Property Valuation Information

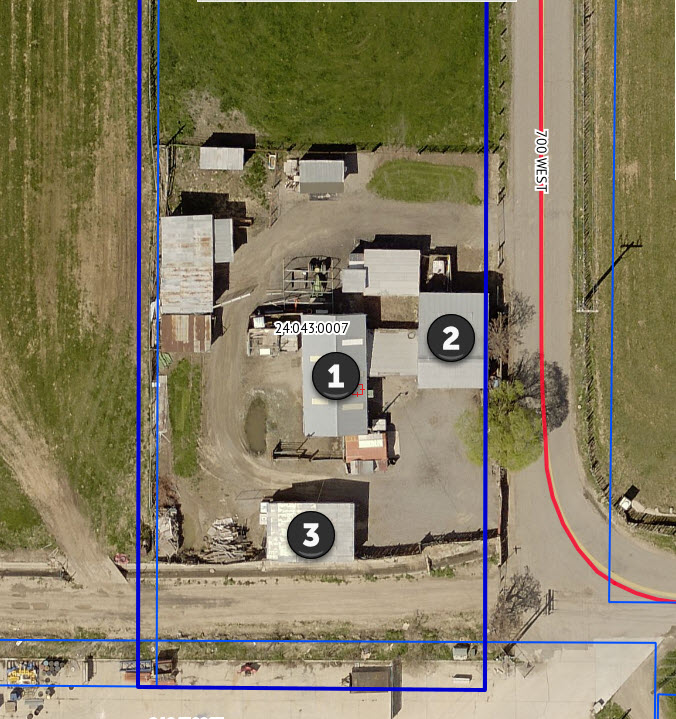

- Serial Number : 240430007

- Tax Year : 2024

- Owner Names : GLH INDUSTRIAL LLC

- Property Address : 5350 S 500 WEST - SPANISH FORK

- Tax District : 150 - SPANISH FORK CITY

- Acreage : 3.34

- Property Classification : CAG - COMM + AG IMP

- Legal Description : COM N 146.78 FT. AND E 2128.53 FT FROM W 1/4 COR. SEC. 12, T8S, R2E. SLB&M; S 0 16' W 1118.79 FT. N 89 27' W 130 FT N 0 16' E 1119.6 FT; S 89 04' E 130 FT TO BEG. AREA 3.34 ACRES.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Non-Primary Residential | $867,600 |

$927,500 |

|||||||

| Total Property Market Value | $867,600 | $927,500 | |||||||