & MARY BETH |

FIRST SECURITY BANK OF UTAH |

| 13244-1989 |

05/05/1989 |

05/12/1989 |

TR D |

PERRY, RONALD D & MARY BETH |

FIRST SECURITY BANK OF UTAH |

| 7205-1986 |

12/11/1985 |

03/12/1986 |

TR D |

PERRY, RONALD D & MARY BETH |

FIRST SECURITY BANK OF UTAH |

| 4722-1986 |

02/14/1986 |

02/18/1986 |

RC |

FIRST SECURITY BANK OF UTAH |

WHOM OF INTEREST |

| 37152-1985 |

12/11/1985 |

12/18/1985 |

TR D |

PERRY, RONALD D & MARY BETH |

FIRST SECURITY BANK OF UTAH |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 12/11/2024 7:29:37 AM |