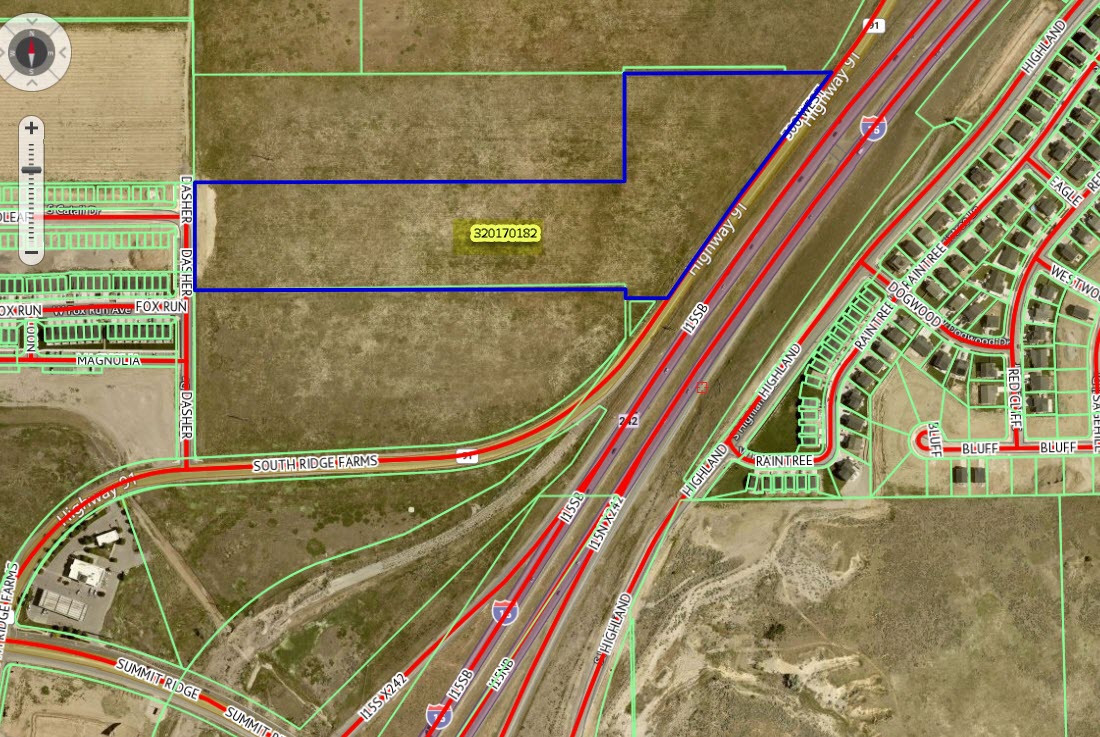

Property Valuation Information

- Serial Number : 320170182

- Tax Year : 2025

- Owner Names : RANDALL AND DEBRA WOODWARD FAMILY TRUST 02-06-2023 THE (ET AL)

- Property Address :

- Tax District : 190 - SANTAQUIN CITY

- Acreage : 15.976836

- Property Classification : V - VACANT

- Legal Description : COM E 1336 FT & N 632.5 FT FR SW COR. SEC. 11, T10S, R1E, SLB&M.; W 16 FT; N 27.5 FT; W 1320 FT; N 330 FT; E 1320 FT; N 330 FT; E 16 FT; E 620.24 FT; S 37 DEG 6' 11" W 353.11 FT; ALONG A CURVE TO L (CHORD BEARS: S 35 DEG 43' 31" W 500 FT, RADIUS = 11532.2 FT); W 115.3 FT TO BEG. AREA 15.977 AC.

| Property Types: | 2024 Market Value |

2025 Market Value |

|||||||

| Vacant | $1,222,700 |

$1,222,700 |

|||||||

| Total Property Market Value | $1,222,700 | $1,222,700 | |||||||