Property Information

mobile view

| Serial Number: 08:151:0007 |

Serial Life: 1981... |

|

|

Total Photos: 15

Total Photos: 15

|

| |

|

|

| Property Address: 45 S 800 EAST - PAYSON |

|

| Mailing Address: 156 N 400 E PAYSON, UT 84651-1837 |

|

| Acreage: 0.86 |

|

| Last Document:

30455-1984

|

|

| Subdivision Map Filing |

|

| Taxing Description:

COM AT SW COR LOT 3, BLK 23, PLAT Q, PAYSON CITY SUR; N 82.5 FT; E 90 FT; N 132 FT; E 141 FT; S 214.5 FT; W 231 FT TO BEG.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

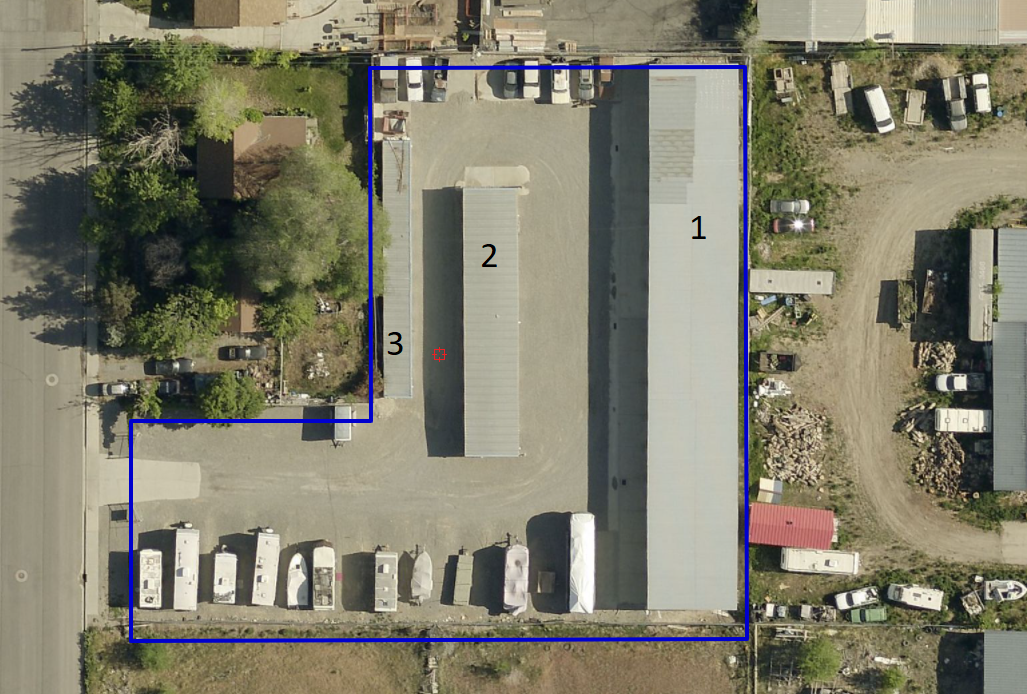

- Aerial Image

| 2005... |

|

CARTER, JULL H |

|

| 2005... |

|

CARTER, LYN W |

|

| 2000-2004 |

|

ZEEMAN, BETH LZRUE (SIC) |

|

| 2000-2004 |

|

ZEEMAN, CHARLES LEROY |

|

| 1995-1999 |

|

ZEEMAN, BETH LA RUE |

|

| 1995-1999 |

|

ZEEMAN, CHARLES LE ROY |

|

| 1989-1994 |

|

ZEEMAN, BETH |

|

| 1989-1994 |

|

ZEEMAN, CHARLES L |

|

| 1985-1988 |

|

CENTRAL BANK & TRUST |

|

| 1984 |

|

GAY, BRYANT L |

|

| 1984 |

|

GAY, ELAINE |

|

| 1983 |

|

HASKELL, DARWIN L |

|

| 1983 |

|

HASKELL, NORA S |

|

| 1981-1982 |

|

HASKELL, DARWIN L |

|

| 1981-1982 |

|

HASKELL, NORA S |

|

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$297,000 |

$0 |

$0 |

$297,000 |

$237,500 |

$0 |

$0 |

$237,500 |

$0 |

$0 |

$0 |

$534,500 |

| 2023 |

$294,900 |

$0 |

$0 |

$294,900 |

$226,700 |

$0 |

$0 |

$226,700 |

$0 |

$0 |

$0 |

$521,600 |

| 2022 |

$284,500 |

$0 |

$0 |

$284,500 |

$262,600 |

$0 |

$0 |

$262,600 |

$0 |

$0 |

$0 |

$547,100 |

| 2021 |

$259,800 |

$0 |

$0 |

$259,800 |

$261,100 |

$0 |

$0 |

$261,100 |

$0 |

$0 |

$0 |

$520,900 |

| 2020 |

$298,200 |

$0 |

$0 |

$298,200 |

$207,500 |

$0 |

$0 |

$207,500 |

$0 |

$0 |

$0 |

$505,700 |

| 2019 |

$246,900 |

$0 |

$0 |

$246,900 |

$207,500 |

$0 |

$0 |

$207,500 |

$0 |

$0 |

$0 |

$454,400 |

| 2018 |

$237,500 |

$0 |

