Property Valuation Information

- Serial Number : 300330031

- Tax Year : 2025

- Owner Names : SAUL NUNEZ REYES LIVING TRUST 08-30-2023 (ET AL)

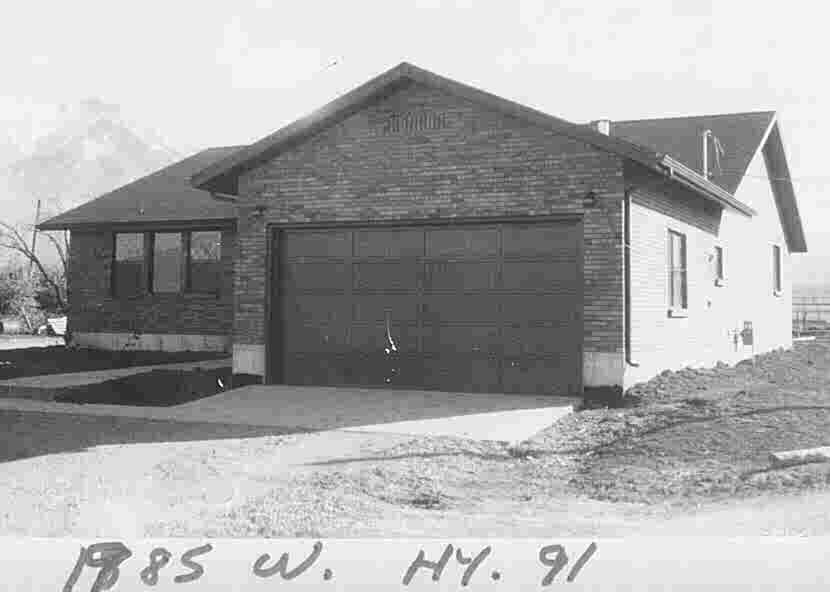

- Property Address : 1985 W HWY 91 - SALEM DIST

- Tax District : 120 - NEBO SCHOOL DIST S/A 6-7-8

- Acreage : 3.15

- Property Classification : RPO - RP PLUS ACREAGE

- Legal Description : COM 1746.557 FT N & 252.689 FT E FR S1/4 COR SEC 10, T9S, R2E, SLM; N 89-19'47"W 329.92 FT; N 46'58"E 168.37 FT; N 77-45'05"E 597.78 FT; S 38'11"E 294.46 FT; S 88-59'17"W 259.88 FT TO BEG. AREA 3.15 AC.

| Property Types: | 2024 Market Value |

2025 Market Value |

|||||||

| Primary Residential | $602,200 |

$602,200 |

|||||||

| Non-Primary Residential | $158,100 |

$158,100 |

|||||||

| Total Property Market Value | $760,300 | $760,300 | |||||||