Property Valuation Information

- Serial Number : 260150007

- Tax Year : 2025

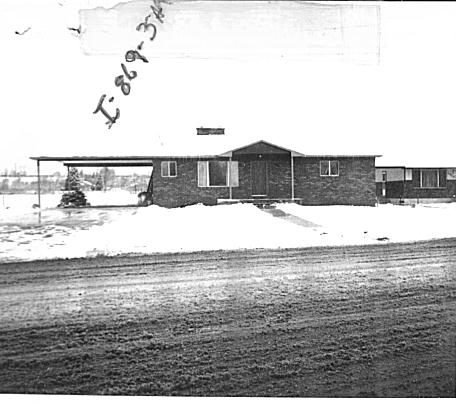

- Owner Names : GARCIA, ANN & JESUS

- Property Address : 1026 E 900 SOUTH - SPRINGVILLE

- Tax District : 130 - SPRINGVILLE CITY

- Acreage : 0.26

- Property Classification : RP - RES PRIMARY

- Legal Description : COM 632.82 FT N & 1575.683 FT E OF W 1/4 COR SEC 3, T8S, R3E, SLM; S 31'22"E 120.78 FT; N 89 40'43"E 81.795 FT; N 31 22"W 159.05 FT; S 64 34'07"W 90.182 FT TO BEG. AREA .26 AC.

| Property Types: | 2024 Market Value |

2025 Market Value |

|||||||

| Primary Residential | $391,300 |

$391,300 |

|||||||

| Total Property Market Value | $391,300 | $391,300 | |||||||