$0 |

$237,500 |

$198,300 |

$0 |

$0 |

$198,300 |

$0 |

$0 |

$0 |

$435,800 |

| 2017 |

$228,500 |

$0 |

$0 |

$228,500 |

$198,400 |

$0 |

$0 |

$198,400 |

$0 |

$0 |

$0 |

$426,900 |

| 2016 |

$217,700 |

$0 |

$0 |

$217,700 |

$201,100 |

$0 |

$0 |

$201,100 |

$0 |

$0 |

$0 |

$418,800 |

| 2015 |

$210,500 |

$0 |

$0 |

$210,500 |

$174,900 |

$0 |

$0 |

$174,900 |

$0 |

$0 |

$0 |

$385,400 |

| 2014 |

$204,500 |

$0 |

$0 |

$204,500 |

$152,100 |

$0 |

$0 |

$152,100 |

$0 |

$0 |

$0 |

$356,600 |

| 2013 |

$194,800 |

$0 |

$0 |

$194,800 |

$152,100 |

$0 |

$0 |

$152,100 |

$0 |

$0 |

$0 |

$346,900 |

| 2012 |

$194,800 |

$0 |

$0 |

$194,800 |

$152,100 |

$0 |

$0 |

$152,100 |

$0 |

$0 |

$0 |

$346,900 |

| 2011 |

$194,800 |

$0 |

$0 |

$194,800 |

$152,100 |

$0 |

$0 |

$152,100 |

$0 |

$0 |

$0 |

$346,900 |

| 2010 |

$53,300 |

$0 |

$0 |

$53,300 |

$246,800 |

$0 |

$0 |

$246,800 |

$0 |

$0 |

$0 |

$300,100 |

| 2009 |

$53,300 |

$0 |

$0 |

$53,300 |

$246,800 |

$0 |

$0 |

$246,800 |

$0 |

$0 |

$0 |

$300,100 |

| 2008 |

$53,300 |

$0 |

$0 |

$53,300 |

$246,800 |

$0 |

$0 |

$246,800 |

$0 |

$0 |

$0 |

$300,100 |

| 2007 |

$50,800 |

$0 |

$0 |

$50,800 |

$235,000 |

$0 |

$0 |

$235,000 |

$0 |

$0 |

$0 |

$285,800 |

| 2006 |

$42,293 |

$0 |

$0 |

$42,293 |

$213,628 |

$0 |

$0 |

$213,628 |

$0 |

$0 |

$0 |

$255,921 |

| 2005 |

$42,293 |

$0 |

$0 |

$42,293 |

$213,628 |

$0 |

$0 |

$213,628 |

$0 |

$0 |

$0 |

$255,921 |

| 2004 |

$42,293 |

$0 |

$0 |

$42,293 |

$213,628 |

$0 |

$0 |

$213,628 |

$0 |

$0 |

$0 |

$255,921 |

| 2003 |

$42,293 |

$0 |

$0 |

$42,293 |

$213,628 |

$0 |

$0 |

$213,628 |

$0 |

$0 |

$0 |

$255,921 |

| 2002 |

$42,293 |

$0 |

$0 |

$42,293 |

$213,628 |

$0 |

$0 |

$213,628 |

$0 |

$0 |

$0 |

$255,921 |

| 2001 |

$36,272 |

$0 |

$0 |

$36,272 |

$176,850 |

$0 |

$0 |

$176,850 |

$0 |

$0 |

