Property Valuation Information

- Serial Number : 230120050

- Tax Year : 2024

- Owner Names : RUIZ, GRACIELA (ET AL)

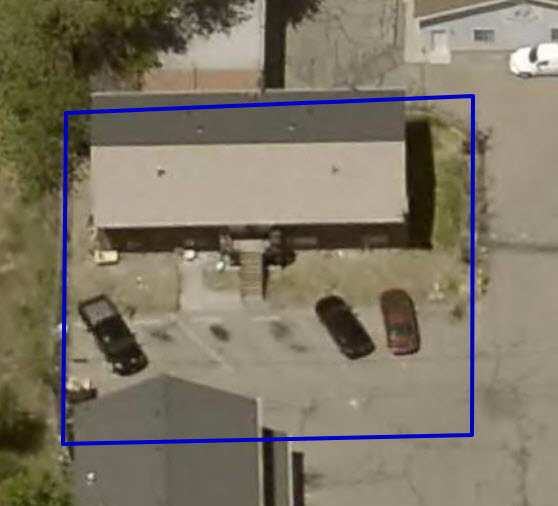

- Property Address : 709 N MAIN ST - SPRINGVILLE

- Tax District : 130 - SPRINGVILLE CITY

- Acreage : 0.15

- Property Classification : JF - APARTMENT 4-PLEX

- Legal Description : COM N 958.86 FT & E 1680.57 FT FR SW COR SEC 28, T7S, R3E, SLM; S 3 DEG 11'33"W 80 FT; N 86 DEG 57'38"W 87 FT; N 3 DEG 11'33"E 80 FT; S 86 DEG 57'38"E 87 FT TO BEG. AREA .15 ACRE.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Primary Residential | $721,100 |

$728,300 |

|||||||

| Total Property Market Value | $721,100 | $728,300 | |||||||