Property Valuation Information

- Serial Number : 240461500

- Tax Year : 2025

- Owner Names : SPANISH FORK FLYING SERVICE (BLDG ONLY)

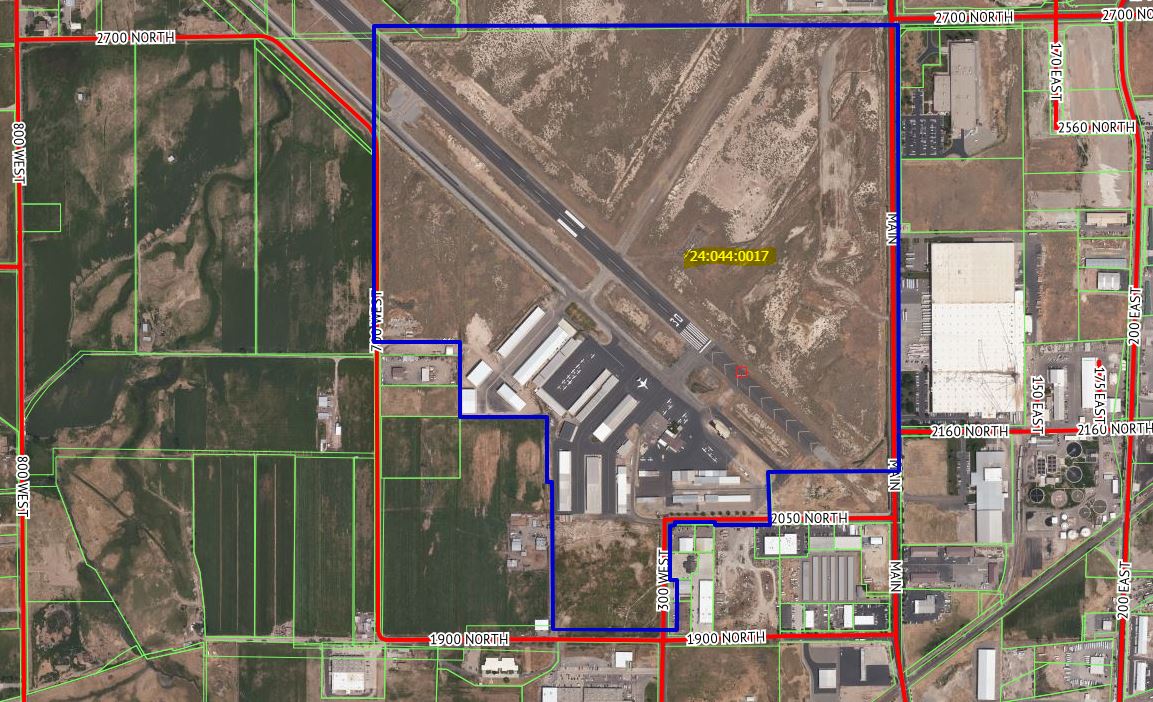

- Property Address : 2070 N 300 WEST - SPANISH FORK

- Tax District : 150 - SPANISH FORK CITY

- Acreage : 0

- Property Classification : CB - COMM-BLDG ONLY

- Legal Description : HANGAR #07, SP FORK-SPRINGVILLE AIRPORT, SEC 12,T8S, R2E, SLM. ********** (BLDG ONLY) ***********

| Property Types: | 2024 Market Value |

2025 Market Value |

|||||||

| Non-Primary Residential | $203,000 |

$203,000 |

|||||||

| Total Property Market Value | $203,000 | $203,000 | |||||||