$0 |

$213,122 |

| 2000 |

$33,899 |

$0 |

$0 |

$33,899 |

$176,850 |

$0 |

$0 |

$176,850 |

$0 |

$0 |

$0 |

$210,749 |

| 1999 |

$33,899 |

$0 |

$0 |

$33,899 |

$112,320 |

$0 |

$0 |

$112,320 |

$0 |

$0 |

$0 |

$146,219 |

| 1998 |

$32,595 |

$0 |

$0 |

$32,595 |

$95,259 |

$0 |

$0 |

$95,259 |

$0 |

$0 |

$0 |

$127,854 |

| 1997 |

$27,623 |

$0 |

$0 |

$27,623 |

$80,728 |

$0 |

$0 |

$80,728 |

$0 |

$0 |

$0 |

$108,351 |

| 1996 |

$27,623 |

$0 |

$0 |

$27,623 |

$80,728 |

$0 |

$0 |

$80,728 |

$0 |

$0 |

$0 |

$108,351 |

| 1995 |

$27,623 |

$0 |

$0 |

$27,623 |

$80,728 |

$0 |

$0 |

$80,728 |

$0 |

$0 |

$0 |

$108,351 |

| 1994 |

$16,154 |

$0 |

$0 |

$16,154 |

$80,728 |

$0 |

$0 |

$80,728 |

$0 |

$0 |

$0 |

$96,882 |

| 1993 |

$16,154 |

$0 |

$0 |

$16,154 |

$52,728 |

$0 |

$0 |

$52,728 |

$0 |

$0 |

$0 |

$68,882 |

| 1992 |

$14,820 |

$0 |

$0 |

$14,820 |

$48,374 |

$0 |

$0 |

$48,374 |

$0 |

$0 |

$0 |

$63,194 |

| 1991 |

$13,000 |

$0 |

$0 |

$13,000 |

$48,374 |

$0 |

$0 |

$48,374 |

$0 |

$0 |

$0 |

$61,374 |

| 1990 |

$13,000 |

$0 |

$0 |

$13,000 |

$48,374 |

$0 |

$0 |

$48,374 |

$0 |

$0 |

$0 |

$61,374 |

| 1989 |

$0 |

$0 |

$13,000 |

$13,000 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$13,000 |

| 1988 |

$0 |

$0 |

$13,000 |

$13,000 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$13,000 |

| 1987 |

$0 |

$0 |

$13,000 |

$13,000 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$13,000 |

| 1986 |

$0 |

$0 |

$17,956 |

$17,956 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$17,956 |

| 1985 |

$0 |

$0 |

$17,956 |

$17,956 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$17,956 |

| 1984 |

$0 |

$0 |

$18,138 |

$18,138 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$18,138 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2024 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2023 |

