Property Valuation Information

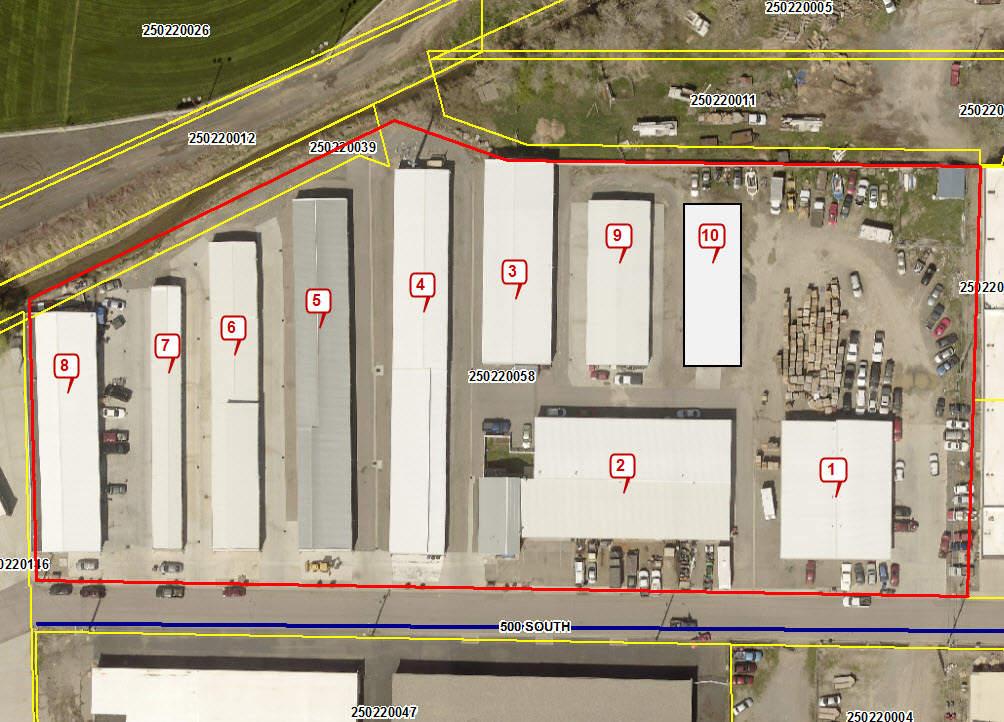

- Serial Number : 250220058

- Tax Year : 2024

- Owner Names : HERRING, DAVID R & LAURA J (ET AL)

- Property Address : 94 W 500 SOUTH - SPANISH FORK

- Tax District : 150 - SPANISH FORK CITY

- Acreage : 4.148166

- Property Classification : MRCB - MULTIPLE RES + COMM > 1 ACRE

- Legal Description : COM N 783.91 FT & W 484.61 FT FR SE COR. SEC. 24, T8S, R2E, SLB&M.; N 1 DEG 47' 0" E 294.5 FT; N 89 DEG 17' 0" W 324 FT; N 70 DEG 22' 0" W 81.83 FT; S 63 DEG 50' 0" W 278.2 FT; S 1 DEG 25' 0" E 192 FT; S 88 DEG 59' 0" E 637.58 FT TO BEG. AREA 4.148 AC.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Primary Residential | $261,500 |

$218,600 |

|||||||

| Non-Primary Residential | $4,482,800 |

$4,844,200 |

|||||||

| Total Property Market Value | $4,744,300 | $5,062,800 | |||||||