Property Valuation Information

- Serial Number : 080050006

- Tax Year : 2025

- Owner Names : SCADDEN, CHRISTOPHER J & MARIAN

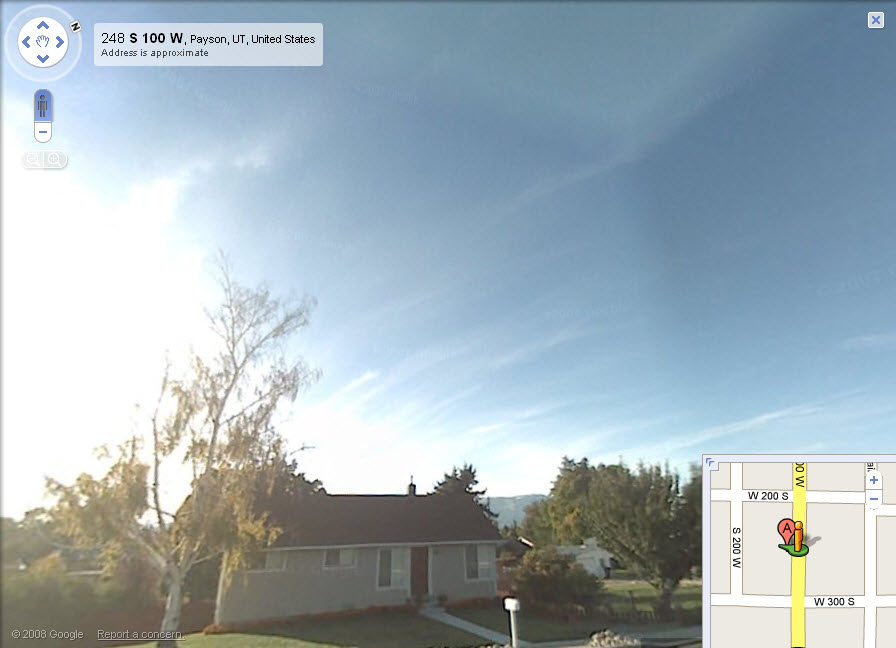

- Property Address : 250 S 100 WEST - PAYSON

- Tax District : 170 - PAYSON CITY

- Acreage : 0.25

- Property Classification : RP - RES PRIMARY

- Legal Description : COM. 1 FT W OF NE COR OF LOT 4, BLK 7, PLAT A, PAYSON CITY SURVEY; W 158.375 FT; S 69.0 FT; E 158.375 FT; N 69.0 FT TO BEG. (IN SEC 8 & 17, T 9 S, R 2 E, SLB&M.)

| Property Types: | 2024 Market Value |

2025 Market Value |

|||||||

| Primary Residential | $303,100 |

$303,100 |

|||||||

| Total Property Market Value | $303,100 | $303,100 | |||||||