$5,111.16 |

$0.00 |

$5,111.16 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2022 |

$5,450.76 |

$0.00 |

$5,450.76 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2021 |

$5,883.04 |

$0.00 |

$5,883.04 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2020 |

$5,837.80 |

$0.00 |

$5,837.80 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2019 |

$5,116.54 |

$0.00 |

$5,116.54 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2018 |

$5,091.45 |

$0.00 |

$5,091.45 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2017 |

$5,100.17 |

$0.00 |

$5,100.17 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2016 |

$5,036.49 |

$0.00 |

$5,036.49 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2015 |

$4,666.81 |

$0.00 |

$4,666.81 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2014 |

$4,287.05 |

$0.00 |

$4,287.05 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2013 |

$4,365.39 |

$0.00 |

$4,365.39 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2012 |

$4,431.30 |

$0.00 |

$4,431.30 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2011 |

$4,326.19 |

$0.00 |

$4,326.19 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2010 |

$3,649.22 |

$0.00 |

$3,649.22 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2009 |

$3,456.25 |

$0.00 |

$3,456.25 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2008 |

$3,214.97 |

$0.00 |

$3,214.97 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2007 |

$3,036.91 |

$0.00 |

$3,036.91 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2006 |

$3,021.66 |

$0.00 |

$3,021.66 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2005 |

$3,216.67 |

$0.00 |

$3,216.67 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2004 |

$3,225.63 |

$0.00 |

$3,225.63 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2003 |

$2,927.74 |

$0.00 |

$2,927.74 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2002 |

$2,857.61 |

$0.00 |

$2,857.61 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2001 |

$2,423.84 |

$0.00 |

$2,423.84 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2000 |

$2,371.14 |

$0.00 |

$2,371.14 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1999 |

$1,561.77 |

$0.00 |

$1,561.77 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1998 |

$1,331.86 |

$0.00 |

$1,331.86 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1997 |

$1,244.95 |

$0.00 |

$1,244.95 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1996 |

$1,226.42 |

$0.00 |

$1,226.42 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1995 |

$1,225.77 |

$0.00 |

$1,225.77 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1994 |

$1,363.32 |

$0.00 |

$1,363.32 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1993 |

$849.12 |

$0.00 |

$849.12 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1992 |

$763.39 |

$0.00 |

$763.39 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1991 |

$780.47 |

$0.00 |

$780.47 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1990 |

$731.92 |

$0.00 |

$731.92 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1989 |

$155.84 |

$0.00 |

$155.84 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1988 |

$155.84 |

$0.00 |

$155.84 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1987 |

$156.29 |

$0.00 |

$156.29 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1986 |

$204.43 |

$0.00 |

