Property Valuation Information

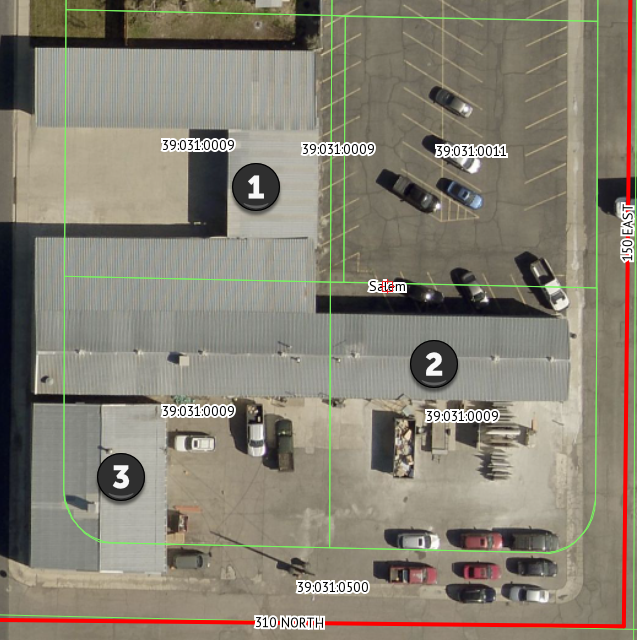

- Serial Number : 390310009

- Tax Year : 2024

- Owner Names : MT HOLDINGS LLC

- Property Address : SALEM

- Tax District : 180 - SALEM CITY

- Acreage : 0.696469

- Property Classification : C - COMMERCIAL

- Legal Description : LOT 3, PLAT B, FLOWERSTONE SUB AREA 0.230 AC. ALSO LOT 4, PLAT B, FLOWERSTONE SUB AREA 0.228 AC. ALSO LOT 5, PLAT B, FLOWERSTONE SUB AREA 0.227 AC. ALSO THE WEST 5 FT OF LOT 6, PLAT B, FLOWERSTONE SUB AREA 0.011 AC. TOTAL AREA .696 AC.

| Property Types: | 2023 Market Value |

2024 Market Value |

|||||||

| Non-Primary Residential | $562,300 |

$626,500 |

|||||||

| Total Property Market Value | $562,300 | $626,500 | |||||||