Property Valuation Information

- Serial Number : 340120036

- Tax Year : 2025

- Owner Names : MORRIS, SHEVIN L & YOLANDA C

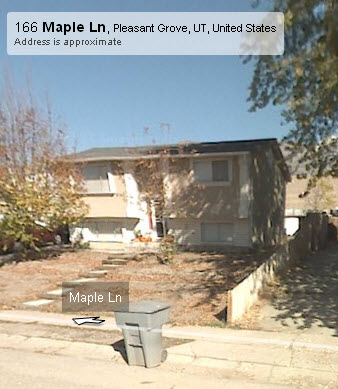

- Property Address : 137 E MAPLE LN - PLEASANT GROVE

- Tax District : 070 - PLEASANT GROVE CITY

- Acreage : 0.137703

- Property Classification : RP - RES PRIMARY

- Legal Description : LOT 36, ALPINE GARDENS SUB AREA 0.138 AC.

| Property Types: | 2024 Market Value |

2025 Market Value |

|||||||

| Primary Residential | $393,600 |

$404,100 |

|||||||

| Total Property Market Value | $393,600 | $404,100 | |||||||