$204.43 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1985 |

$199.01 |

$0.00 |

$199.01 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 1984 |

$188.05 |

$0.00 |

$188.05 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 3187-2015 |

12/04/2014 |

01/14/2015 |

QCD |

UNITED STATES OF AMERICA |

SOUTH UTAH VALLEY ELECTRIC SERVICE DISTRICT |

| 114949-2008 |

10/20/2008 |

10/22/2008 |

CT |

STATE OF UTAH |

WHOM OF INTEREST |

| 107508-2008 |

09/30/2008 |

09/30/2008 |

RESOL |

BOARD OF COUNTY COMMISSIONERS UTAH COUNTY |

WHOM OF INTEREST |

| 150993-2005 |

12/29/2005 |

12/29/2005 |

REC |

ZIONS FIRST NATIONAL BANK TEE |

ZEEMAN, CHARLES L & BETH L |

| 144382-2005 |

10/03/2005 |

12/14/2005 |

D TR |

ZEEMAN, CHARLES L & BETH L |

ZIONS FIRST NATIONAL BANK |

| 133418-2004 |

11/10/2004 |

11/26/2004 |

REC |

RIVERS, ROD TEE |

ZEEMAN, CHARLES LEROY & BETH LARUE TEE |

| 133417-2004 |

10/19/2004 |

11/26/2004 |

SUB TEE |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC |

RIVERS, ROD SUCTEE |

| 131820-2004 |

11/22/2004 |

11/22/2004 |

CORR AF |

WASATCH LAND & TITLE INSURANCE AGENCY INC (ET AL) |

WHOM OF INTEREST |

| 124650-2004 |

09/17/2004 |

11/03/2004 |

REC |

RIVERS, ROD TEE |

ZEEMAN, CHARLES L & BETH L |

| 124649-2004 |

08/12/2004 |

11/03/2004 |

SUB TEE |

GMAC MORTGAGE CORP |

ZEEMAN, CHARLES L & BETH L |

| 113760-2004 |

09/30/2004 |

10/05/2004 |

WD |

ZEEMAN, CHARLES LEROY & BETH LARUE TEE (ET AL) |

CARTER, LYNN W & JILL H |

| 92942-2004 |

07/23/2004 |

08/12/2004 |

D TR |

ZEEMAN, CHARLES LEROY & BETH LARUE |

GMAC MORTGAGE CORPORATION |

| 107149-1999 |

09/13/1999 |

10/01/1999 |

P REC |

UNITED TITLE SERVICES OF UTAH INC FKA (ET AL) |

ZEEMAN, CHARLES L & BETH L |

| 66470-1999 |

05/28/1999 |

06/04/1999 |

QCD |

ZEEMAN, CHARLES L & BETH L |

ZEEMAN, CHARLES LEROY & BETH LZRUE (SIC) TEE |

| 66469-1999 |

05/28/1999 |

06/04/1999 |

D TR |

ZEEMAN, CHARLES L & BETH L |

NEW AMERICA FINANCIAL INC |

| 66468-1999 |

05/28/1999 |

06/04/1999 |

QCD |

ZEEMAN, CHARLES LE ROY & BETH LA RUE TEE (ET AL) |

ZEEMAN, CHARLES L & BETH L |

| 73738-1994 |

08/10/1994 |

09/19/1994 |

REC |

ZIONS FIRST NATIONAL BANK TEE |

ZEEMAN, CHARLES L & BETH |

| 24535-1994 |

10/07/1993 |

03/24/1994 |

QCD |

ZEEMAN, CHARLES L & BETH (ET AL) |

ZEEMAN, CHARLES LE ROY & BETH LA RUE TEE |

| 24316-1993 |

04/20/1993 |

04/23/1993 |

D TR |

ZEEMAN, CHARLES L & BETH |

ZIONS FIRST NATIONAL BANK |

| 58518-1992 |

10/19/1992 |

10/30/1992 |

REC |

CENTRAL BANK & TRUST COMPANY TEE |

ZEEMAN, CHARLES L & BETH L |

| 29182-1989 |

08/15/1989 |

09/28/1989 |

D TR |

ZEEMAN, CHARLES L & BETH L |

CENTRAL BANK & TRUST COMPANY |

| 36281-1988 |

12/01/1988 |

12/01/1988 |

SP WD |

CENTRAL BANK & TRUST COMPANY |

ZEEMAN, CHARLES L & BETH |

| 30455-1984 |

06/14/1984 |

10/15/1984 |

QCD |

GAY, BRYANT L & ELAINE TEE |

CENTRAL BANK & TRUST COMPANY |

| 11081-1983 |

03/23/1983 |

04/18/1983 |

WD |

HASKELL, DARWIN L & NORA S |

GAY, BRYANT L & ELAINE TEE |

| 12989-1982 |

04/26/1982 |

05/25/1982 |

REAS CN |

GAY, DENNIS W & SHERRY D TEE |

HASKELL, DARWIN L & NORA S |

| 22984-1981 |

04/13/1981 |

08/10/1981 |

AS CN |

GAY, SHERRY D & DENNIS W TEE |

CENTRAL BANK & TRUST COMPANY |

| 10840-1981 |

04/13/1981 |

04/15/1981 |

AS CN |

GAY, SHERRY D TEE |

WHOM OF INTEREST |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 9/17/2024 3:59:23 AM |