Property Valuation Information

- Serial Number : 081230016

- Tax Year : 2025

- Owner Names : GRIFFIN, ERVA KARLEEN (ET AL)

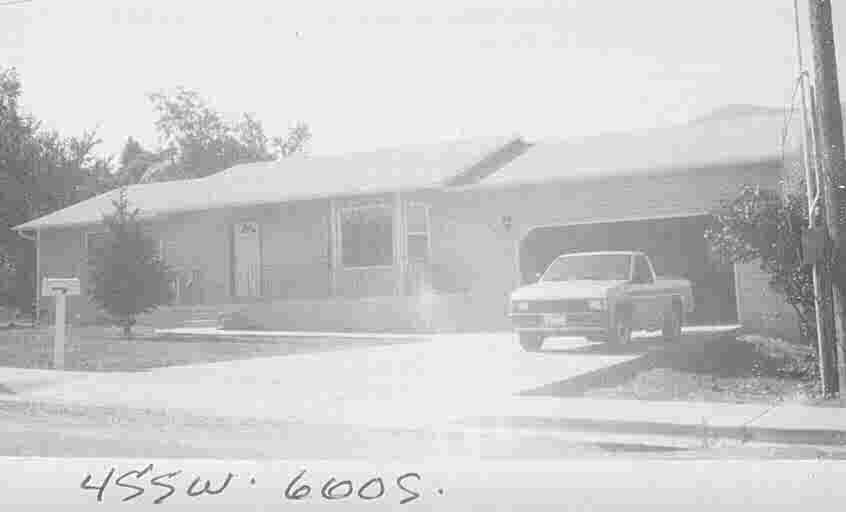

- Property Address : 455 W 600 SOUTH - PAYSON

- Tax District : 170 - PAYSON CITY

- Acreage : 0.209912

- Property Classification : RP - RES PRIMARY

- Legal Description : COM AT NE COR. LOT 6, BLK. 13, PLAT P, PAYSON CITY SURVEY; W 95 FT; S 96.25 FT; E 95 FT; N 96.25 FT TO BEG. AREA 0.210 AC.

| Property Types: | 2024 Market Value |

2025 Market Value |

|||||||

| Primary Residential | $352,700 |

$352,700 |

|||||||

| Total Property Market Value | $352,700 | $352,700 | |||||||